Executive summary

Establishing a company in China is far easier for foreign investors than liquidating one. Chinese authorities have a long list of requirements to meet before authorizing the shutdown of a China business. In most cases, ensuring that your business complies with local regulations is a must for any successful business deregistration process. Keeping track of books, taxes, salaries and other financial and regulatory information is paramount.

Many foreign companies have excellent business in China. But some need to liquidate for different reasons, such as internal restructuring for better expansion in China, or because barriers to success in China have prompted investors to reshore the business.

Although it can be tempting to leave China and abandon the business, this approach is not recommended. There are serious consequences for not deregistering a business properly. In prior cases, foreign investors have been prohibited from re-entering the market, subjected to heavy fines and shareholders and investors have been blacklisted. Closing a business should not be taken lightly.

With the merger of state-level and local-level taxes and China’s new tax management system (the Golden Tax System Phase III), the tax authorities have become increasingly strict with compliance. Enterprises that cease operations are thus faced with a challenging deregistration process, for which tax clearance is the most complicated and lengthy step.

What should foreign investors consider before beginning the liquidation process? What are their options? How long can it take? In recent years, China has reformed its deregistration system to make it more efficient. We look at two options and offer a case study of a recent liquidation.

We are pleased to share our latest insgiht in collaboration with The American Chamber of Commerce in Shanghai (AmCham Shanghai)

1: Cancellation procedure background: simple deregistration vs. normal deregistration

In 2017, China’s State Administration for Industry and Commerce implemented two ways to cancel a company, depending on its taxation history (outlined in the sections below): a simple deregistration or a normal deregistration. Three years later, additional regulatory bodies streamlined the cancellation process.

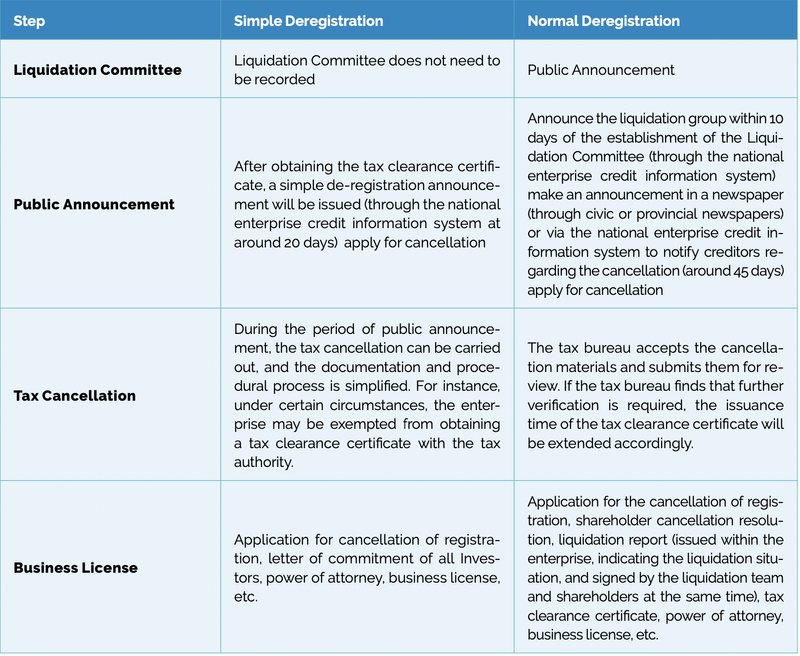

There are five main steps in the cancellation process, including liquidation committee organizing, public announcement, tax de-registration, business license cde-registration and bank account cancellation. The simple deregistration differs from the normal deregistration process in four of these steps:

2: Simple deregistration: what are the eligibility criteria?

Not every company to be deregistered may be eligible for a simple deregistration. According to guidelines, the simplified cancellation procedure does not apply to an enterprise under any of the following circumstances:

1. Foreign-invested enterprises involved in the implementation of special access management measures stipulated by the state

2. Enterprises listed as having abnormal operation or seriously illegal and dishonest behaviors.

3. Situations in which the equity (investment rights) is frozen, pledged or mortgaged.

4. The enterprise is under investigation or administrative coercion, judicial assistance, or administrative punishment.

5. The unincorporated branch of the enterprise has not gone through the cancellation of registration.

6. The enterprise has a termination history in the simple deregistration process;

7. Enterprises that have obtained pre-approval before the cancellation process according to the laws, administrative regulations or decisions of the State Council.

3: A simplified tax deregistration procedure?

According to regulation, taxpayers who apply for the simplified cancellation process, and meet one of the following circumstances (see below), are exempt from getting a tax clearance certificate from the tax bureau prior to deregistration:

1. Companies with no tax history with the tax bureau; or

2. Companies with tax history but no history of invoice issuance and no outstanding tax, overdue fines or penalties.

Despite the exemption, if these taxpayers need a tax clearance certificate and have applied to the tax bureau, they can still immediately obtain one. Taxpayers may also get tax clearance and obtain a tax clearance certificate when information is missing by ‘making a commitment’ (a commitment of a resubmission within a specified period), if they have satisfied the following conditions:

1. Are an enterprise with tax history but which have never applied to issue invoices and does not have outstanding tax payments, overdue fines or other penalties; and

2. For enterprises that have applied to issue invoices, are not under tax inspection and do not have outstanding taxes, overdue fines or other penalties and have handed in the special value-added tax (VAT) invoices and VAT invoices machine to the tax bureau for cancellation.

And at the same time:

- Are taxpayers with a class-A or class-B tax credit rating;

- Are taxpayers with a class-M tax credit rating whose parent company has a class-A tax credit rating;

- Are enterprises whose founders are talents introduced by a provincial government or recognized by industrial associations above the provincial level;

- Are individual businesses that are not included in the evaluation of tax credit rating and make regular tax payments of fixed amounts; or

- Are taxpayers that have not reached the VAT payment threshold – individual taxpayers (excluding individually owned businesses registered as general taxpayers) whose sales do not reach the VAT threshold and are exempted from paying VAT.

However, if the commitment is not fulfilled in the stipulated period, the tax authorities will categorize the applicant’s legal representatives and financial managers with a class-D tax credit rating.

4: Key steps before tax deregistration

There are many pre-steps to consider before starting the deregistration application with the tax bureau, including clearing the balance sheet (including disposal of fixed assets, settlement of all receivables and payables). In this process, there may be additional tax costs derived from uncollectable debts, waived liabilities, etc. Upon clearing the balance sheet, the company to be liquidated needs to repatriate all retained earnings or computed liquidation income (if any). As it would take certain time to accomplish the repatriation of the retained earnings (especially if the preferential rate under tax treaties for dividend payment is going to be applied), we would suggest starting relevant preparation for this step as soon as possible. Having completed the above steps, the investor should also calculate if the company has enough cash to settle the final tax payable (if any).

Case study – cancellation case through the simplified cancellation process

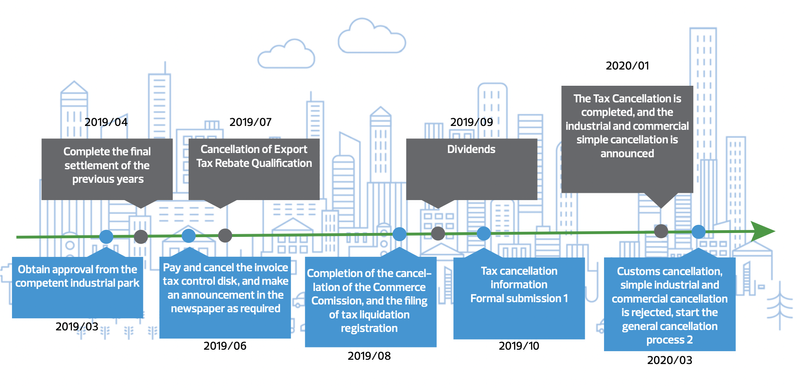

Company ABC is a Shanghai-based manufacturer established in 2004, with 100% foreign-owned shares. From January to March 2019, the company operated normally, with an export business of about RMB6 million monthly. It stopped operating in April, dismissed most employees and disposed of its fixed assets. At the end April, most of the receivables and payables had been cleared, and the remaining rental deposit will be recovered in September. By the end of September, all receivables and payables will be cleared.

What would be the timeline and procedure like for such project?

Company ABC originally qualified for the simple deregistration procedure. However, due to historical administrative penalties later identified, the simplified industrial and commercial deregistration application was rejected, and the company had to use the normal deregistration procedure.

Tax-wise, Company ABC had many receivables, payables and assets at the beginning of the period, thus supplementary information was requested by the tax authority. (Please note: the final tax settlement of the previous year shall be completed first, while the deadline for this final settlement during the operating period is the month prior to the liquidation registration and filing.)

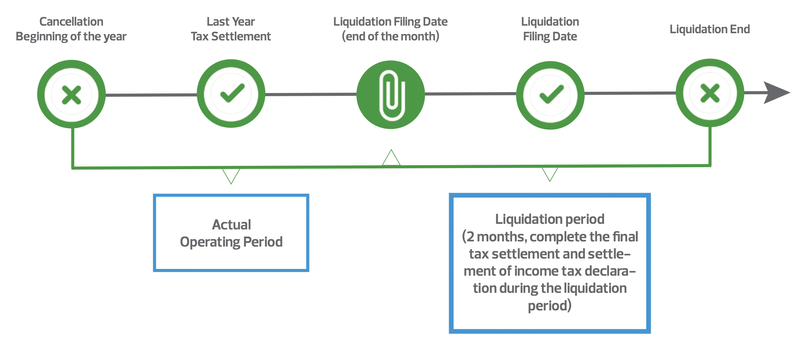

According to local tax authority practice, the liquidation period begins at the start of the month of liquidation registration and filing lasts for two months.

What practical advice can we give?

We recommend that all foreign businesses in China meet documentation and compliance requirements. Many factors influence the timeline and complexity of a company deregistration process, among which the tax de-registration step may be the most time-consuming and challenging. The procedure can be long, and it requires interaction with different government bodies. A detailed plan of action is key to identifying issues that will arise while professional advice and support can help expedite the liquidation process.