By Pitipong Santadram, Payroll Manager

Important Update: New Employee Welfare Fund Regulations

Starting 1 October 2025, under the Labor Protection Act B.E. 2542, both employers and employees will be required to contribute to the Employee Welfare Fund. This is a significant development for businesses to stay in compliance with the latest labor regulations. If an employer doesn’t have an existing provident fund or policy covering employee welfare upon job departure or death, they must contribute to the Employee Welfare Fund alongside their employees.

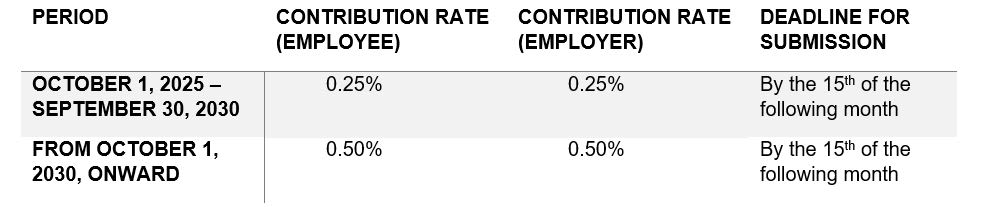

The specific contribution rates will be determined in these regulations.

Eligibility:

- Businesses with 10 or more employees are generally required to participate in the Employee Welfare Fund.

- However, certain organizations are exempt from this requirement, such as those that employ workers without seeking economic profit, as per the Ministry's regulations (1998) under the Labor Protection Act B.E. 2541. Examples of exempt business include foundations, associations, and non-profit organizations.

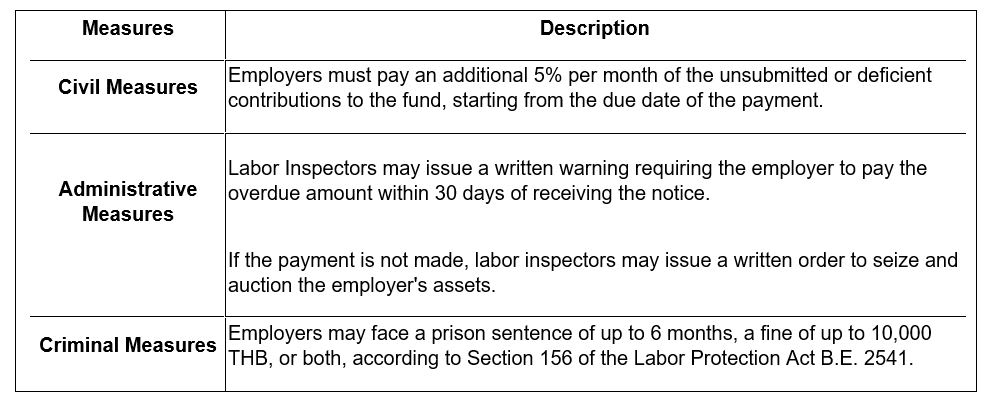

Here’s a table summarizing the measures for non-compliance with the contribution deadlines to the Employee Welfare Fund:

New Employee Welfare Fund Regulations: What Employers and Employees Need to Know

The new Employee Welfare Fund regulations, which will impact both employers and employees, bring important changes regarding contributions, withdrawals, and beneficiary designations.

Benefits Breakdown: The funds are generally divided into three components: Employer Contribution, Employee Contribution, and Benefits. When an employee leaves their job—whether due to resignation, retirement, contract completion, or dismissal—they are entitled to receive the accumulated employee contributions, employer contributions, and any interest earned on those funds.

In the unfortunate event of the employee’s death, the fund will be paid to the designated beneficiary as per the employee’s written instructions.

How to Withdraw Funds: Employees must contact the Welfare Department directly in their area to withdraw the funds once they leave their employment.

Employer’s Responsibility: In addition to employee actions, employers must also register with the Welfare Department in their respective regions. This registration process may require specific documentation and procedural steps. Employers are encouraged to begin this process promptly to avoid delays.

How RSM Thailand Can Support You

As this is just the first phase of the new regulations, we at RSM Thailand will keep you updated on any further changes to ensure your company remains fully compliant. Should you need assistance navigating the registration or compliance process, we are here to offer expert guidance on every step of the way.

For further inquiries or assistance, feel free to contact us at [email protected].

………………………………………………………………………………………………………………………………………

Reference:

1. The Beneficial Article from Our Professional Legal Team: https://www.rsm.global/thailand/insights/new-labor-regulation-welfare-fund-accordance-labor-protection-act-be-2542

2. Royal Gazette

3. Labor Protection Act: https://legal.labour.go.th/กฎหมาย?id=17#พระราชกฤษฎีกา