RSM Australia (RSM) has published its latest control premium study, undertaken in partnership with Curtin University, with the metals and mining sector showing a significant peak in the last 18 months against long-term averages.

The RSM 2021 Control Premium Study analyses successful takeovers and schemes of arrangement from 1 July 2005 through to 31 December 2020.

This period saw 605 successful control transactions for companies traded on the Australian Securities Exchange (ASX) and 131 transactions for companies on the New Zealand Securities Exchange (NZSX).

Metals and mining companies saw the highest number of transactions over the study period, representing 26.6% of overall transactions.

A control premium is the amount that a buyer is willing to pay over and above the traded share price to gain a controlling ownership interest in a publicly-traded company. RSM calculated the implied control premium as (offer price – share price) / share price, based on the closing share price of the target company at 20, 5 and 2 days before and following the announcement of the offer. The analysis primarily focuses on 20-day pre-bid premiums, as it was considered less likely to be influenced by bid speculation and therefore providing the most reliable observation of any control premium implicit in the transaction.

The study revealed that, during the COVID-19 pandemic, average control premiums in Australia nearly doubled, growing from 32% in the 2019 calendar year to 61% in the 2020 calendar year. It also showed that the highest premiums were generated in sectors which traditionally price on future cashflow potential, such as metals and mining, energy, healthcare and telecommunications, IT & software.

The average control premium in the metals and mining sector increased from 58% in the 2019 calendar year to 64% in the 2020 calendar year. This is a significant divergence from the long-term Australian average for the metals and mining sector over the 15.5-year period of 36.6%.

Notably the trend in commodity projects changed significantly, from primarily electric vehicle and battery minerals in 2019 to being dominated by gold company mergers in 2020. Of the metals and mining sector total transaction value in 2020, 99% related to gold companies in our study findings.

This merger and acquisitions (M&A) wave in the gold industry has been driven by high gold prices, with financial investors seeking “safe-haven” assets amid global uncertainty and a low interest rate environment. However, executives need to be mindful of mistakes made during the previous gold price boom, and ensure that deal premiums are aligned with the expected shareholder value extraction.

“Control premiums have risen sharply, especially in April and May 2020, when economic uncertainty was at its peak and acquirers took advantage of the distressed capital markets. With interest rates remaining low and companies holding significant cash reserves following a capital raising spree during COVID-19, M&A activity is expected to be high in Australia and New Zealand through FY2022 and beyond.

It is critical for directors and investors to carefully consider the control premium component when assessing equity values for potential transactions.” Nadine Marke, Partner, RSM Australia.

RSM explores factors that can have an impact on the premium paid to acquire control of a company.

The study is the fourth in the series, and the results show that control premiums are influenced by numerous factors including industry sector, consideration and transaction type, timing within the economic cycle, toehold (the extent of the buyer’s existing investment in the target), and size and market capitalisation of the company.

The new study spans 15.5 financial years, during which time Australia experienced the global financial crisis (GFC), a mining boom and the post-boom ‘hangover’ followed by a gradual expansion until the COVID-19 pandemic.

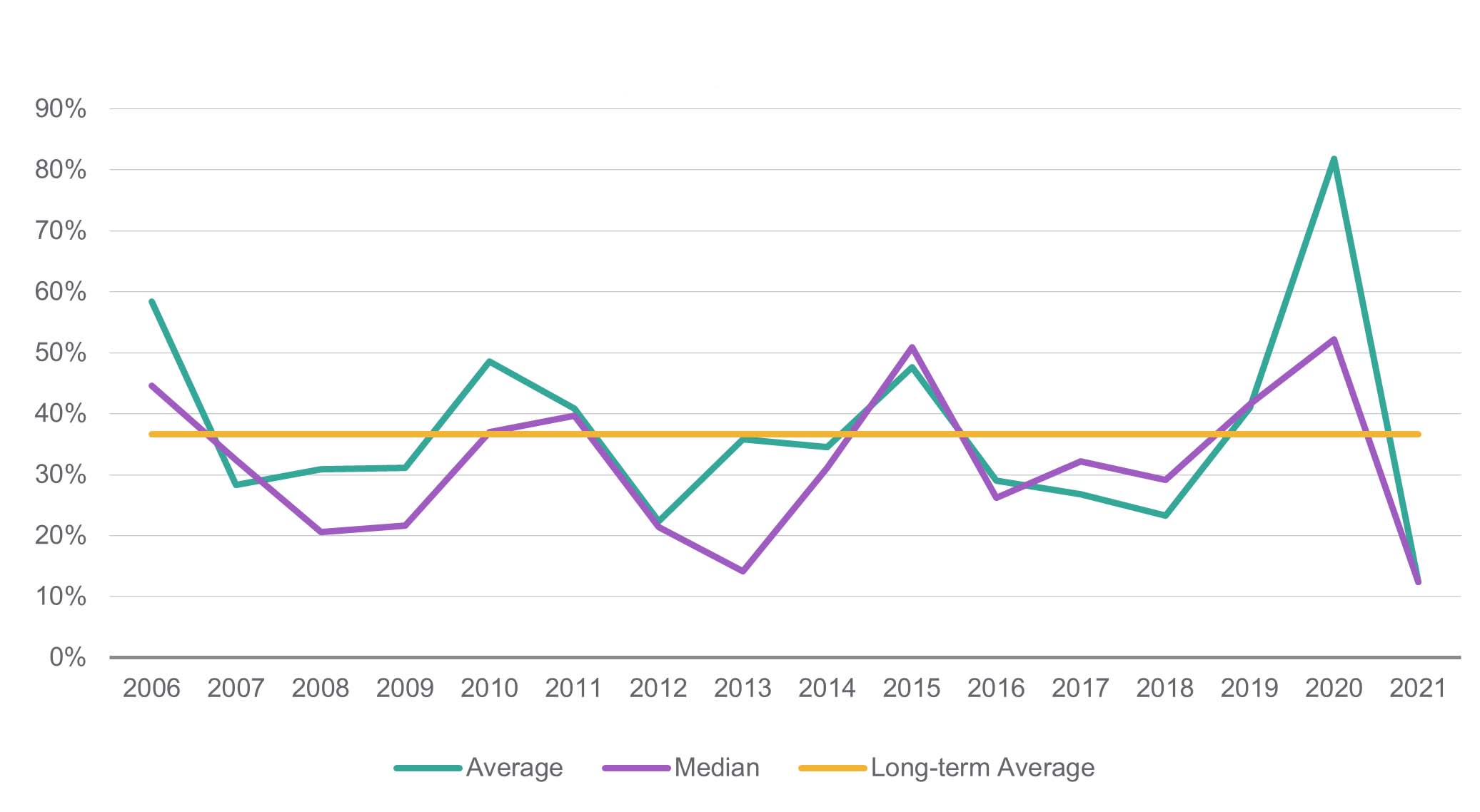

Metal & Mining Sector Implied Control Premium: 20 Days Pre-Announcement (by Financial Year)

The analysis shows a significant increase in metals and mining control premiums from an average of 41.0% in FY2019 to 81.9% in FY2020 and by calendar year (CY) from 57.6% in CY2019 to 63.7% in CY2020 reflecting the impact of COVID-19 on the Australian capital markets and equity valuations.

The analysis shows a significant increase in metals and mining control premiums from an average of 41.0% in FY2019 to 81.9% in FY2020 and by calendar year (CY) from 57.6% in CY2019 to 63.7% in CY2020 reflecting the impact of COVID-19 on the Australian capital markets and equity valuations.

The metals and mining sector in Australia is also impacted by exchange rates. Capital provision in mining is highly internationalised and the attractiveness of deals can relate in part to the AUD/USD exchange rate.

Over the period of analysis, exchange rates presented an inverse relationship with the average and median control premium for metals and mining transactions e.g. the exchange rate falling was met with a corresponding rise in control premiums in this sector.

For more information

For a more detailed analysis, please refer to our RSM 2021 Control Premium Study or contact your local RSM adviser.