Our Private Client Service practice focuses on serving business owners, protecting the interests of the business founder or patriarch and transforming a ‘Family Business’ into a ‘Business Family’ to grow their businesses and preserve their wealth through generations.

A family in business faces a multitude of challenges, such as keeping harmony in the family, caring and developing individual family members, sharing the fruits of success, and at the same time, protecting, sustaining and growing the family businesses.

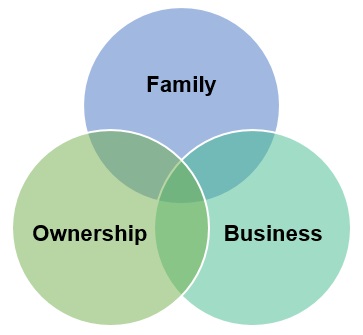

Optimal alignment among the three domains — Family, Ownership and Business — is the hallmark of a healthy, functional family business. Like it or not, the joy of success in a family business will ultimately require the creation of appropriate structures or problems will occur in all three domains.

Our Holistic Approach for Your Family Business

We leverage our experience in serving family businesses to provide solutions that align the three domains of family, ownership and business.

Family

Family Constitution

Relationships will start to become more fragmented, complex and difficult as the family and family businesses develop and grow. When a conflict in one of the three domains does not have a forum for expression and resolution, it will find a way to emerge and affect the harmony of one or both the other domains. It is therefore important to build a family governance structure to foster mutual understanding of the rights and responsibilities of all persons who have an interest in the family wealth. The key pillar of such a governance structure is the Family Constitution.

| Benefits of having a Family Constitution | Components of a Family Constitution |

|

|

Philanthropy

The principal purpose of family philanthropy is to reinforce the family’s value in giving back. However, many family business leaders are often frustrated about how to handle the many requests. To make giving a more positive experience, the family should establish a focused family foundation or donor-advised philanthropic fund as the major conduit for family business giving. This will increase the impact and results.

Highly recognised in the charity sector, our dedicated NPO practice assists in setting up the family charity foundation and provides support in governance, audit, information technology, secretarial, recruitment, accounting and payroll.

Family business philanthropy will also bring about the following benefits:

- Enables younger family members to work with other family members to develop and apply their abilities, such as decision-making and policy-setting skills;

- Develops humility, which is an important trait for future family business leaders

- Reinforces relationships and builds family pride; and

- Allows family members who are not directly involved in the business to make meaningful contributions

Ownership

Surveys show that a large percentage of family-owned business do not survive the transition from the founder to the second generation. The 'killer' in most cases is taxes or family discord. Family business succession planning should therefore be a priority for every business owner who wants to hand over the business to the next generation. Who will manage the business when the family patriarch no longer does so? How will ownership be transferred? What is the optimal structure for tax purposes?

Management

- Establish Family Council to oversee the well-being and management of family businesses and investments

- Planning for family liquidity needs and business investment needs

- Assess potential successors realistically and plan accordingly

- Conduct gap analysis, train and develop the successor(s)

- Appoint outsiders to provide mentorship if necessary

Ownership

- Start the planning early

- Involve family members in business succession planning discussions and pay close attention to personal feelings, ambitions and goals

- Depending on the family situation, an equal share for everyone may not be the best approach

- Consider other exit strategies — IPO or selling may be a better option

- Shareholders’ Agreement and estate planning to avoid problems with future ownership

Tax Optimisation

- Trust structure

- Corporate structure and tax planning

Business

As a family business grows, professionalisation and globalisation become ‘needs’ rather than ‘wants’. We help family businesses address these challenges through our proprietary business management models and the following solutions:

| Professionalisation | Globalisation |

|

|

Our Advantages

Deep experience in serving family businesses

One-stop shop with fully integrated services by specialist teams

High partner, director and manager involvement

Extensive network of relationships with financial institutions, fund managers, venture capital trusts and private equity firms to uncover business expansion opportunities

Global presence in 120 countries to assist with overseas growth and entry into new markets