Bespoke solutions for your workforce tax and compliance needs

Our Global Employer Services team develops solutions tailored towards you and your workforce, combining tax technical and advanced tax technology, to help you navigate the complexities and challenges with confidence.

![]()

We have specific expertise in various employment matters, including:

- Wage compliance

- Superannuation Guarantee

- Fringe Benefits Tax (FBT)

- Payroll Tax

- Contractors

- Global Mobility / Expatriate Tax

- Pay as you go (PAYG) Withholding

In a world where employers are facing increased tax audit activity and with greater scrutiny on wage compliance by both authorities and employees alike, we can equip you with robust solutions to help minimise your compliance and reporting risks, while simultaneously maximising your tax savings. We will help build policies and processes that are efficient and dynamic enough to deal with legislative changes, yet thorough enough to combat complex legal issues.

Employment tax management also plays an important role in planning for expatriate taxation, for which we also provide assistance.

Wage Compliance

- Rapid Assessment® Health checks

- End-to-end wage compliance reviews, audits, and remediation

- Superannuation Guarantee remediation

- Payroll due diligence

Employment Taxes

- Fringe Benefits Tax Analytics and automation

- Superannuation technical reviews and analytics

- Single Touch Payroll configuration and advisory

- Contractor technical reviews and analytics

- Tax governance

- Compliance and advisory

- Payroll Tax compliance and reviews

Expatriate Taxes

- Expatriate tax compliance and advisory

- Independent payroll services

- Policy design for global mobility and tax equalisation

- Tax planning for international assignments/relocations

RSM's proprietary Rapid Assessment ® approach is designed for clients who, whilst they are not aware of any known non-compliance, have not undertaken any material level of review to confirm their compliance. This assessment is broad and considers:

- Payroll environment

- Technical accuracy and compliance across industrial instruments, superannuation, and single touch payroll

- Sample testing

- Data and risk assessment

Our wage compliance services include:

- End-to-end wage compliance reviews, audits, and remediation

- Superannuation Guarantee remediation

- Payroll due diligence

We provide solutions for employment tax matters, including fringe benefits tax (FBT), payroll tax, Superannuation Guarantee (SG), Pay-as-you-go (PAYG) withholding, Single Touch Payroll (STP) and contractor compliance.

Our employment tax services include:

- Employment Tax Analytics, including:

- FBT automation and optimisation

- FBT outsourcing

- Superannuation guarantee payroll analytics

- Includes review of superannuation underpayments, late payment optimisation, Superannuation Guarantee Charge (SGC) calculations, and lodgement of SGC statements

- Contractor analytics across superannuation guarantee and payroll tax

- Employee termination payment/Redundancy automation

- Employment Tax compliance and advisory, including Employment Tax Health Checks for:

- Fringe benefits tax (FBT)

- Payroll tax

- Superannuation Guarantee (SG)

- Pay-as-you-go (PAYG) withholding

- Single Touch Payroll (STP)

- Employment Tax Governance, such as review of policies and systems for employment taxes, wage compliance and contractor compliance.

RSM provides a comprehensive suite of services addressing taxation and payroll issues that arise with the international transfer of employees - whether commencing an assignment outbound from Australia or inbound to Australia, or where returning home after working or living overseas.

Our expatriate tax services include:

- Preparation of Australian individual income tax returns for expatriates, including:

- Medicare levy exemption applications

- Certificate of coverage applications

- Preparing gross up calculations, tax equalisation calculations and hypothetical tax calculations.

- Advice on expatriate tax matters, including on:

- Mitigating double taxation and claiming foreign tax credits

- Employer tax obligations resulting from sending employees on assignment

- Superannuation obligations resulting from sending employees on assignment

- Departing residents access to Australian superannuation

- Assistance with drafting global mobility and tax equalisation policies

- Independent payroll services, including shadow payroll

- Planning for taxation consequences of an assignment or relocation in or out of Australia, including:

- Cost projection calculations

- Cost comparisons between assignment arrangements

- Remuneration planning to utilise fringe benefits which may be provided tax-free or concessionally taxed

What insights are you getting from your employee data?

It is important to get both a birds-eye view and the ability to drill down into the detail, when it comes to optimising your employee data. With a little help from our analytics, automation and outsourcing solutions, you can do just that and more.

Have you considered:

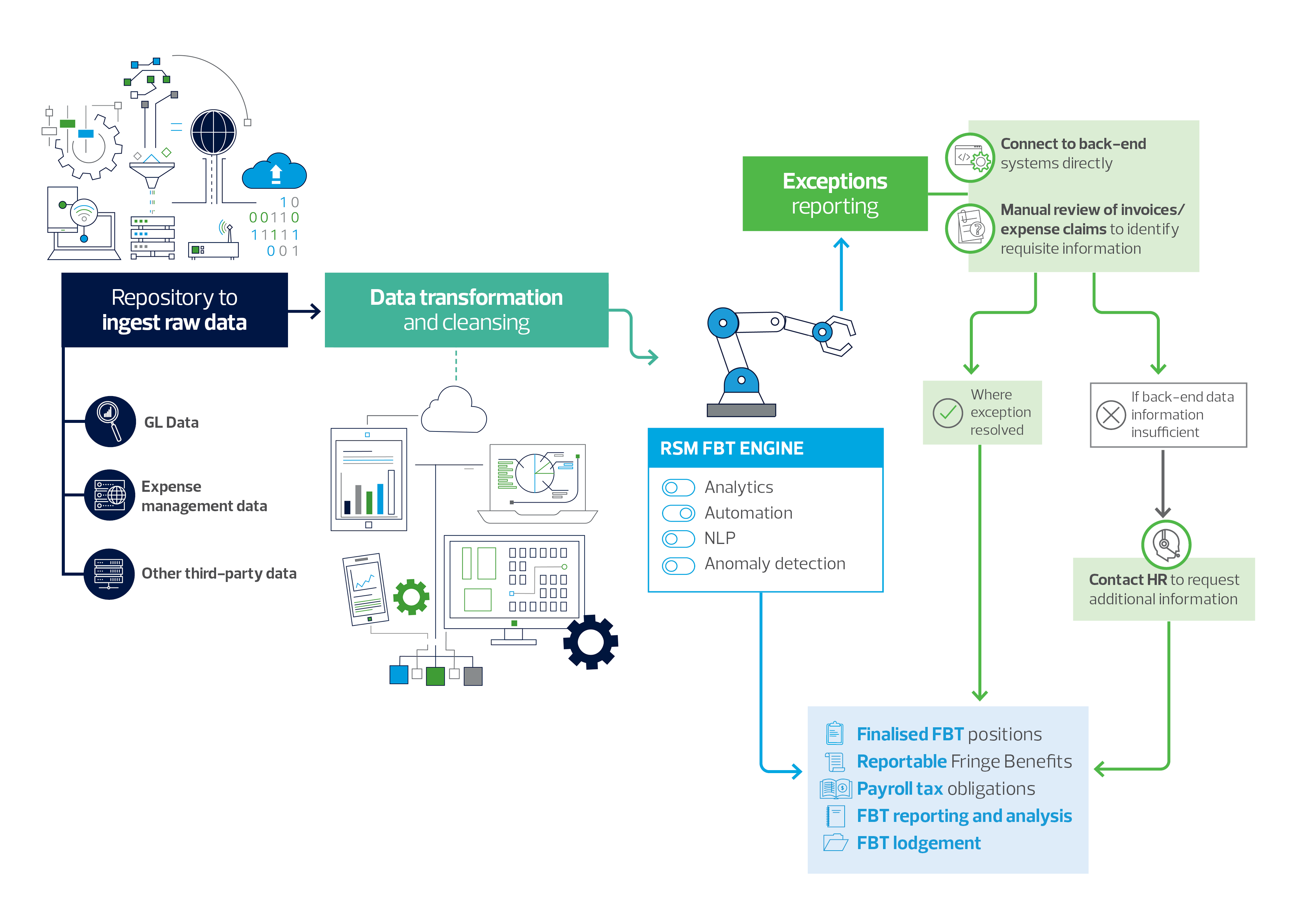

Our approach is an all-encompassing end-to-end solution for your business, whereby we provide detailed FBT return preparation, designed to ensure that a thorough assessment of FBT is completed, therefore increasing compliance and maximising tax savings. We manage the entire FBTprocess from start to end, thus freeing up more time and capacity for you to handle other business matters.

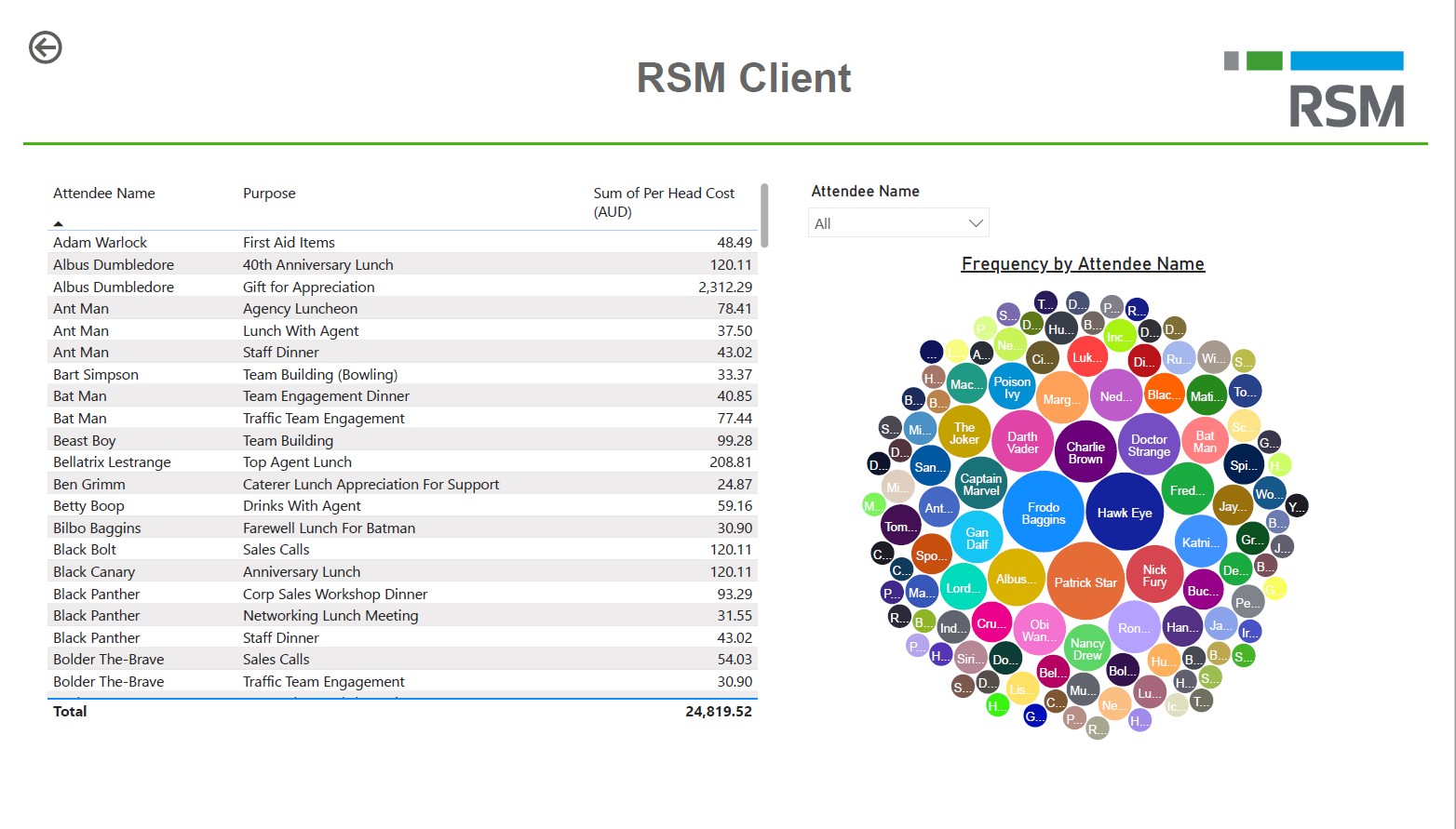

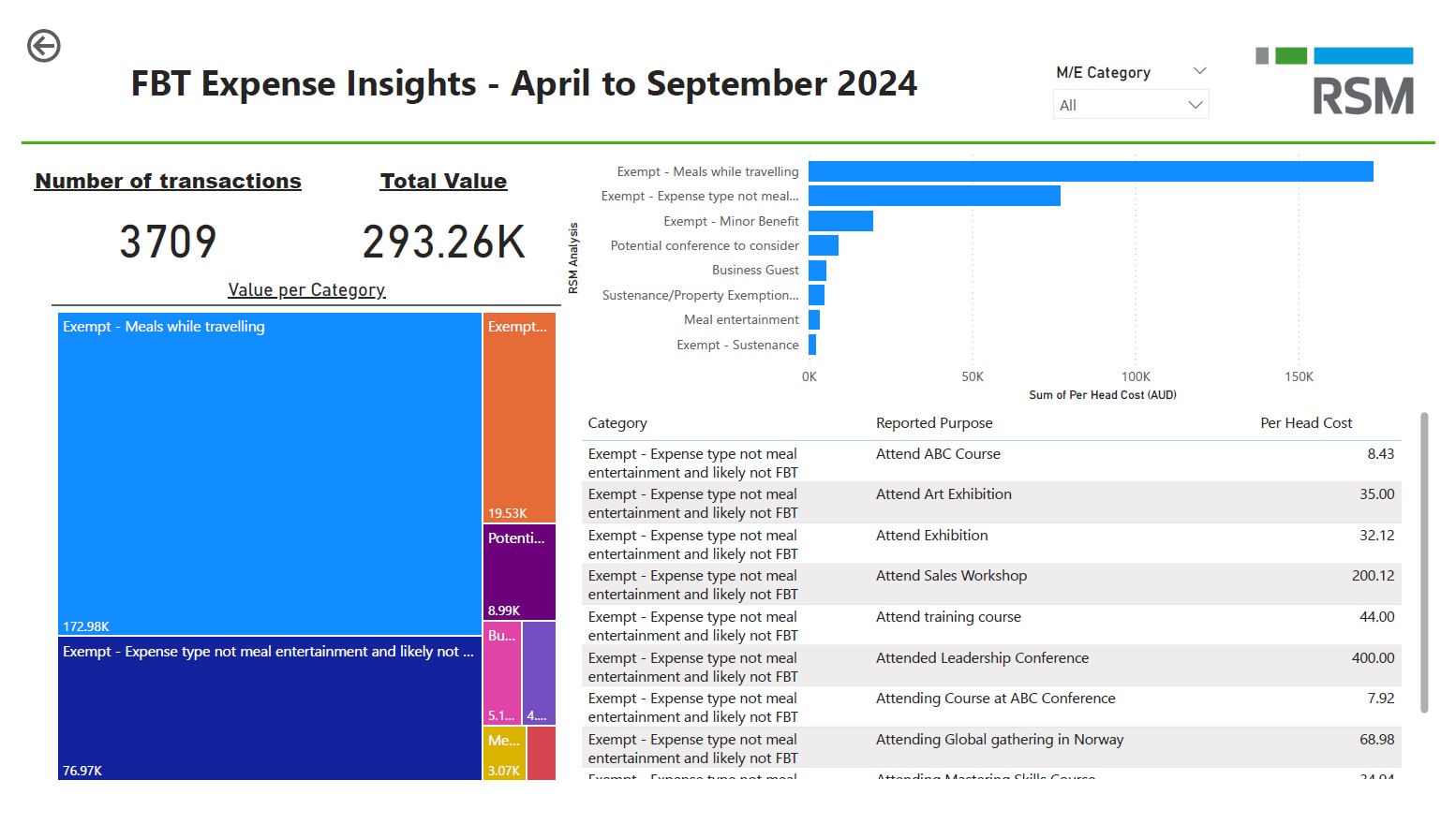

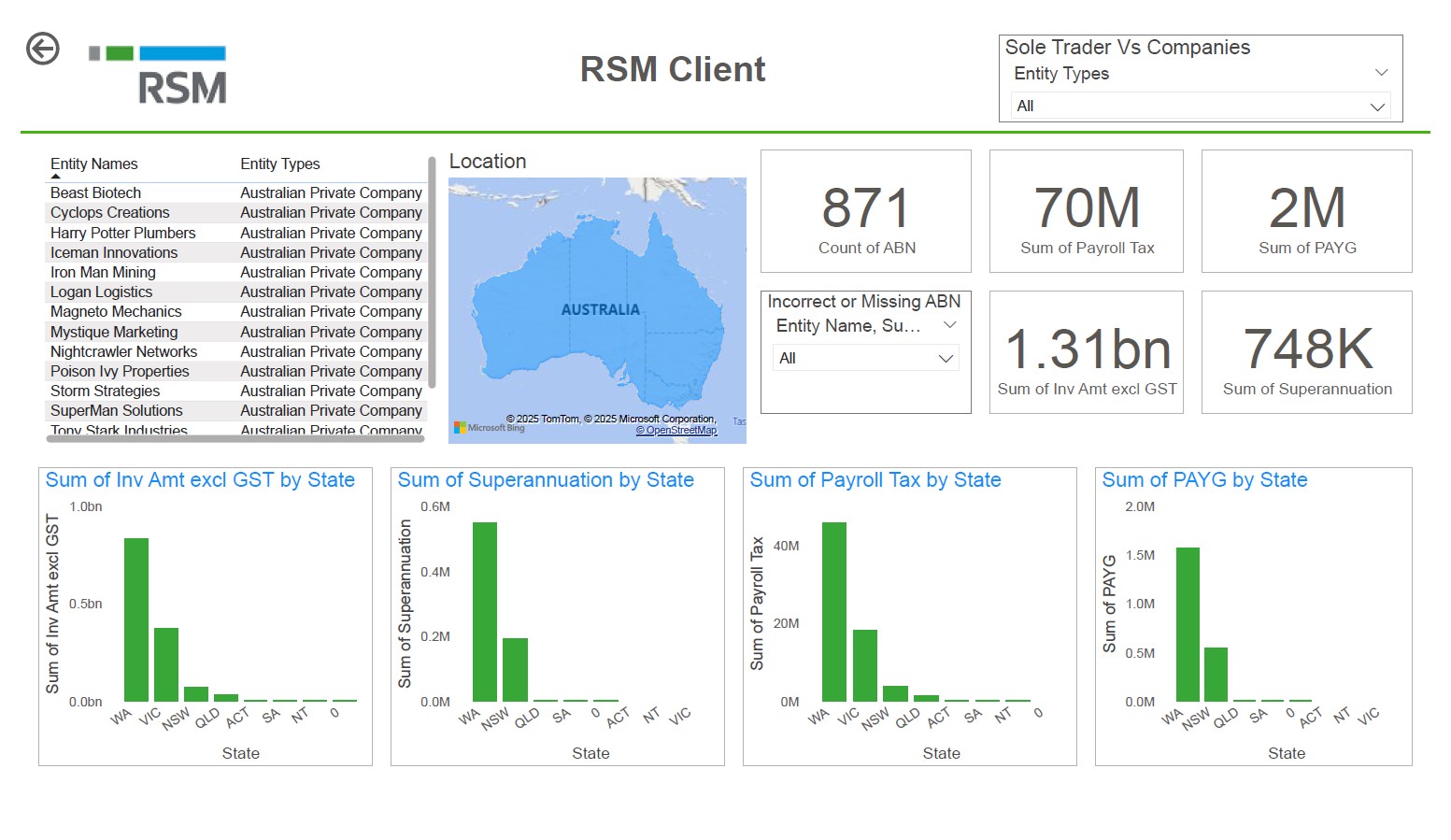

Our interactive employment taxes dashboards helps employers get a snapshot of their employee and contractor population, to efficiently assess the risks for employment taxes, and to identify areas where cost savings can occur.

*Information on these dashboards is displayed strictly as an example. No client sensitive information is used in these images.

Rick Kimberley

Rick Kimberley is a Partner in the Tax Services division and leads the Global Employer Services practice in Australia.

A unique focus of Rick and his team is developing bespoke technological solutions to tax problems for his clients.

In addition to his technology-focused approach, Rick is best known in the market for his work in respect of wage compliance, particularly superannuation guarantee, where he has assisted some of Australia’s largest listed and multi-national corporations.

Peter de Sousa

Peter de Sousa is a Senior Manager who leads the RSM Victorian Global Employer Services practice.

Peter is an employment tax specialist with over 8 years of experience within Big 4 professional services firms. Peter is a member of Chartered Accountants Australia and New Zealand and the Tax Institute of Australia.

His clients are of all sizes, from small closely held businesses to large multinationals across diverse industries. He takes pride in identifying value-adding opportunities for clients and delivering high-quality solutions.

He combines his tax technical knowledge with his advanced data analytics skill set to help his clients meet their employment tax obligations in Australia.

Gina Nedeljkovic

Gina Nedeljkovic is a Director and the WA leader for RSM's Global Employer Services division.

Gina's specialty areas include wage compliance, employment tax matters (Fringe Benefits Tax, Superannuation, PAYG Withholding, Payroll Tax), and global mobility/expatriate tax compliance and advisory services.

Gina works with employers of all sizes to ensure they are meeting their wage and employment tax obligations. She assists clients in minimising future penalties and reputational risks.

Niamh Oakley

Niamh Oakley is a Manager in Global Employer Services at RSM Australia

Niamh specialises in employment taxes, superannuation guarantees, PAYG withholding, fringe benefits tax, and payroll tax. She works with businesses to navigate complex tax compliance requirements, leveraging technology-driven solutions to enhance accuracy, efficiency, and data-driven decision-making.

With experience across Big Four consulting and in-house tax compliance, Niamh has a deep understanding of the challenges organisations face in managing employment tax obligations. Her ability to integrate automation and analytics into compliance processes allows her to help clients streamline reporting and mitigate risk.

Jason Dutt

Jason is a tax professional with nearly a decade of expertise in Australian employment and expatriate tax.

As a Manager in our Global Employer Services (GES) team, he combines public and private sector experience to deliver innovative and efficient solutions for his clients. His passion for leveraging value-adding tax automation technologies enables him to craft practical strategies tailored to diverse business needs.

Jason’s professional journey includes representing the Australian Taxation Office (ATO) in Superannuation Guarantee and other employer obligations investigations and audits, working with some of Australia’s most complex employers. This experience, combined with his in-depth knowledge of Federal and State/Territory employment taxes, wage compliance, and tax automation, equips him with a unique perspective on organisational problem-solving.

Contact our Global Employer Services specialists

Whether it's working with you to protect your assets, find your business growth, or develop an exit strategy to maximise your return for a comfortable retirement, our Global Employer Services team can help you achieve your goals.

Contact our Global Employer Services specialists

Whether it's working with you to protect your assets, find your business growth, or develop an exit strategy to maximise your return for a comfortable retirement, our Global Employer Services team can help you achieve your goals.