The Federal Tax Authority released Decision No. 3 of 2024, specifying the Corporate Tax (CT) registration timeline that all resident juridical persons, non-resident juridical persons, and natural persons must adhere to avoid being penalized for obtaining late Corporate Tax registration.

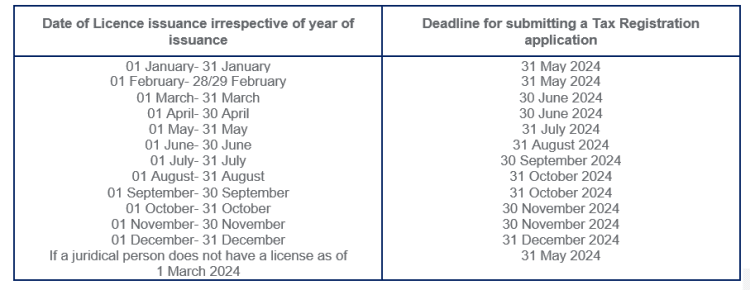

A Resident Juridical Person who is incorporated or established or recognized before 1st March 2024 should submit the Tax Registration application by the deadline date mentioned in the below table, irrespective of the year of issuance of the Trade License.

If a juridical person has more than one license, the license with the earliest issuance date will be used to register the juridical person for corporate tax.

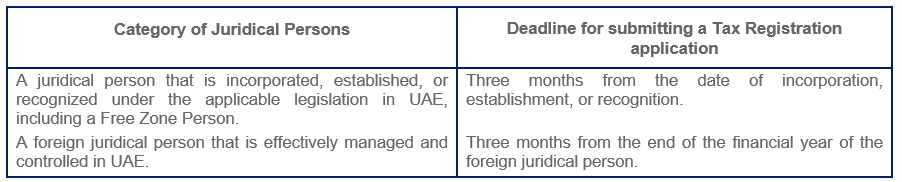

A Resident Juridical Person that is incorporated or established or recognized on or after 1st March 2024 must submit the Tax Registration application by the deadline date mentioned in the table below:

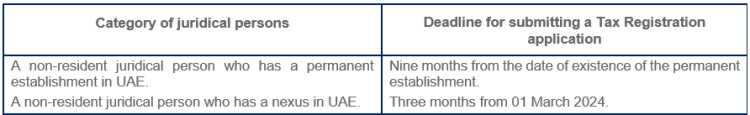

A Juridical person who is a Non-Resident Person before 01 March 2024 should submit the Tax Registration application by the following table:

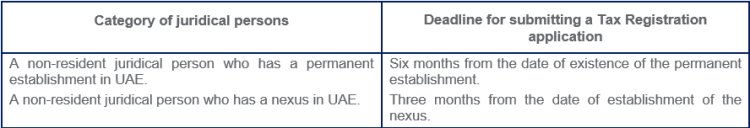

A juridical person who is a Non-Resident Person on or after 01 March 2024 should submit the Tax Registration application by the following table:

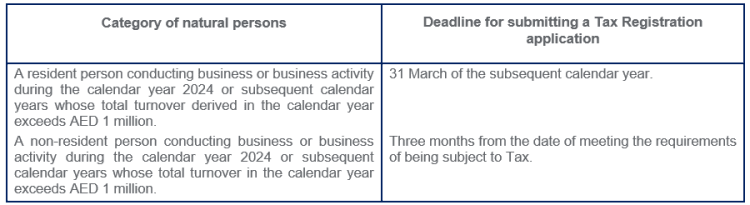

A natural person who conducts business or business activity in UAE should submit a Tax Registration application by the following table:

Failure to submit a Corporate Tax registration application within the specified timelines by resident juridical persons, non-resident juridical persons, and natural persons will attract a penalty of AED 10,000.