Environmental, Social, and Governance (ESG) has received growing levels of attention in recent years amidst waves of consumer activism, climate awareness, and green politics. In Singapore, the government has also announced the Singapore Green Plan 2030, which aims to advance the national agenda on sustainability and carbon emissions. As part of this plan, companies are mandated to report climate-related business impact. However, many will be challenged by data issues. Given that ESG data plays a crucial role in evaluating business sustainability, building stakeholder confidence, and attracting investors, inaccurate data can be detrimental to the organisation.

You Cannot Manage what you Cannot Measure

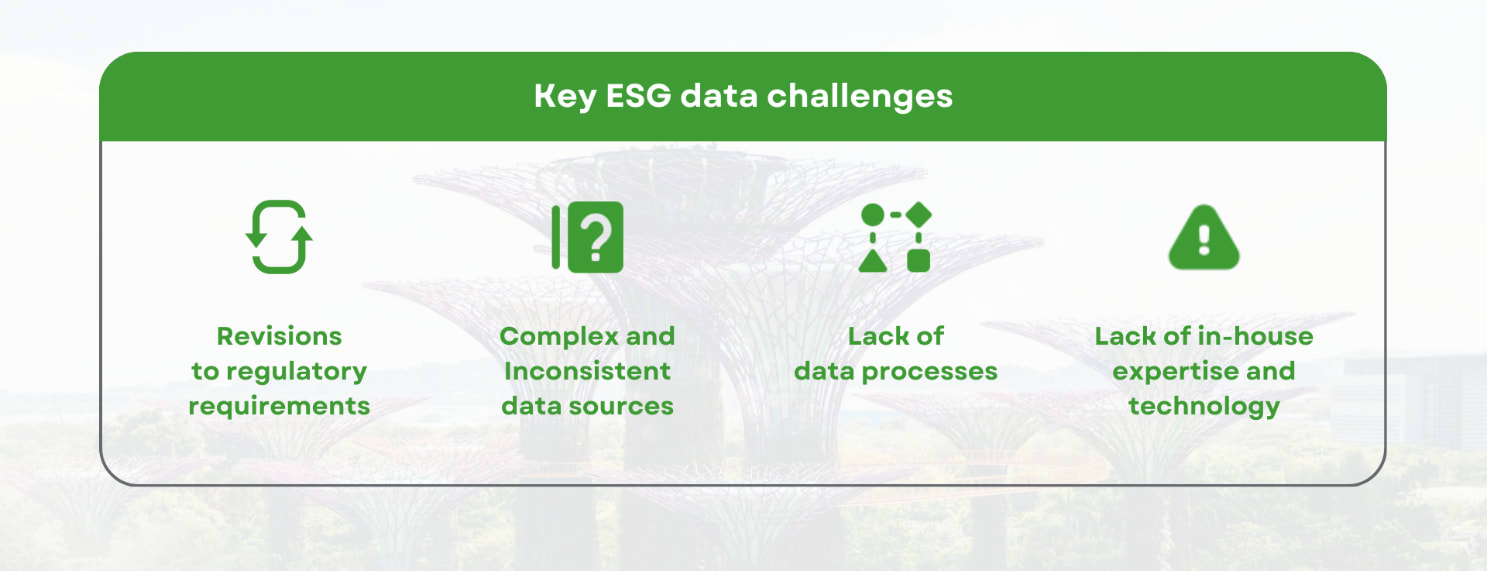

Many organisations struggle to collect relevant data. This is due to:

Revisions to regulatory requirements – A constantly evolving ESG landscape affects companies seeking to establish standardised data collection processes. For instance, with the upcoming 2024 International Financial Reporting Standards (IFRS S1 and S2), some companies may struggle to identify sources of Scope 1 to 3 emissions to meet the reporting requirements.

Complex and inconsistent data sources – ESG spans a wide range of topics, even within each pillar. As such data sources are varied, with multiple types and structures. Therefore, it can be a challenge to collect, aggregate and store such information.

Lack of data processes – Data inconsistencies are magnified without a proper process for data collection. Due to a lack of knowledge, management may also be ineffective in driving the strategy and processes. In the 2023 ‘Navigating ESG Reporting Challenges Through Innovation and Collaboration’ study by Eco-Business, 79% of Singaporean business leaders struggle with ESG data collection and how to capitalise on the data.

Lack of in-house expertise in data and technology –In-house experts and technology are integral to analysing and visualising collected data. Companies lacking such expertise may struggle to derive business insights or accurately report ESG findings.

Addressing the key ESG Data Issues – the A to E

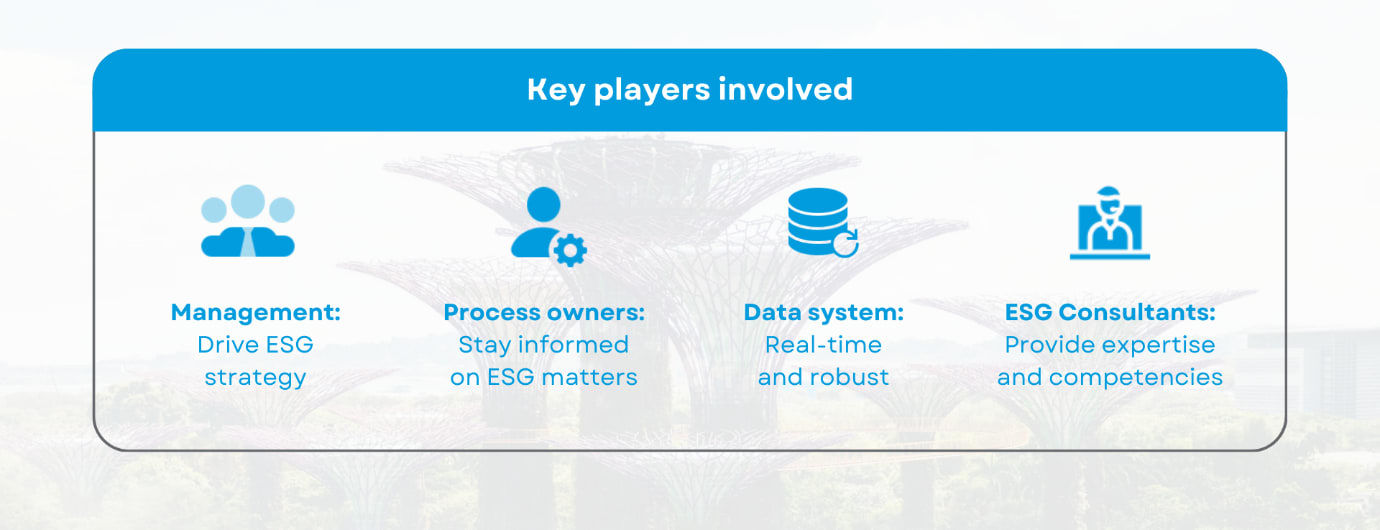

For an organisation to implement an effective ESG strategy, key data issues must be resolved. This requires the involvement of key players, such as management, process owners, data systems, and ESG consultants.

Companies can adopt an ‘ABCDE’ approach to address key ESG data issues:

- Assess – To know what data to collect, companies first need to identify which ESG topics are material to their business. This requires a formal evaluation of the business operations. A strong understanding of the regulatory requirements will also help in determining which data to collect and report.

- Build – To build a robust data framework, companies need to institute effective data collection practices. Effective data policies contribute to improved data governance within the organisation, thereby enhancing data credibility and fostering trust among stakeholders.

- Collect – To collect data via robust data collection systems, capable of storing standardised, historical data for analysis. Before determining the tools and approach, key decision-makers should consider organisational requirements and alignment with the ESG strategy.

- Drive – To define and communicate management-driven ESG strategy within the organisation. Meanwhile, the implementation success of the strategy can be measured through management-formulated Key Performance Indicators (KPIs).

- Engage – To engage ESG consultancy services to reduce gaps in skill competencies. By leveraging external experts experienced with ESG data, companies can harness valuable business insights to sharpen the firm’s practices.

Turning ESG Data Challenges into Opportunities

Fundamentally, the ESG problem is also a data problem. With 71% of investors citing ‘incomplete and inconsistent data and research’ as the largest barrier-to-entry for ESG investing in the ESG Global Survey 2023, we predict that moving forward, lucrative ESG investments will become another strong stakeholder push for companies to strengthen ESG data capabilities.

With a well-thought out ESG and data strategy, companies can transform the ESG data problem into an opportunity for meaningful change.