RSM’s new Corporate Advisory Hub at Port Macquarie on the Mid-North Coast of NSW is continuing to see an increase in enquiries from business owners that are looking to protect themselves in business.

This month’s Business Protect insight focusses on supply risks and considerations for business owners in seeking to limit their bad debts.

In most industries margins continue to be tight and competition strong noting many businesses are grappling with supply chain issues and associated pandemic disruption.

Due to the increasing risk, Tim Gumbleton, Principal of RSM on the Mid-North Coast of NSW is encouraging suppliers to review their supply agreements, credit terms, and recovery practices, particularly for those customers that are material to their revenue and profitability.

Our view is that it never hurts to double check that supply agreements have the correct parties named, your security interests are valid and enforceable, credit terms are being applied and remain appropriate, and that you understand all of the available options for recovery such as payment plans, garnishees, stock recovery, guarantee enforcement, etc.

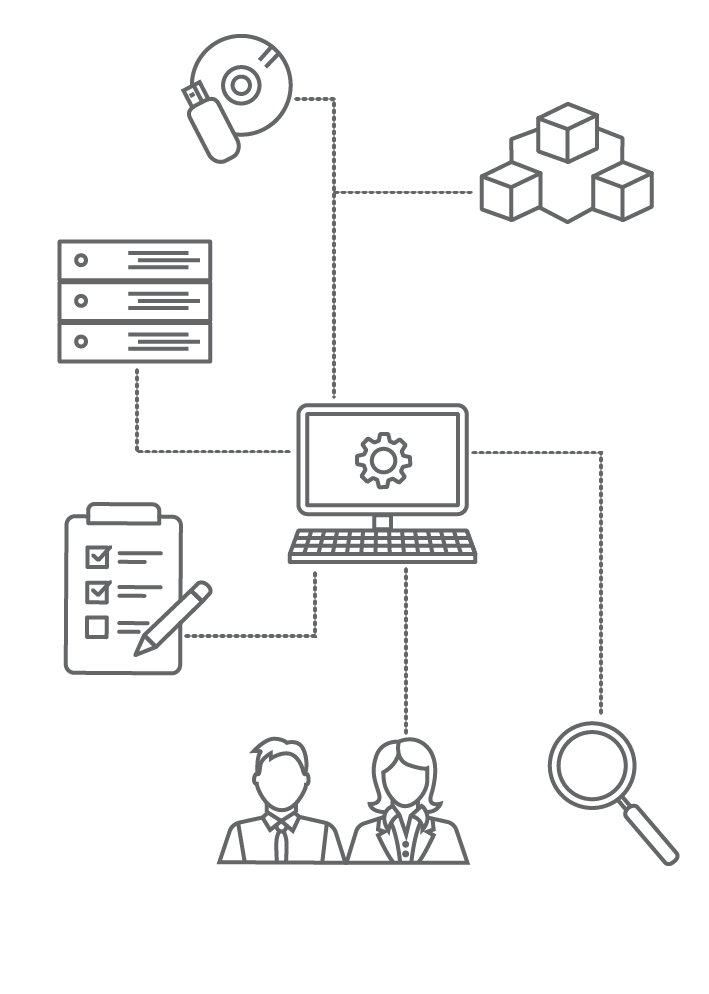

A supplier has various tools that they can utilise to minimise their risk when supplying goods.

As always it can be a risk vs reward consideration when there is uncertainty regarding the prospects of your customer as against the competitive operating environment.

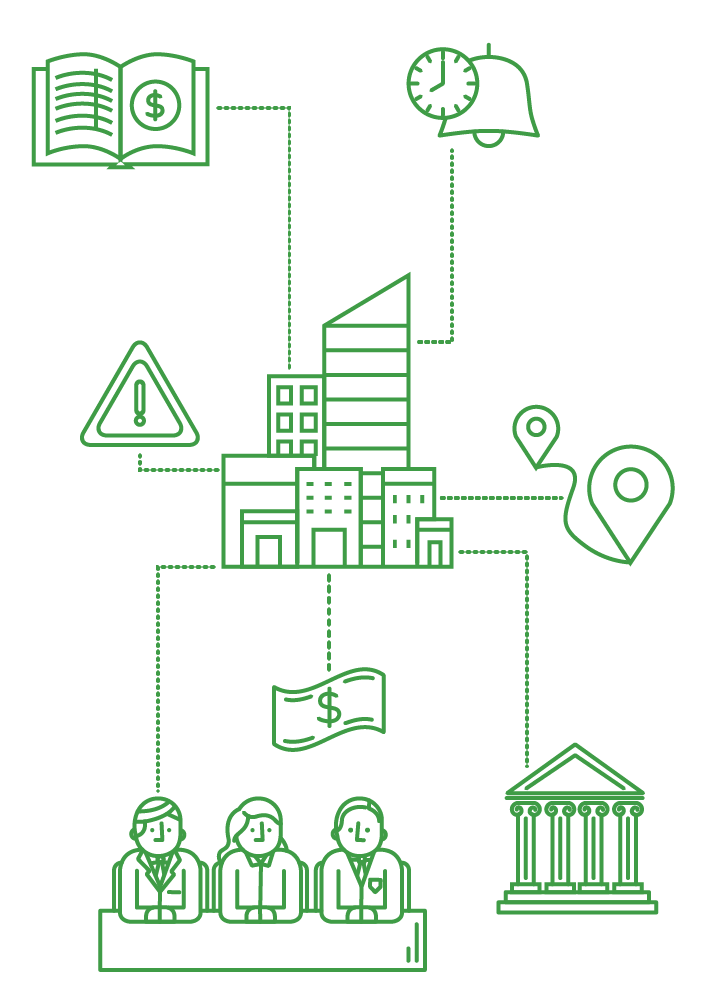

Supply Considerations

The first issue we tend to look at is to ensure that you understand your customer’s business structure and its key players as this will guide firstly who should be executing the supply agreement and from there allowing background and credit checks to be appropriately undertaken and determining appropriate security including who should be providing a personal guarantee.

An effective invoicing and monitoring system will minimise errors and disputes.

Simple and easy-to-follow payment options certainly assist and we recommend that invoices are always issued on time and monitored for payment.

The supply options can include cash on delivery and a wide array of trade account scenarios.

Security and Credit Terms

When debt is being incurred, rather than simple cash on delivery trading, terms of supply are critical as they will provide for matters such as maintaining ownership over stock as far as possible until payment is received (using the PPSA via a PMSI or other security interest options including tracing proceeds), the option of a personal guarantee from those responsible for the business, charging provisions allowing caveats to be placed over personal property, etc.

Debtor insurance/trade credit insurance is also a consideration, particularly again if it is a material/significant supply arrangement based on your existing revenue and profitability.

Debt Recovery

Positive communication strategies, vigilance, and early debt recovery efforts are important if payments are delayed to mitigate further losses and maximise the prospects of recovery and potentially avoid being drawn into a future unfortunate liquidator’s preference recovery process.

Trained and effective administration and recovery staff combined with external support is essential.

We find that effective debt recovery strategies utilise the assistance of lawyers, accountants, agents, and insolvency practitioners like us.

It is fair to say that as insolvency practitioners not much surprises us anymore as we see all types of scenarios.

We are the ones that unfortunately need to investigate when things go wrong and unwind various asset protection strategies.

If things are starting to deteriorate, it can be a prompt to review your trading terms, security position, and recovery strategy.

It would be a good time to also consider cash on delivery (COD) trading terms and other terms such as credit limits and the like, and also contemplating again the debtor insurance and associated options.

Customer Liquidation / Bankruptcy

Unfortunately, many liquidation scenarios see little if any return to unsecured creditors such as suppliers when a company fails.

At this point, it becomes too late to turn back the clock and revisit your trading terms, security options, or debt recovery strategies.

The time to get this right is at the outset when negotiating terms and undertaking your due diligence.

However, like most corporate failures, you do tend to see warning signs which are again a significant prompt to revisit, review, and double check that all will be okay if things don’t work out for your customer even though they are perhaps telling you that all is okay and the issues are just “temporary cash flow issues”.

How we can help:

At RSM we are happy to help suppliers pressure test their credit terms and strategies and assist in recovery if bad debts are on the horizon and you need help to maximise your recovery or even instigate proceedings such as winding up applications.

About Tim Gumbleton: Tim Gumbleton and RSM are the Mid North Coast’s business improvement, corporate turnaround, dispute resolution, restructuring (incl legislated small business restructuring), asset protection, forensic accounting, insolvency, liquidation and bankruptcy specialists.

About RSM – Our Point of Difference:

RSM is a full-service national accounting, consulting, and advisory firm operating from over 30 offices (and on a mobile basis) throughout Regional and Metropolitan Australia. We are uniquely placed given our regional expertise, footprint, and extensive national coverage backed by international reach and scale. RSM can help you and your business, no matter where you may be based.