Much has already been written about the application of ‘relevant contract’ provisions contained in harmonised payroll tax legislation to medical centre businesses and medical practitioners.

For a full recap of the position in other states and territories other than Queensland, as at August 2023, please see our earlier Tax Insight here.

Despite already providing the equal-longest amnesty from payroll tax for general practitioners (to 30 June 2025), the Queensland Government has now gone further than any other jurisdiction in providing a narrow, though potentially workable, permanent solution. In a significant rewrite of the existing public ruling on the application of payroll tax to medical centres, the Queensland Revenue Office (“QRO”) now accepts that direct payments of patient fees and Medicare benefits to a medical practitioner are not actual or deemed taxable wages and, therefore, should not attract payroll tax (even after the amnesty is over).

The key points arising from the revised public ruling are:

- The QRO has separately set out the different common payment arrangements between a medical centre and a practitioner and whether they will fall within the relevant contract provisions. These are summarised as follows:

As can be seen above, the QRO’s clarified position is that direct payments from either the patient or Medicare to the medical practitioner should not attract payroll tax. This is on the basis that the payment to the medical practitioner represents consideration for the medical service and not payment for services by the medical practitioner to the medical practice.

However, there are a number of examples set out in the public ruling that are worth highlighting:

“Third party” payments and the use of a “practitioner entity”

- Under section 51 of the Payroll Tax Act 1971 (Qld), “third party” payments of money may be taken as wages paid or payable by an employer to an employee. A third-party payment may consist of:

- a payment by a person other than a deemed employer to a deemed employee;

- a payment by a deemed employer to a person other than a deemed employee; or

- a payment by a person other than a deemed employer to a person other than a deemed employee.

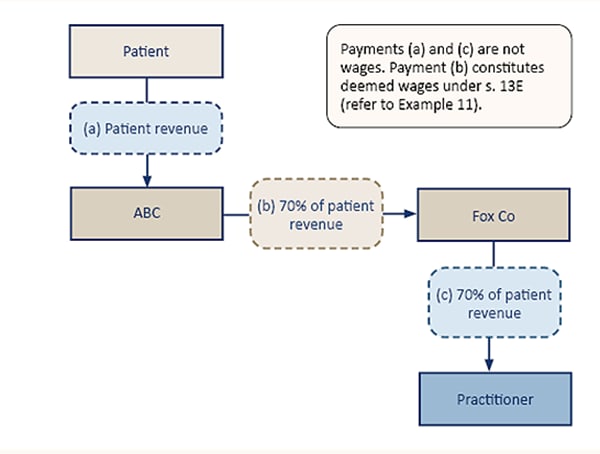

- The QRO’s view is that where a patient pays their patient fee to the medical practice (ABC) and the medical practice passes the patient fees (net of 30% administration fees) to an entity controlled by the medical practitioner (i.e., a practitioner entity) (Fox Co), that payment to the practitioner entity will be deemed wages per section 51 as a third-party payment. Any subsequent payment from Fox Co to the medical practitioner (e.g., as a dividend) will not attract payroll tax. Example 14 taken from the public ruling is extracted below:

Clearing houses

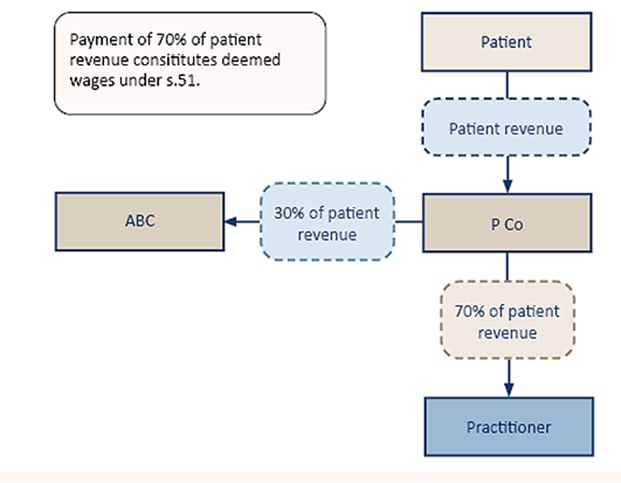

- The third-party payment provision in section 51 can also apply to any third-party clearing houses. In Example 15 extracted below, P Co acts as a third-party clearing house in collecting the patient fees and directly remitting 30% to the medical practice and the remaining 70% to the medical practitioner. Notwithstanding that the medical practice never receives (or pays) the 70% paid to the medical practitioner, the payment by the clearing house to the medical practitioner will be deemed wages under section 51.

Wages paid by practitioner entity to medical practitioner

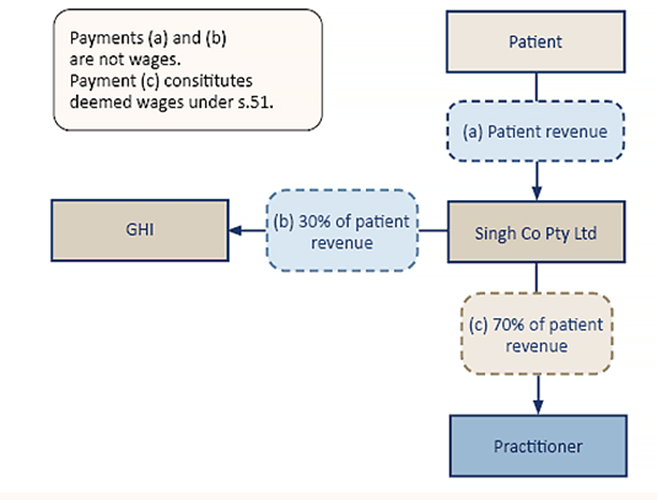

- Example 16 will be of significant interest to many practitioners. Where the patient fees are collected directly (and entirely by) a practitioner entity (in this example, Singh Co Pty Ltd as an entity controlled by the practitioner (Dr Singh)), the initial patient fees are not deemed wages. Any administration fee that Singh Co pays to the medical practice (GHI in this example) is also not deemed wages.

- However, any subsequent payment from the practitioner entity to the practitioner will be wages deemed to have been paid by the medical practice (GHI) to the practitioner (Dr Singh).

Other observations

It is clear that the use of any entity to directly or indirectly receive patient fees will very likely (if not certainly) result in the payments being deemed wages by the medical practice. Therefore, the safest option would be for all patient fees to be directly received by medical practitioners without the involvement of any practitioner entity or clearing house.

We are aware of payment solutions which seek to achieve a payroll tax efficient outcome whereby patient fees are deposited directly to a practitioner, followed by an immediate direct payment from the practitioner to the medical practice for the administration fees. This would alleviate the commercial concern of medical practices taking on the additional administration burden and credit risk of chasing medical practitioners for payment.

Somewhat disappointingly, the public ruling does not provide any opinion or guidance as to whether the QRO would consider applying any anti-avoidance provisions to medical practices seeking to restructure their current agreements with medical practitioners to be more aligned with a direct collection model. This omission does leave medical practices with some level of risk should they look to restructure their affairs before the end of the amnesty period.

For more information

If you are potentially affected by the developments set out in this Insight, please contact Sam Mohammad of RSM Australia.