Introduction

On 16 February 2024, Hespe J of the Federal Court delivered her judgment in the case of AusNet Services Limited v Commissioner of Taxation [2024] FCA 90, holding that the CGT rollover provisions contained in Division 615 of the Income Tax Assessment Act 1997 applied to a scheme of arrangement entered into by the AusNet Services Limited (AusNet) during the income year ended 30 June 2015 (FY15).

Somewhat curiously, Hespe J’s holding was in favour of the Commissioner of Taxation (Commissioner), after AusNet identified the deleterious tax effects the application of Division 615 had for its wholly-owned group and sought to elude the Class Ruling it had previously obtained in connection with the relevant scheme of arrangement[1]

Background

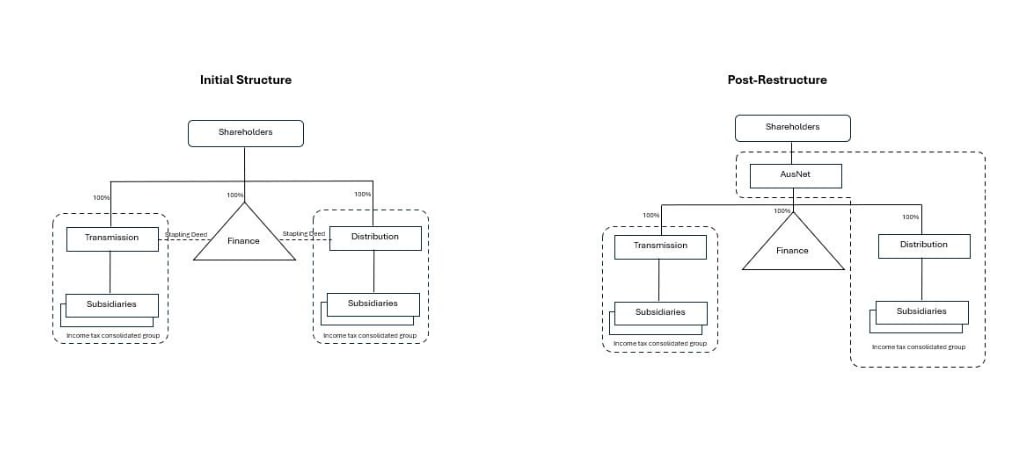

The former AusNet Services group was a triple-staple comprising the following three entities and their respective subsidiaries[2]:

- AusNet Services (Transmission) Limited (Transmission);

- AusNet Services Finance Trust (Finance); and

- AusNet Services (Distribution) Limited (Distribution).

Following the settlement of a dispute with the Australian Taxation Office (ATO), the outcome of which threatened the viability of the group’s operating structure[3], it was resolved to ‘top hat’ the structure through the interposition of a single holding company (AusNet) between security holders and each of the three stapled entities.

The foregoing was implemented through three schemes of arrangement effected on 18 June 2015, whereafter Distribution became a subsidiary member of an income tax consolidated group of which AusNet was Head Company (AusNet ITCG), whereas an election was made for the continued existence of the income tax consolidated group of which Transmission was Head Company. The diagram below poses the pre- and post-restructure group structures:

Distribution

On 1 July 2015, the Commissioner issued a favourable Class Ruling to AusNet confirming, inter alia, that rollover relief would apply to the restructure under Division 615. However, AusNet subsequently objected to income tax assessments issued to it in respect of the income years ended 31 March 2016 to 31 March 2020[4] (the Relevant Period) on the basis that Division 615 did not apply to the scheme of arrangement by which it came to be the holder of shares in Distribution (only). This would entitle it to an uplift in the cost bases of assets formerly held by the income tax consolidated group of which Distribution was Head Company, in turn increasing the capital allowance deductions the AusNet ITCG could claim[5].

The Commissioner disallowed the objections, and AusNet appealed directly to the Federal Court against that decision.

AusNet’s Submissions

AusNet contended that Division 615 (specifically, section 615-65) did not apply in respect of its shares in Distribution because:

- The requirement under paragraph 615-5(1)(c) that the Distribution shareholders, under a ‘scheme for reorganising its affairs’, disposed of all their Distribution shares to the applicant in exchange for shares in AusNet and ‘nothing else’ was not satisfied; and

- In any case, the ratio under paragraph 615-20(2)(a) in relation to the Distribution scheme did not equal the ratio calculated under paragraph 615-20(2)(b), which is a precondition to the application of Division 615.

In support of these grounds, AusNet submitted as follows:

Ground 1 – paragraph 615-5(1)(c) not satisfied

Any ‘reorganisation’ was not of Distribution’s affairs alone, but of Distribution’s affairs and the affairs of other entities (viz. Finance and Transmission), whereas the ‘and nothing else’ requirement required by the concluding words of paragraph 615-5(1)(c) could not be satisfied as each security holder received not only AusNet shares under the Distribution scheme, but also ‘something else’ in the form of an uplift in the values in the shares each of them held in AusNet as a result of the related Finance and Transmission schemes.

Ground 2 – ratios under subsection 615-20(2) not equal

Subsection 615-20(2) requires, as a precondition to the application of Division 615, that the ratios at paragraphs (a) and (b) thereunder must be equal.

AusNet’s submitted that because the numerator of the former comprised the market value of all AusNet shares owned by each exchanging member (i.e., including shares issued to a person as a result of all three schemes), and all other integers comprised only shares exchanged in connection with the Distribution scheme, the ratio under paragraph (a) would be three times the ratio under paragraph (b).

Underlying AusNet’s submissions was that Division 615 was intended only to apply to rollovers involving a valuable or substantial original entity and the interposition of a ‘shelf company’ and could not apply where the interposed company was not a ‘shelf company’.

AusNet did not seek to dispute the application of Division 615 to the acquisition of its shares in Transmission nor to the acquisition of its units in Finance.

Judgment

Hespe J rejected AusNet’s submissions and instead affirmed the Commissioner’s decision.

With respect to AusNet’s first ‘ground’, Hespe J held, having regard to the relevant stapling deed and associated arrangements, that AusNet’s position overlooked the hitherto intertwined business and inextricably linked affairs of Distribution, Finance and Transmission, which were in substance a single economic unit. The following passage at 79 encapsulates that holding:

“There is an air of unreality in positing a moment in time in which Distribution is hypothesised as carrying on a business that had an existence and value independent of Transmission and Finance.”

Turning to the ‘and nothing else’ requirement, Hespe J referred to the terms of the Implementation Deed underpinning the multiple schemes of arrangement and observed that the interdependency of each step, the inability for any of the steps to have effect independently of another, and the inability to calculate the market value of AusNet shares without taking into account all schemes of arrangement, stating:

“ … the inter-conditional nature of the schemes meant that either all the schemes were to be implemented or none were … Read together, each of the Transmission, Finance and Distribution schemes and the Implementation Deed were “different, though connected, parts of the same transaction”[6] … It is not accepted that the value of [AusNet] incrementally increased in the compartmentalised manner contended for by [AusNet]”

Finally, after exploring the statutory language and context of subsection 615-20(2), and applying section 1-3 of the ITAA 1997, which provides that differences in drafting style of a re-written provision will not alter the meaning to be taken from a predecessor provision, Hespe J concluded:

”The first ratio is examining the “after” position — being the market value of the interest of each exchanging member in the interposed company which that member acquired as a result of the scheme as a proportion of the market value of all interests in the interposed company that were issued to exchanging members under the scheme. The second ratio is the “before” position — being the market value of the interest of each exchanging member in the original company (Distribution) that that member held and were disposed of as a result of the scheme as a proportion of the market value of all exchanging members’ interests in the original company that were disposed as a result of the scheme.”

Implications

The decision in AusNet Services Limited v Commissioner of Taxation [2024] FCA 90 has a number of significant implications for taxpayers, whether or not they maintain a stapled structure:

- The primacy afforded by Hespe J to the economic substance of the overall arrangement over its legal form arguably provides for a broader application of Division 615 than the Commissioner has previously acknowledged – see, for example, Taxation Ruling TR 97/18 and its addendum[7], wherein, in the context of predecessor provision to Division 615 (viz. former section 160ZZPA of the ITAA 1936), the Commissioner makes successive reference to an apparent requirement than an interposed company must be a ‘shelf company’. The decision would also seemingly open the door for the interposition of a new company above two or more companies commonly held in the same proportions.

- The narrow construction the ‘and nothing else’ requirement such that it concerns only the ‘quid pro quo received for the disposal of the shares’ and not the consequences of the scheme. This is potentially impactful for taxpayers, given that the same requirement appears elsewhere in the income tax legislation, including in other CGT rollover provisions such as Subdivisions 124-E and 124-F, and the demerger relief provisions contained in Division 125 of the ITAA 1997.

- Clarification on the appropriate construction of the ratios at subsection 615-20(2), which makes clear that Division 615 can apply to interposed companies with existing substantial value and not just shelf companies and may simplify Division 615 rollovers by rendering redundant additional transaction steps such as any need to cancel ‘original shares’.

- Further clarity on the judicial approach to statutory construction – e.g., reliance on the following statement from Gummow J in Wik Peoples v Queensland [1996] HCA 40:

“Statements as to legislative intention made in explanatory memoranda or by Ministers or in this case by the Commissioner in a taxation ruling, cannot overcome the need to carefully consider the words of the statute to ascertain its meaning.”

- The assertion at 11 that a stapling arrangement may be “like the dual listed company arrangement described by the High Court in BHP Billiton v Federal Commissioner of Taxation [2020] HCA 5 … a form of synthetic merger pursuant to which the businesses of separate entities were to be managed a unified basis”, which may put on notice taxpayers maintaining a stapled structure.

FOR MORE INFORMATION

If you are considering a group restructure or would like to discuss the content of this article, please do not hesitate to contact Simon Aitken or your local RSM adviser.

[1] CR 2015/45 | Legal database (ato.gov.au)

[2] For income tax purposes, each of Transmission and Distribution were Head Companies of respective income tax consolidated groups.

[3] The terms of the settlement with the Commissioner of Taxation (Commissioner), which included, inter alia, an undertaking not to claim deductions for payments of interest on certain intra-group financing arrangements despite the corresponding receipt remaining assessable to the financier (Finance), rendered the stapled structure sub-optimal for security holders

[4] In lieu of the income years ended 30 June 2016 to 30 June 2020.

[5] ITAA 1997, paragraph 110-25(2)(b).

[6] Isles v Daily Mail Newspaper [1912] HCA 18