Key takeaways

At its meeting today, the Reserve Bank of Australia (RBA) Board decided to leave the cash rate target unchanged at 4.35 per cent.

The Reserve Bank of Australia's decision to maintain the cash rate was anticipated and we expect it to remain unchanged for the next six months. Considering the time lag in policy effects, in our view, the RBA is likely to wait for two additional quarterly CPI readings before considering any adjustments. It is notable that Governor Bullock has echoed our sentiment that the RBA prefers to hold long term views on incoming data rather than reacting at each print.

The central bank has maintained a neutral stance, slightly more hawkish than before (we say this more due to forecast revisions than its tone) while closely monitoring global and economic developments. The upward revision to inflation forecasts provides the RBA with greater flexibility to respond if inflation persists. Having said that, the central bank faces the delicate task of balancing consumer weakness with bringing price pressures down in the months ahead.

We reiterate that the RBA aims to strike a balance between price stability and full employment and expect its attention to shift to the domestic labour market conditions.

Easing pressure in the labour market is crucial for tempering price pressures in the services sector.

Statement on Monetary Policy Forecast Revisions

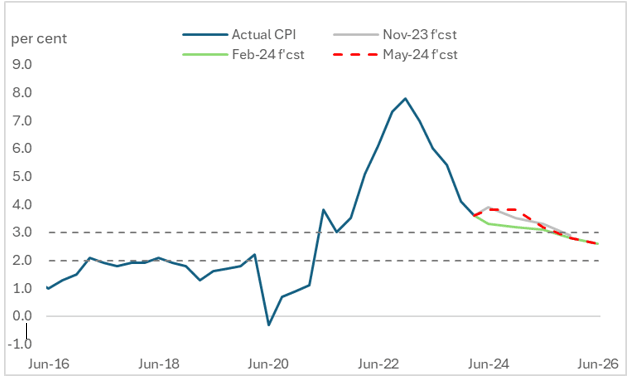

Among key indicators, the RBA's new predictions estimate inflation in 2Q24 to be around 3.8%, up from 3.3% from the Feb Statement on Monetary Policy (SMP) while expecting it to return to the middle of the target range by mid-2026. Meanwhile, the cash rate will stay around its current level until mid-2025, then gradually decrease to around 3.8% by mid-2026. It's crucial to understand that the RBA's cash rate forecasts rely on market assumptions and don't guarantee its policy decisions.

Source: ABS, RBA, RSM Australia

Forecast for unemployment rate shows it peaking at 4.3% instead of 4.4%, a touch lower on the back of the tightness we are currently experiencing. Meanwhile, the RBA has lowered its GDP growth forecast for 2024 but left it unchanged for the rest of the forecast period.

What Lies Ahead

Governor Bullock confirmed during her media appearance that a rate hike was among the options discussed in the policy deliberations before the board decided to maintain the status quo. Our current expectation is for the RBA to maintain policy rates until November this year. We still anticipate that the initial move would likely be a rate cut rather than a hike but just like the central bank, we remain data-dependent.

FOR MORE INFORMATION

If you would like to learn more about the topics discussed in this article, please contact Devika Shivadekar.

Devika Shivadekar

Devika Shivadekar, our seasoned economist, boasts extensive expertise in macro-economic and financial research across APAC. With over 8 years of experience, including roles at the Reserve Bank of India and a top investment bank, she now excels at RSM, aiding middle-market clients in making informed business decisions.

Her passion lies in simplifying economic data for clients' comprehension. Devika closely monitors macroeconomic indicators, such as growth and inflation, to gauge economic health. Get in touch with Devika >