Our corporate income tax regime has all along been premised on the concept of revenue versus capital. Income and gains which are revenue in nature are taxable whereas gains of a capital nature are not taxed.

Section 10L of the Income Tax Act 1947 (“ITA”), recently enacted to take effect from 1 January 2024, will allow Singapore to tax gains derived from the sale or disposal of foreign assets that are received in Singapore by businesses which do not have economic substance in Singapore. This is notwithstanding that such gains may be tax exempt under certain specific provisions of the ITA currently or are capital in nature.

The introduction of Section 10L to our tax regime is indeed a fundamental shift from our long-standing treatment of not taxing capital gains.

Why Section 10L is introduced

As part of the initiative to combat harmful tax competition and address international tax avoidance risks, the EU Code of Conduct Group reviewed several foreign-sourced income exemption (“FSIE”) regimes in various jurisdictions. In its updated guidance dated December 2022, it requires an FSIE regime to include capital gains as a category of income which should be subject to the economic substance requirements. Section 10L was introduced with the aim to align the treatment of gains from the sale or disposal of foreign assets to the EU Code of Conduct Group guidance.

Who are within the scope of Section 10L

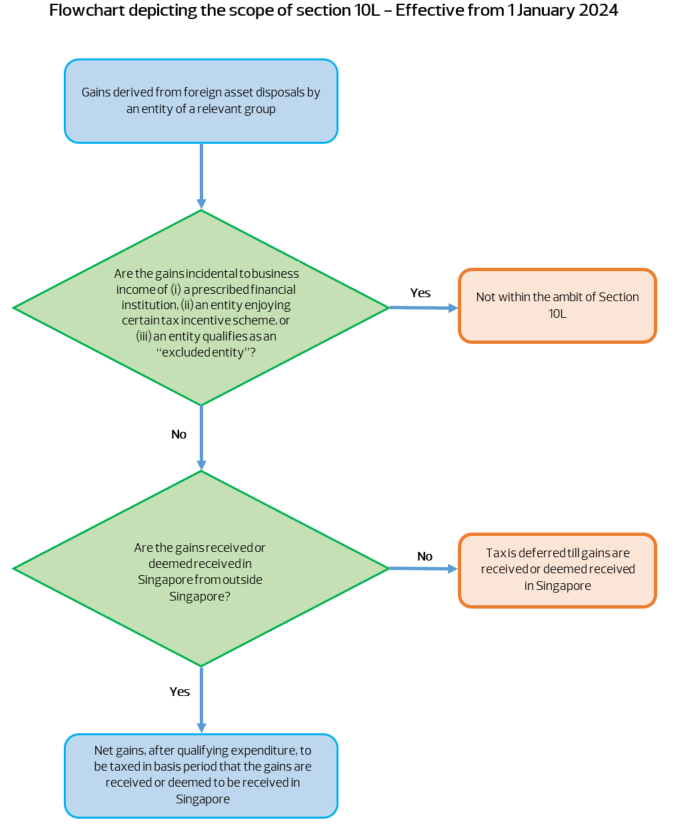

With effect from 1 January 2024, gains derived from the sale or disposal of immovable or movable property situated outside Singapore, received or deemed to be received in Singapore from outside Singapore, by an entity of a relevant group may fall within the ambit of Section 10L and hence to be brought to tax for the year of assessment relating to the basis period in which the gains are received or deemed to be received in Singapore.

A group is a relevant group if the entities of the group are not all incorporated, registered or established in a single jurisdiction or any entity of the group has a place of business in more than one jurisdiction. An entity is considered a member of a relevant group if its assets, liabilities, income, expenses and cash flows are included in the consolidated financial statements prepared by the parent entity of the group or excluded solely on grounds of materiality or the entity is held for sale.

A domestic group with no presence outside of Singapore or a standalone entity in Singapore will therefore not fall within the ambit of Section 10L.

The Section 10L provisions apply notwithstanding any tax exemption provided elsewhere in the ITA unless the gains derived from the sale or disposal of foreign assets are incidental to business income of prescribed financial institutions and entities enjoying tax incentives, such as shipping industry incentives, Development and Expansion Incentive, Global Trader Programme and Finance and Treasury Centre Incentive. For entities which do not fall within these exclusions, there is still a possibility to exclude them from Section 10L, as “excluded entities”, if the prescribed economic substance requirements in Singapore can be demonstrated and met. For foreign gains arising from the sale or disposal of an intellectual property right, separate rules apply.

Economic substance requirements for an “excluded entity”

An entity, whether a pure or a non-pure equity-holding entity, must meet all the prescribed economic substance requirements (see table below) during the basis period in which the foreign asset disposal occurred in order to be regarded as an “excluded entity”, and falls outside the ambit of Section 10L.

A pure equity-holding entity means an entity whose function is to hold shares or equity interests in other entities and derives only (i) dividends, (ii) share or equity interest disposal gains or (iii) incidental income from the holding of such share or equity interests.

| Type of entity | Economic substance requirements |

| Pure equity-holding entities |

|

| All other entities which are not pure equity-holding entities |

|

We expect Inland Revenue Authority of Singapore (“IRAS”) to provide guidance through an e-Tax Guide on what are acceptable contemporaneous documentation to substantiate the fulfilment of the above mentioned economic substance requirements in the relevant basis period in which a foreign asset disposal takes place.

Funds

Investment funds currently enjoying various fund tax incentive schemes in Singapore are not specifically carved out from Section 10L provisions. Such funds typically would have met the substance-based conditions before a particular tax incentive scheme is accorded to them. It is common for investment activities of funds to be outsourced to Singapore-based fund managers; entities which would have met economic substance criteria themselves. In practice, the conduct of the outsourced activities by Singapore-based fund managers would have been carefully determined and documented by way of a duly executed investment management agreement, outlining fully the duties and responsibilities of the fund managers to the funds.

On the premise that there is sufficient documentation put in place for the conduct of outsourced activities by fund managers in Singapore, investment funds should not in our view have too much of an issue in maintaining that they are “excluded entities”, falling outside the confines of Section 10L. Clarifications from IRAS are eagerly awaited by the fund industry on this issue.

Foreign assets

“Foreign assets” referred to under Section 10L are in reference to movable or immovable properties situated outside Singapore.

The following are some of the basic rules in determining where properties are situated:

- Immovable property and tangible movable property are situated where such properties are physically located.

- Intangible movable property is situated where the ownership rights in respect of the property are primarily enforceable.

- A secured or unsecured debt (other than a judgement debt or securities) is situated where the creditor is resident.

- Any shares in or securities issued by a company (including any right or interest in such shares or securities) are situated where the company is incorporated.

It should be noted that there is no specific carve-out or exclusion for intra-group transfers of foreign assets.

In instances where foreign assets are disposed of before 1 January 2024 and the gains are remitted to Singapore after 31 December 2023, Section 10L provisions should not apply.

Received or deemed received in Singapore

Section 10L provisions are in line with the existing income tax concept that foreign-sourced income must be received or deemed received in Singapore to be taxable. Hence foreign asset disposal gains are only to be brought to tax upon the happening of any of the following events, when any amount from such gains is:

- remitted to, transmitted or brought into Singapore;

- applied in or towards satisfaction of any debt incurred in respect of a trade or business carried on in Singapore; or

- applied to the purchase of any movable property which is brought into Singapore.

Under the existing provisions of Section 10(25) of ITA, IRAS had clarified that foreign-sourced income utilised to reinvest overseas or pay a dividend to foreign shareholders, without repatriating the offshore income funds to Singapore first, would not be considered “received in Singapore” and trigger a tax charge at the point of reinvestment or paying a dividend to foreign shareholders.

It remains to be clarified by IRAS whether this existing concession would similarly apply to the Section 10L gains. If applicable, taxpayers should take note that they must continue to keep track of the foreign funds which are utilised for reinvestments. The current concession granted by IRAS for reinvestments merely defers the tax incidence until such time when the reinvested assets are eventually sold and the proceeds brought back to Singapore.

Computation of disposal gains

In the computation of the remitted disposal gains to be brought to tax, deductions allowable may include expenditure incurred to acquire, create or improve or dispose of the foreign asset.

Section 10L provisions will only take effect from 1 January 2024. There is however no specific provision to allow a step-up of the original cost base as at 1 January 2024 to take into consideration that the portion of the disposal gain accruing from the date of the asset acquisition to 31 December 2023 should perhaps not form part of the gains to be brought to tax. To do so would appear to imply a retrospective application of the Section 10L provisions.

It is hoped that IRAS will address this issue and make certain concession in this regard when their e-Tax Guide on Section 10L is issued.

The global tax landscape is changing

The introduction of Section 10L in Singapore, the legislative changes announced in Hong Kong thus far and the proposed legislative changes announced by the Malaysia tax authority are all indicative of the increasing global focus on addressing international tax avoidance.

Section 10L emphasises the need for entities based in Singapore to have a greater substantive economic activity conducted out of Singapore. The new law provisions, on balance, should not have a significant adverse impact on Singapore’s attractiveness as a choice of investment holding jurisdiction. The level of economic substance requirements for a pure equity-holding entity does not appear to be too onerous. Currently IRAS already requires an investment holding company to have a certain level of economic substance, to prevent treaty shopping, before acceding to its request for the issuance of a Certificate of Residence. Taxpayers in Singapore therefore should be familiar with the concept of meeting economic substance requirements.

How we may assist

We welcome an opportunity to discuss with you on the impact of Section 10L provisions to your existing group structure and the potential of taxability on gains arising from future disposal of foreign assets.