With the theme “Moving Forward in a New Era”, Budget 2023 was delivered by Singapore’s Finance Minister, Mr. Lawrence Wong, on 14 February 2023. Budget 2023 marks a paradigm shift away from pandemic-focused budgets post-2020, and aims to re-orientate Singapore towards the long-term future. To ensure that Singapore thrives in a new era with an increasingly ‘zero-sum’ global economy, this year’s Budget ramps up support and funding for innovation in SMEs, strengthens the social compact amidst a post-pandemic reality, and rewards the active participation of a citizen workforce in navigating an ever-changing economic and geopolitical landscape.

Here are our thoughts on what the Budget has to offer to businesses and the impact of its key policy changes.

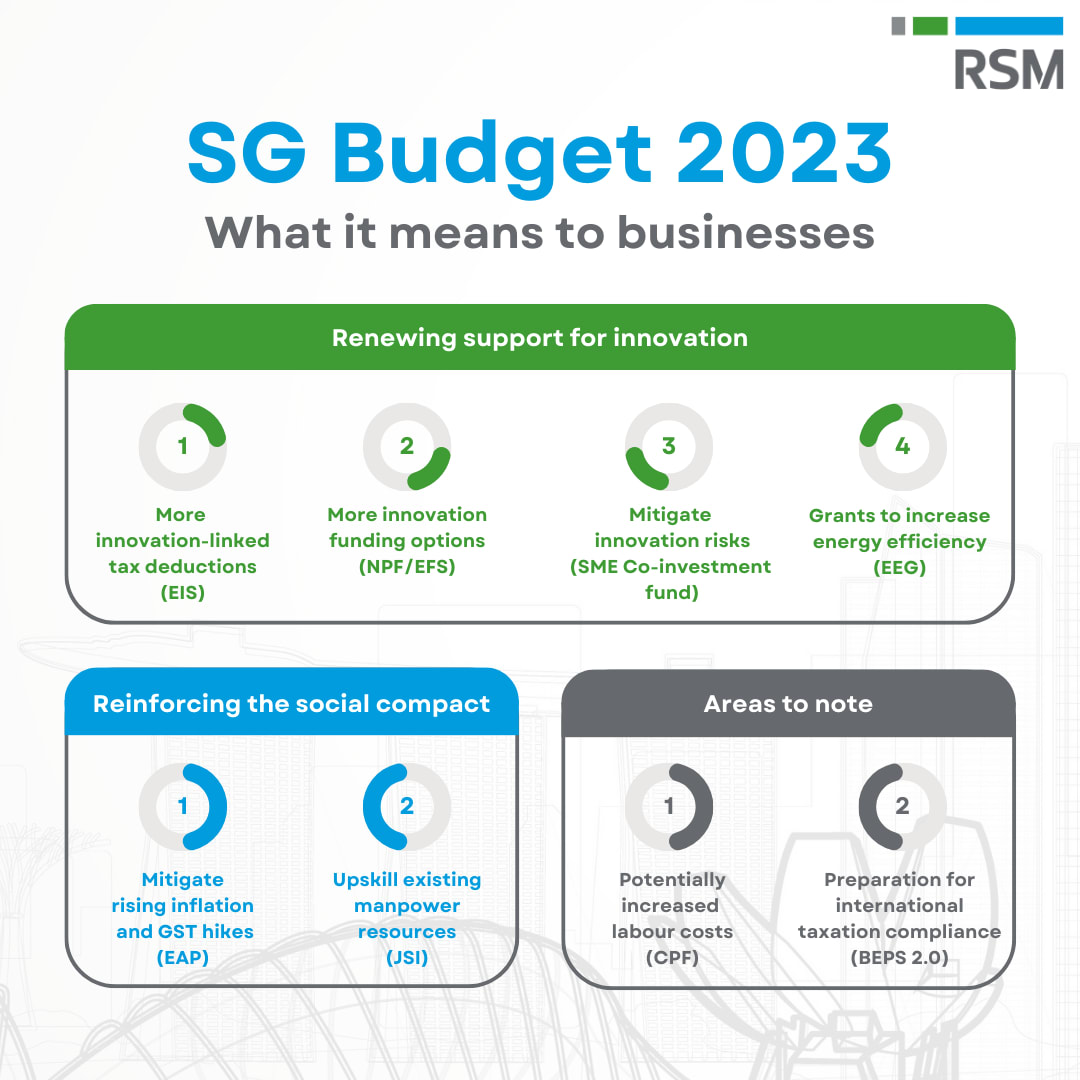

Renewing support for innovation

Given the current economic climate, companies emerging from a post-pandemic mindset of prudent resilience may opt to delay investments in innovation. Thus, it is encouraging that Budget 2023 continues to push for constant innovation among Singaporean companies with the newly-implemented Enterprise Innovation Scheme (EIS). The EIS scheme raises tax deductions to 400% of qualifying expenditure, mainly in areas of research and development (R&D), intellectual property and training courses aligned with the Skills Framework. The qualifying expenditure will be capped at $400,000 for each activity, except for innovation carried out with Polytechnics and Institute of Technical Education (ITE) which is capped at $50,000. Smaller firms that have yet to turn profitable may convert 20% of their total qualifying expenditure per Year of Assessment into a cash payout of up to $20,000.

Companies looking to fund innovation efforts may leverage a S$4 billion top-up to the National Productivity Fund (NPF), which has also expanded its scope to include support for promoting investment. Apart from traditional financial institutions, SMEs may also tap on the Enterprise Financing Scheme (EFS) to fund more capital-intensive technology investments, which will create long-term value for both employees and the domestic ecosystem. Other innovation investments may include harnessing data science-as-a-service, to deliver actionable business insights to optimise existing business processes, before deciding to embark on full-scale innovation development.

To mitigate perceived risks of investing in innovation, the SME Co-Investment Fund which is co-funded by the government and private investments, has received an additional $150 million from the government. This is intended to catalyse an additional $300 million of private investments. With the additional S$450 million, promising SMEs are incentivised to overcome the inertia of innovation and prioritise building new capabilities and upskilling employees.

With the Energy Efficiency Grant (EEG) extended until 2024, relevant SMEs in the Food Services, Food Manufacturing and Retail sectors can focus on building capacity and capability, through co-funding investments into more energy efficient equipment. By incorporating sustainable company practices, this not only mirrors the consumer and government push towards optimising Environment, Social and Governance (ESG) business factors, but also generates a virtuous cycle of growth for the economy. SMEs looking to green their value chain beyond energy consumption may also leverage ESG consulting services, in order to access additional green financing and achieve a competitive market positioning.

Enhancing the Singaporean workforce and social compact

Budget 2023 aims to reinforce Singapore’s social compact by targeting families, the elderly and lower-wage, less-privileged demographics with an extensive plan of handouts and rebates to defray the rising costs of living, inflationary prices and the phased GST hike. Consumption-linked SME stocks stand the most to gain from the enhancement to the Assurance Package, amounting to an injection of S$3.0 billion into Singapore’s economy.

Notably, the move to future-proof the long-term savings of local workers by raising the Central Provident Fund’s (CPF) salary ceiling may present cost headwinds for company profits, especially firms with significant labour cost exposure. However, SMEs in three pilot sectors can look forward to harnessing greater manpower resources with the new Job-Skills Integrators scheme which aims to bridge the workforce skill gaps. With this scheme, SMEs can leverage additional skilled or re-skilled workers to bolster their workforce.

Embracing international opportunities and regulations

As Singapore repositions itself as a global hub of innovation, businesses also need to prepare for international regulations that come with promising opportunities post-recovery. The global implementation of Pillar 2 of the Base Erosion and Profit Shifting initiative (BEPS 2.0) commencing from 2024, may not only impact large Multinational Enterprises (MNEs), but may also have rippling effects across the entire Singapore economy. Hence, it is important for SMEs to stay up-to-date with international developments.

Final words

Budget 2023’s measures aim to position Singapore as a key player in the global economy. It recognises that driving innovation development and reinforcing the social compact remain critical in ensuring Singapore’s competitive relevance in the global marketplace. Likewise, in view of quantum leaps in the development of artificial intelligence and rampant digitalisation of international corporate processes forged by the pandemic, SMEs and local companies alike should capitalise on Budget 2023 to continually invest in innovation, digital upskilling and the development of more efficient methods of doing business; – not to merely stay afloat, but to stay ahead of the curve.

By focusing on building capacity and capability for fast, on-demand scaling, companies that strive to adapt and thrive in a drastically-evolving business landscape can fully maximise the opportunities that lie ahead.

This article is contributed by Cephas Lim of the Data Science team.

To find out how our team can assist you in technology or sustainability management matters, please consult our specialist:

Adrian Tan

Partner & Industry Lead, Technology, Media & Telecommunications

T: +65 6594 7876

[email protected]