For international businesses, navigating complex tax regulations can often pose significant challenges for companies seeking to optimise their financial operations. For example, global commodities traders, with headquarters in Singapore, may find it challenging to repatriate profits from subsidiaries in low-tax jurisdictions (with less than 15% headline tax) to qualify for Singapore’s income tax exemption, due to the country’s current tax laws and practices. Generally, Singapore's Foreign Source Income Exemption (“FSIE”) regime offers tax exemption for foreign dividends, received in Singapore, provided certain criteria are met.

However, for companies headquartered in Singapore with key production facilities operated by subsidiaries located in various low-tax jurisdictions, repatriating profits (i.e. dividends) from its subsidiaries may or may not qualify for an exemption from Singapore income tax.

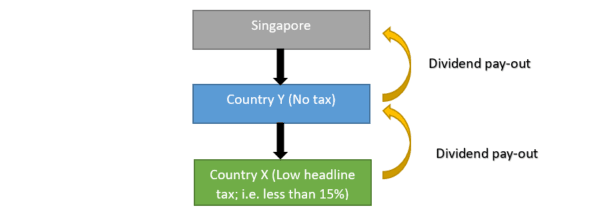

The group structure can be as follows:

Based on the above example, the Group’s corporate structure does not fully align with the predefined criteria of the FSIE regime. As a result, the foreign dividends to be received by the Singapore holding company from its profitable Country X subsidiary would be subject to Singapore's corporate income tax rate of 17%.

Under our current law, it is possible to seek approval from the Singapore Ministry of Finance (“MOF”) via a special application for tax exemption.

RSM Singapore assisted a Client in seeking special approval from the MOF under such circumstances. The application required meticulous preparation and close collaboration between our team and the Client. We compiled comprehensive documentations to address queries raised by the MOF during the assessment process.

The MOF closely examined the Client's corporate structure and fund flows, questioning the necessity of interposing Country Y between the Singapore holding company and Country X subsidiary. The Client successfully provided commercial reasons to justify this arrangement and as a result, the MOF granted approval, enabling the Client to repatriate dividends, without incurring additional taxes in Singapore.