As we shift to recovery gear, the reopening phase brings hope and opportunities to the business community. Jointly organised by RSM and the Bank of Singapore, “The Business Resilience & Equity Investment Opportunities” webinar (held on 25 Aug 2020) deep-dived into challenges faced in the COVID-19 pandemic and how companies can strengthen business resilience post-COVID-19, and seek good opportunities.

There is no better time than now for business owners to assess the current market environment for investment opportunities to build into their business strategies for growth, and re-evaluate their business operations to re-design a business model that is more sustainable and viable in the new normal.

Jeffery Tan, Managing Director and Market Head (for Singapore and Malaysia) of the Bank of Singapore, in his opening address, identified challenges companies face during this period; the pandemic is not just a health crisis, it has also affected the global economy and financial markets.

Strengthening Business Resilience Post COVID-19

There are opportunities in every crisis. New business strategies and operations are founded on resilience. For years, we have been operating in a VUCA world, but COVID-19 exacerbates it by causing damages at a magnitude no one has expected. Companies need to review the reason they first started their businesses, lead with purpose, and determine the course of actions necessary to build greater resilience.

Yvonne Tang, Senior Manager and Deputy Industry Lead for Private Client Services at RSM, shared that if the pandemic has taught us anything, it is that people and organisations are interconnected. In strengthening business resilience, companies need to reinvent their business model, establish business continuity, and develop a succession plan.

A Reinvention of Business Model

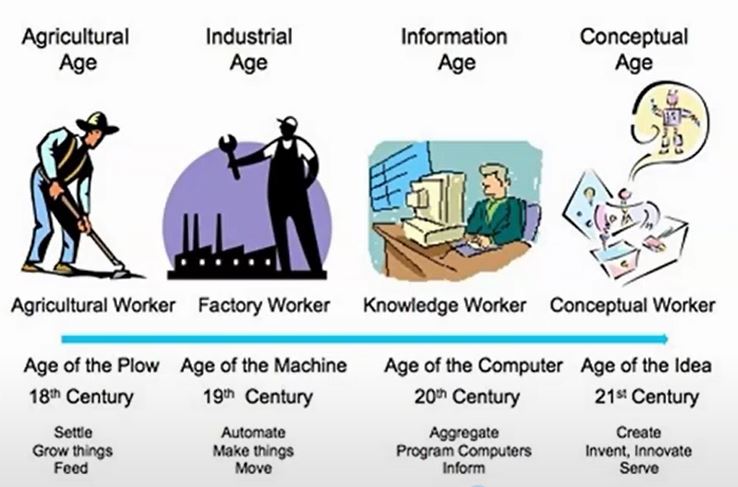

The current knowledge-worker age is different from the past. If leadership is based on industrial age thinking and formal authority, companies would not be able to adapt and would be left behind.

Companies also need to rethink their business model and digitise their processes. The online world of contactless commerce can be bolstered to reshape consumer behaviour. Companies need to leverage customer data and analytics to improve processes, drive decisions, and build a deeper connection between brands and customers.

Succession Planning

The uncertainty from the pandemic reminded us of the fragility of life. There are limits to our power and what we can control. The pandemic has revealed the importance of succession planning across businesses, and why having a clear succession plan is important for any business to survive.

One way is by identifying and grooming potential successors to help the company build capabilities and maintain stability so that the company can better withstand a crisis and move forward swiftly.

Inheritance Planning

For family businesses, inheritance planning is crucial. Legal elements of inheritance planning must be organised, such as the appointment of a Lasting Power of Attorney if the owner loses his/her mental capacity to make decisions in unforeseen circumstances, and the establishment of a will.

To plan for the future, company owners also need to reflect on the following questions:

- What is the legacy they want to leave behind for their loved ones?

- What are the family values that drive cohesion amongst family members?

- What are the governance structures to identify the roles and responsibilities of each family member?

- Are my children keen to continue to run the family business in the long term? If not, should I be considering exit strategies now in preparation for the future?

Family offices can also be set up to preserve, grow, and transfer wealth for the generations to come.

Investments in Equities amidst the current market environment and beyond

Eli Lee, Head of Investment Strategy of Bank of Singapore, shared that while crosswinds of negative news on the COVID-19, macroeconomic, and geopolitical factors will inject volatility and near term swings in the market, there will still be an upside in the long term.

Much of the stock market rally worldwide has been fuelled by stimulus packages aggressively rolled out by central banks and governments to boost growth. In addition to expansion and fiscal stimulus, interest rates are expected to stay at the current near-zero level for up to the next five years, which translates to lower cost of leverage for businesses and lower margin for buying financial assets for investors. This in turn will continue to drive investment yields in the market.

The reopening of businesses and economies underpins optimism and hope.

The pandemic reveals not just vulnerabilities but also opportunities to improve business performance. The market will go through severe bouts of volatility, but we must be ready to position ourselves for recovery.