Unsere Global Employer Services (GES) Praxis erbringt hochwertige, spezialisierte Dienstleistungen in den Bereichen Beschäftigung und international mobile Arbeitnehmerschaft.

Dazu zählen insbesondere die individuelle Einkommensteuerberatung, sozialversicherungs- und vorsorgerechtliche Fragestellungen, die Gestaltung von Vergütungs- und Beteiligungsplänen, migrations- und arbeitsrechtliche Beratung sowie umfassende Betreuung im Bereich Global Mobility (einschliesslich Expatriates, Local-to-Local-Transfers, Grenzgänger, Kurzzeiteinsätze – STBTs).

Unser engagiertes Team betreut wachstumsorientierte Unternehmen unterschiedlichster Grösse, die sowohl in der Schweiz als auch grenzüberschreitend tätig sind.

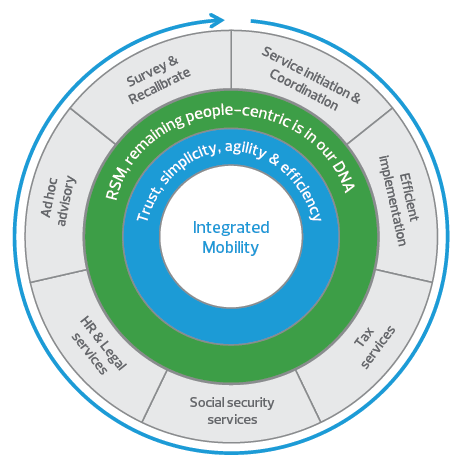

Technologisch gut aufgestellt, basiert unsere Arbeitsweise auf einem menschenzentrierten, von erfahrenen Fachleuten geführten und massgeschneiderten Ansatz – drei zentrale Säulen, um führende Compliance- und Beratungsdienstleistungen zu erbringen.

Das erfolgreiche Management international mobiler Mitarbeitender erfordert eine laufende Betreuung und Überwachung der betreffenden Personen. Dazu gehören unter anderem die Umsetzung von Mobilitätsrichtlinien, die Reiseplanung der Mitarbeitenden, die internationale Compliance ihrer Situation sowie eine persönliche Begleitung in einem sich ständig wandelnden Umfeld. Da diese Prozesse komplex und stetigem Wandel unterworfen sind, unterstützen wir Sie und Ihre Mitarbeitenden bei der Einrichtung eines effektiven Mobilitätsprogramms.

Gleichzeitig beraten wir Sie zu den vielfältigen Herausforderungen in den Bereichen Steuern, Sozialversicherung und Vorsorge, Datenschutz, Immigration sowie arbeits- und aufenthaltsrechtliche Fragestellungen. Dank unseres globalen Netzwerks und der Expertise unserer Fachleute in fast 120 Ländern sind wir in der Lage, Ihre Bedürfnisse sowohl lokal als auch international zu verstehen und Sie mit fundierter lokaler Kenntnis und globaler Perspektive zu begleiten.

Steuerberatung für Arbeitnehmer und Arbeitgeber im mobilen Kontext

Um den vielfältigen nationalen und internationalen steuerlichen Anforderungen gerecht zu werden und gleichzeitig das Risiko einer Doppelbesteuerung sowie einer unerwünschten Unternehmensbesteuerung im Ausland zu minimieren, bieten wir Ihnen eine individuelle Beratung und begleiten Ihre Mitarbeitenden während des gesamten internationalen Einsatzes.

Unsere Leistungen umfassen die steuerliche Planung vor dem Einsatz, Briefings bei Ankunft und Abreise, Unterstützung vor der Einstellung, hypothetische Steuerberechnungen und Abgleiche, die Kommunikation mit den Steuerbehörden sowie die Erstellung der Steuererklärungen.

Da sich das steuerliche Umfeld stetig verändert, ist eine laufende und sorgfältige Überwachung unerlässlich. Unsere Beratung geht über reine Compliance-Dienstleistungen hinaus und wird getragen vom Fachwissen, der Erfahrung und der Weitsicht von RSM, die wir Ihnen kontinuierlich zur Verfügung stellen.

Sozialversicherung und Altersvorsorge

Jedes Land verfügt über ein eigenes Sozialversicherungssystem, dessen Regelungen insbesondere in grenzüberschreitenden Situationen schwer zu durchblicken sein können.

Die korrekte und regelkonforme Anmeldung im richtigen Sozialversicherungssystem ist oft komplex, ebenso wie die Frage nach den Leistungen aus Sicht der Mitarbeitenden.

RSM unterstützt Sie dabei, Ihre Verpflichtungen in internationalen Konstellationen zu verstehen – mit fundierter Expertise im schweizerischen, europäischen und internationalen Sozialversicherungsrecht. Darüber hinaus stellt ein attraktiver und steuerlich effizient gestalteter Vorsorgeplan einen wichtigen Wettbewerbsvorteil für Unternehmen bei der Gewinnung und Bindung von Talenten dar. Gerne beraten wir Sie zu Ihren sozialversicherungsrechtlichen Anforderungen sowie zur optimalen Planung von Kosten und Leistungen.

Vergütungs- und langfristige Anreizprogramme

Für jedes Unternehmen ist es entscheidend, über ein marktgerechtes und effizientes Vergütungssystem zu verfügen, insbesondere im Hinblick auf variable Vergütung und langfristige Incentive-Pläne (LTIP), das zur Unternehmensstrategie und zu den Zielen passt und gleichzeitig die Gewinnung und Bindung qualifizierter Talente ermöglicht. Wir unterstützen Sie bei der Entwicklung und Umsetzung Ihres Vergütungssystems und stellen sicher, dass es rechtlich und steuerlich korrekt ausgestaltet ist, auch in internationalen Konstellationen.

Einwanderung und Personalwesen

Personalmanagement ist ein ebenso vielseitiges wie komplexes Thema, insbesondere wenn es um die zusätzlichen Kosten geht, die durch unzureichende administrative Abläufe entstehen können. Dank unseres weltweiten Netzwerks verstehen wir die unterschiedlichen Märkte, sowohl in der Schweiz als auch international, und unterstützen Sie bei der Umsetzung Ihrer Mobilitätsrichtlinien.

Wir begleiten Sie bei Herausforderungen im Zusammenhang mit der Verwaltung komplexer oder internationaler Lohnabrechnungen. Wir helfen Ihnen dabei, die Einhaltung der geltenden gesetzlichen Bestimmungen in verschiedenen Ländern sicherzustellen, und unterstützen Sie bei der Beschaffung der notwendigen Dokumente für die Migration Ihrer mobilen Mitarbeitenden (Arbeits- und Aufenthaltsbewilligungen, Visa usw.).

Internationale Mobilitätsberatung (Auswanderer, dauerhafte Versetzung, Grenzgänger, kurzfristige Einsätze)

Die zahlreichen Regelungen, die für international mobile Mitarbeitende gelten, verändern sich ständig, sind teilweise widersprüchlich und auch die Praxis der Unternehmen entwickelt sich rasant weiter. So hat beispielsweise die jüngste Gesundheitskrise das Konzept der virtuellen Entsendung hervorgebracht, während zunehmend mobile Mitarbeitende auf Basis lokaler Arbeitsverträge mit zusätzlichen, speziell ausgestalteten Leistungen eingesetzt werden.

Vorausschauendes Handeln, die Gestaltung eines möglichst effizienten Vergütungspakets und die Einhaltung der Vorschriften im Herkunfts- und Einsatzland sind entscheidend für eine erfolgreiche und nachhaltige Steuerung Ihrer global mobilen Belegschaft. In einem Umfeld, in dem höchste Transparenz erwartet wird, sind diese Faktoren von zentraler Bedeutung.

Unsere fundierte Fachkompetenz und breite Erfahrung über sämtliche Branchen und Unternehmensgrössen hinweg ermöglichen es uns, Ihnen erstklassige Beratung und wirkungsvolle Unterstützung in dieser komplexen Materie zu bieten.

Unser fundiertes Wissen über die schweizerischen Vorschriften, Unternehmensstrukturen, Verwaltung und den Markt sowie unser starkes internationales Netzwerk ermöglichen es uns, Sie effizient in allen Bereichen dieser Dienstleistungen zu unterstützen.