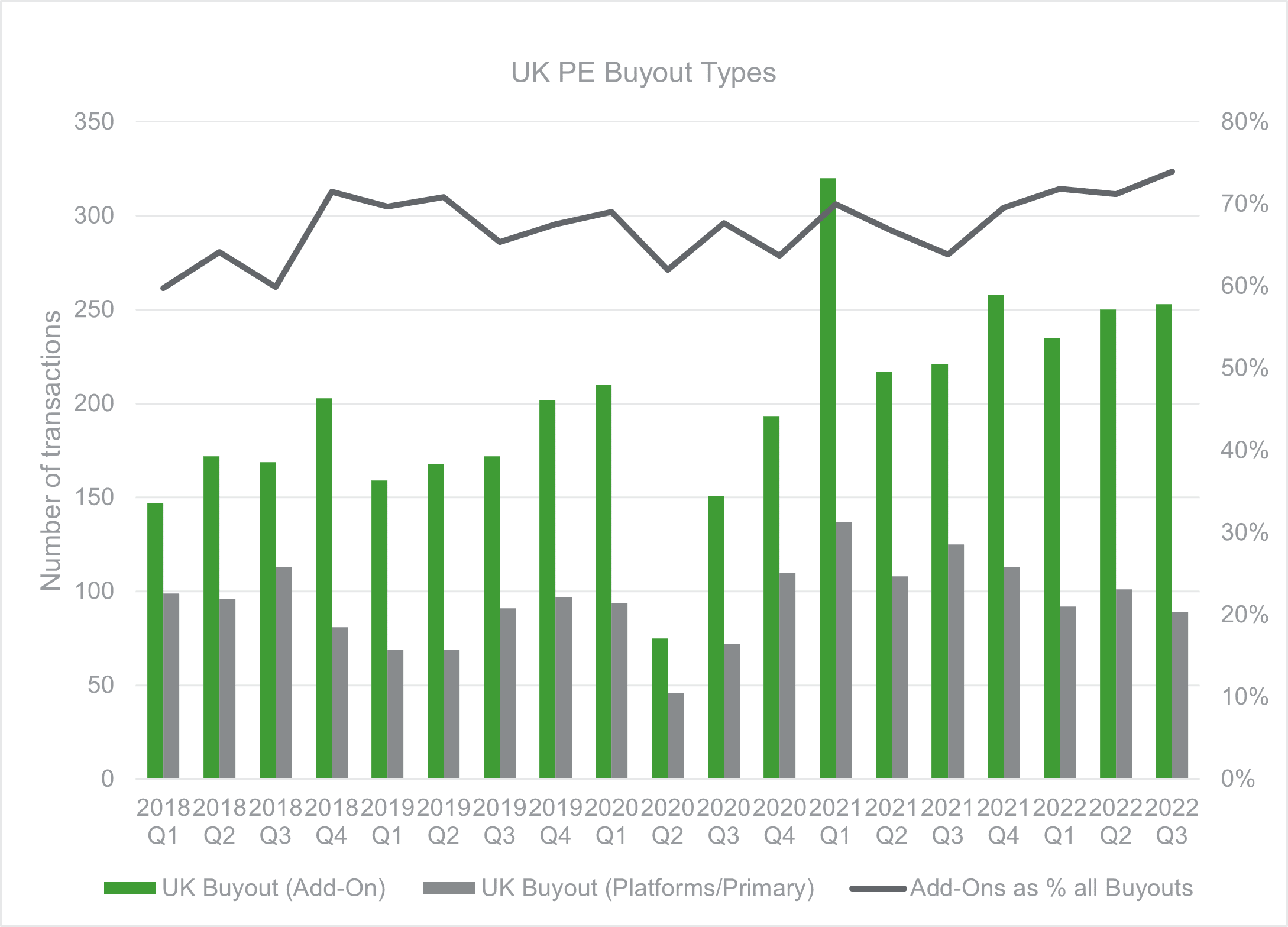

When diving into the profile of Private Equity (PE) transactions that have occurred since 2018, it’s striking how add-on acquisitions have become such an important part of the market.

These acquisitions, which involve a PE-backed business making acquisitions, have been at their highest in 2022 to Q3, and made up 74% of all UK buyout deal flow by number of transactions. The remaining 26% of deals are what’s known as platform or primary acquisitions, where the PE firm makes an acquisition and there is no pre-existing portfolio company that that business will be integrated into.

Add-on acquisitions have become an important feature of the market

Data source is PitchBook Data Inc, Analysis by RSM UK

There are multiple reasons for add-on acquisitions, such as:

- Improved strength and growth: Add-ons provide access to new markets, products and propositions, skills and/or customers, and offer economies of scale.

- Valuation increase through multiple arbitrage: A larger business typically sells for a higher price-to-EBITDA multiple than a smaller one that is, otherwise, identical. This is a function of the larger risk and lower momentum that characterises smaller firms. The arbitrage occurs where the multiple that the combined business is able to command becomes at least that of the acquiring company’s. The effect is that the acquired entity is worth more simply because of the acquisition.

To illustrate, a small business of £5m EBITDA might attract a price multiple of 5, giving it a value of £25m. If an identical, but larger, business of £50m EBITDA and attracting a multiple of 7, and therefore with a value of £350m, acquires that smaller company, the combined EBITDA of £55m would then attract a multiple of at least 7. That then gives the combination a valuation of £385m, vurses the £375m of the two business if they weren’t combined.

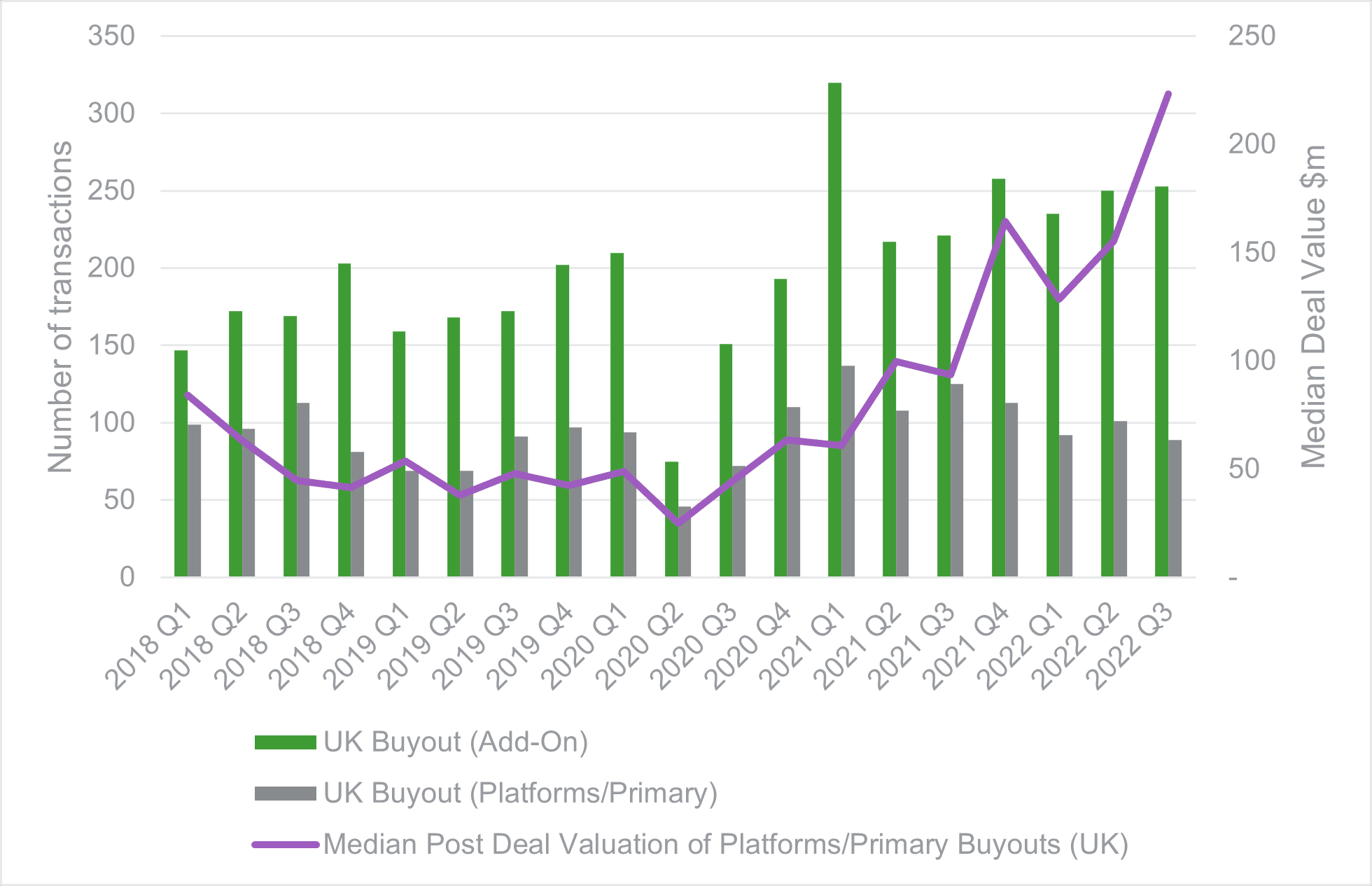

Add-ons in an era of highly priced platform and primary acquisitions

Multiples arbitrage is particularly attractive when valuations are high, especially for the platform businesses that go on to make the add-on acquisitions. The lower price multiples that smaller companies can command help blend down the average acquisition price of all the companies that now make up the enlarged company. This is evidenced in the chart below where the rise in add-ons relative to platforms/primary deals coincides with a rise in the median post deal valuation of platform/primary deals undertaken.

Add-on acquisitions in the UK have risen as the value of platform/primary deals have risen

Data source is PitchBook Data Inc, Analysis by RSM UK

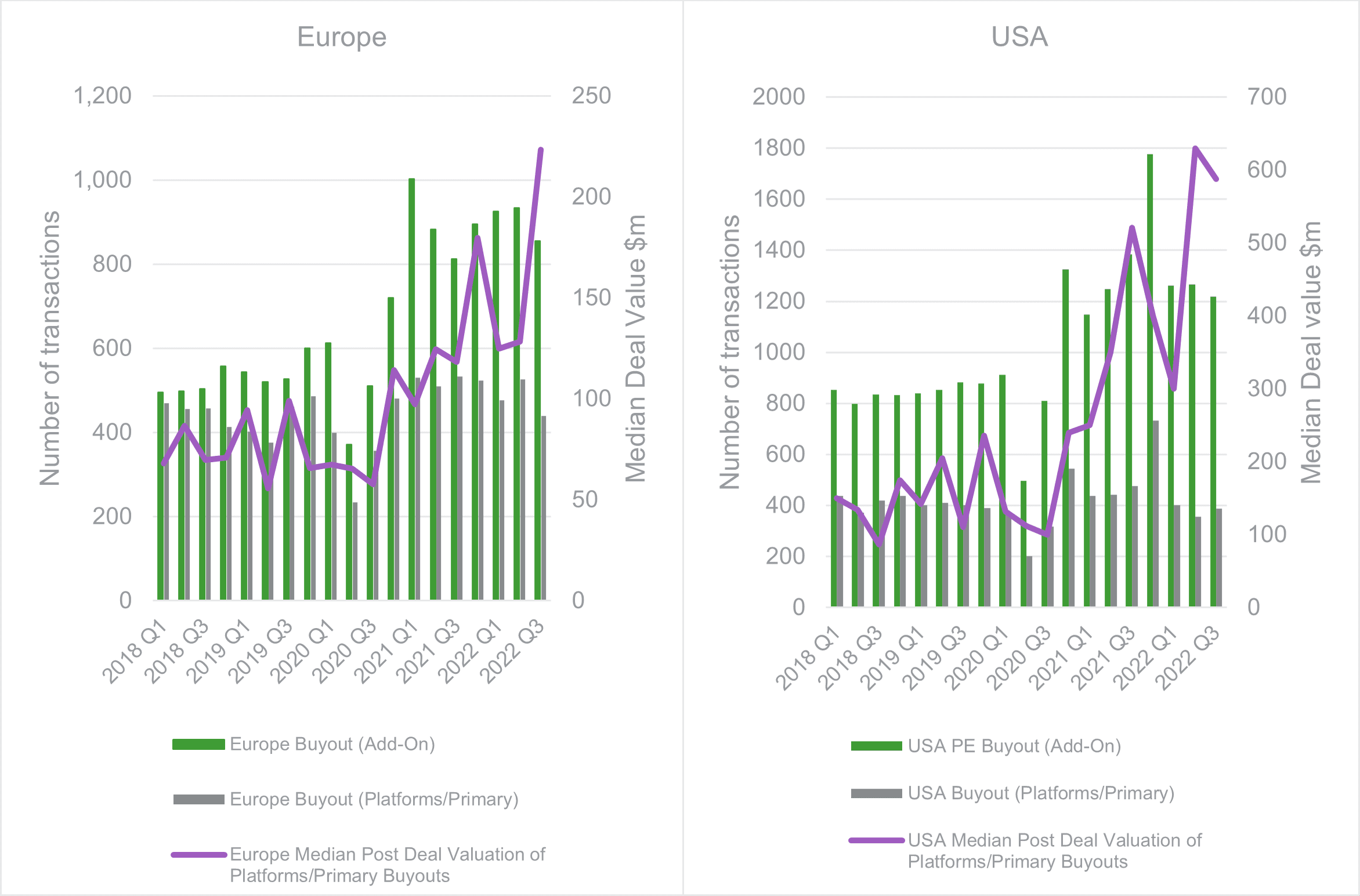

Looking at Europe and the USA, the simultaneous rise in platform/primary deal valuations and add-ons deal volumes while platform/primary deal volumes remain more flat is even more pronounced. Note the drop in platform/primary volumes in the US in 2022 which is a function of weakened debt market conditions where larger deals are typically more leveraged than smaller ones, which add-ons typically are.

European and USA add-on deal volumes rise at the same time as the value of platform/primary deals

Data source is PitchBook Data Inc, Analysis by RSM UK

We do, however, expect median valuations to decline as company performance is impacted by the current economic climate.

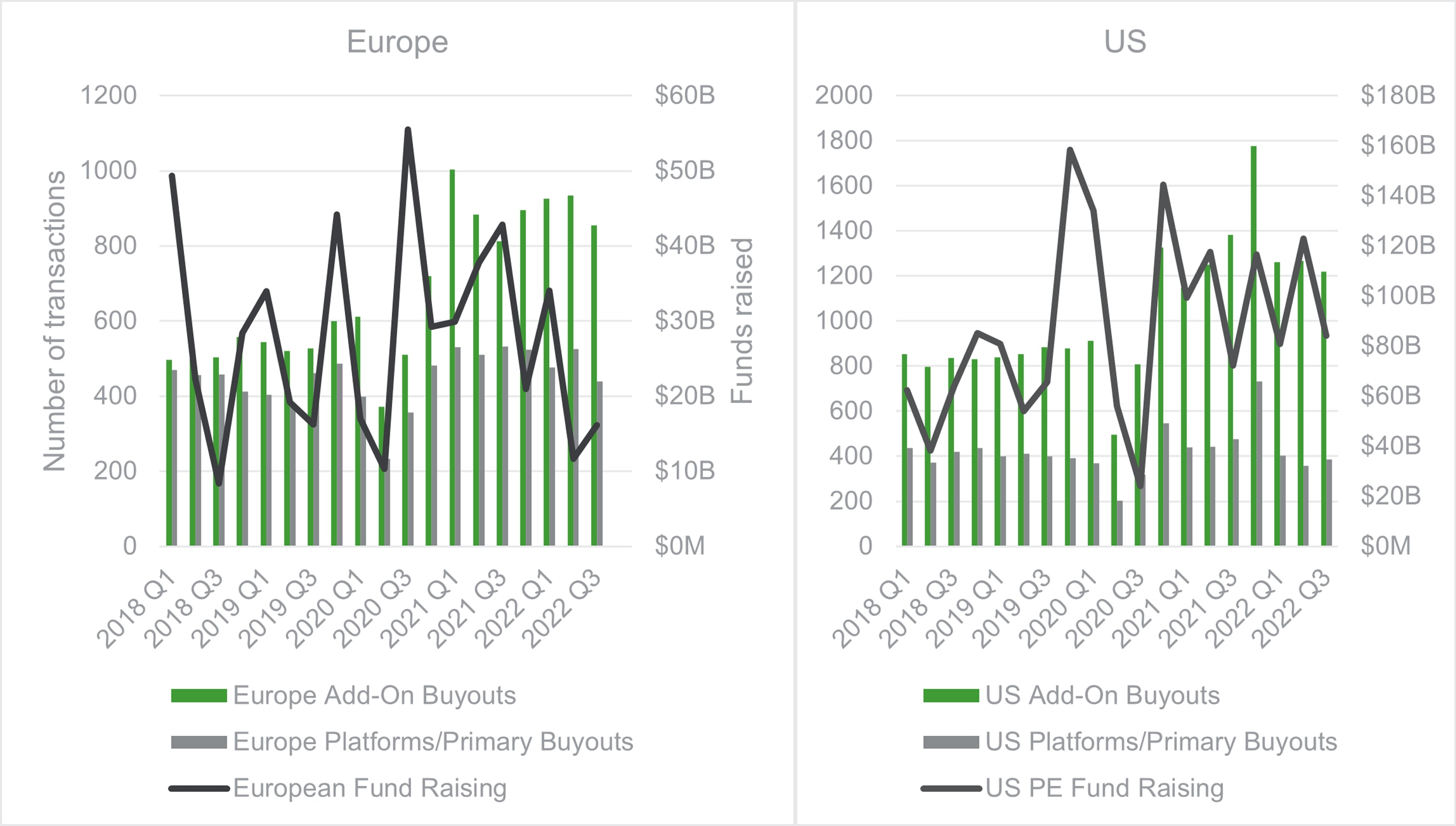

Additional context to the rise of add-ons – corresponding increase in funds being raised and add on volumes

As would be expected, there’s a general rise in fund raising by PE funds and their investmetnt activity in both Europe and the US, i.e. the more money that’s raised, the more deals that occur. A notable difference however occurs from the later part of 2022 where Europe starts seeing a decline in funds being raised starting in 2021. But that period coincided with a marked increase in the number of transactions, especially in add-ons. That explains the 23% drop in dry powder located in Europe from the peak of $350bn in 2020 to $271bn in June 2022, and only 13% in the US from $845bn to $749bn for the same period.

In the US after the first wave of the pandemic in 2020 Q2 there was a rise in add-on deal volumes and a parallel increase in fund raising indicating that those funds were being used for add-on activities (and the increasingly expensive platform acquisitions as laid out above).

Europe’s fund raising has slowed while the number of transactions has remained high. The US fund raising and add-on deal volumes have stayed high

Data source is PitchBook Data Inc, Analysis by RSM UK

However, add-ons must be integrated…

Value creation through using multiples arbitrage alone is unlikely to be successful, as potential buyers might, on closer inspection, value the entities separately. It’s therefore imperative that PE firms, their portfolio operations teams, and the management teams of the portfolio companies involved, actively pursue the strategic, commercial and operational benefits of the combination.

The necessity for effective integration is even more pronounced when pressured economies and a diminished dry powder pool, albeit from close to the peak, start shrinking the pool of interested investors in a business, which would otherwise have been key to pushing up prices as investors compete for the asset.

…and the opportunity cost considered

A highly active acquisition strategy can have the consequence of diverting company resources away from internal projects that would otherwise drive up productivity e.g. training, machinery, equipment, software, and R&D. This is particularly important when considering the long-term productivity of UK businesses and related prosperity. In 2021 for example, the UK was 20% less productive than the US and also behind that of France and Germany when measured on GDP per hour worked.

Add-on acquisitions have been, and will continue to be, a key type of acquisition made within the private equity arena as PE dry powder looks to deploy its near all time high levels of dry powder in both Europe and US.

PE firms are paying higher valuations for businesses they that will go on a consolidation journey with so business owners should think about companies they could acquire to attract PE investment. These could include competitors, or companies in upstream, downstream and/or adjacent markets.

Alternatively, business owners that seek an exit path for themselves should consider selling their business to a PE-backed firm. The business will be actively integrated with the acquiror making a strong combined entity that can better embrace opportunities and weather storms.