VAT IN THE UAE: A RECAP OF HOW THE EMIRATES’ FIRST TAX PERFORMED IN THE LAST YEAR

Introduction

The UAE government introduced VAT on 1st January 2018; it was a historic moment as it signaled the reimagining of the UAE from a tax-exempt location to a regional economic powerhouse. In addition to opening up a new income source, the move also accomplishes the government’s vision to shift its reliance from oil revenues to alternative sources. Though the rate imposed is a trivial 5%, this is the first time the country has been seen imposing taxes on consumption, and the tariff has been imposed on a majority of goods and services with only a few items being exempted.

VAT stemmed from the emerging need for economic diversification by adding a tax base, but will also help the economy increase financial transparency. Though the government faced various challenges in implementing the tax, the country has, till date, successfully implemented the regime with close to 296,000 companies and tax groups registering for VAT, and more than 650,000 returns in the initial year. UAE residents paid Dh27 billion in value-added tax (VAT) last year, surpassing the government's target of collecting of Dh12 billion, an increase of 125 percent. It even surpassed the goal of Dh20 billion VAT revenue collections for 2019.

The total VAT collection was also close to the UAE's nine-month of surplus, which stood at Dh28 billion during the January-September 2018 period.

To have a better understanding, let us understand what is changing with VAT’s implementation.

The Tax Format

The UAE is connected to the Gulf Cooperation Council via the Economic Agreement and the Customs Union and thus, the country’s framework for VAT implementation has been structured in line with the Unified GCC Agreements. Bahrain followed the UAE and Saudi Arabia by introducing VAT in 2019. Oman, Qatar, and Kuwait are expected to follow suit soon. This ensures there is no tax shopping in GCC.

The tax regulations apply uniformly to all tax-registered businesses functioning in the UAE mainland or free-zones with the exception of defined “designated zones” by the UAE cabinet, in which case the zone will be deemed as outside the UAE for tax purposes under certain transactions. A transfer of goods is tax-free under certain conditions within the designated zones.

The Authorities have tried to keep the law as simple as possible. As per the Decree Law, it is mandatory for businesses whose taxable supplies and imports exceed the amount of AED 375,000 (approximately US$ 100,000) per annum to register for VAT, while it is optional for businesses with taxable supplies and imports which exceed AED 187,500 per annum. The VAT payable (or refund) is calculated by assessing the VAT paid to suppliers (input VAT) and VAT charged to/paid by Customers (output VAT).

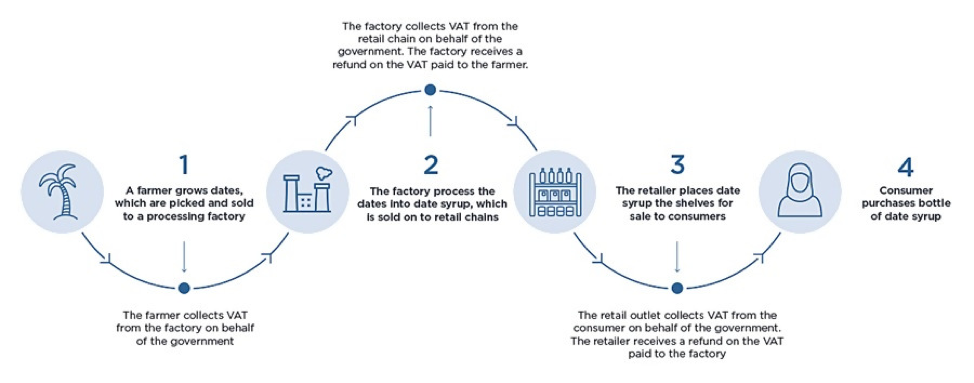

The tax collection process can be understood from the following:

Source: https://government.ae/en/information-and-services/finance-and-investment/taxation/valueaddedtaxvat

FTA’s Role in Implementing the Policy during the Year

To reduce any implementation bottlenecks, the Federal Tax Authority (FTA) issued user and industry guides throughout the year. The tax return filing frequency has been defined by the size of the businesses, where large businesses file on a monthly basis and all others file on a quarterly basis. The tax authority ensured businesses were made aware of the filing dates clearly.

Challenges on the way

It will take time to adapt to any new reform or system. The UAE is also experiencing minor glitches in implementing VAT across the country, such as:

- Validating and linking issues: Issues emerged in linking the customs registration numbers of companies to the official VAT systems which enables finalizing and submitting the returns. This is as a result of implementing the tax in a short time frame.

- VAT differs for different accounting requirements: Accounting for VAT and accounting as per International Financial Reporting Standards (IFRS) will differ on certain issues so companies must reconcile tax accounting with book accounting in order to properly account for VAT on the books and report on the returns.

- Treatment of VAT: The treatment of VAT differs between designated zones and mainland entities in the UAE. The designated zones offer incentives for business and so are not considered a part of the UAE for VAT purposes under certain conditions.

- Cash-flow management: Due to strict time frames of filing the returns and payment of tax (monthly or quarterly timelines), there is a short-term cash flow imbalance in the market.

A New Addition: Refund for Tourists

On 18th November 2018, the FTA allowed visitors and tourists the opportunity to reclaim the VAT on most transactions they incurred during their stay in the country, subject to certain conditions. The refund can be recovered by the fully integrated electronic system that acts as a connector between the registered retailers under “Tax Refund for Tourist’s Scheme” and all the ports of entry and exit from the UAE, the principal conditions being:

- The retailer from whom the goods have been purchased must be registered under the “Tax Refund for Tourists Scheme”

- The purchased goods must be a part of, and not be excluded from, the “Refund Scheme of the Federal Tax Authority”

- The tourist must have an intention to leave the country within 90 days from the date of purchase

- The goods must be exported within 30 days from the date of purchase

- The process of purchase and export should be executed while adhering to the requirements and procedures stated by the FTA

- The purchase must be at a minimum of 250 Dhs.

Other Refund Schemes

The Federal Tax Authority (FTA) has also issued guides clarifying relief available for business visitors, suppliers of exhibitions and conferences, participants of the Expo 2020 Dubai, UAE Nationals building new homes, and company’s incurring bad debt. Relief is available under certain conditions depending on many factors which must be detailed with a professional consultant.

Conclusion: A Great Start

The Country has overall been very flexible in adopting the new tax reform. Commendable execution has been witnessed in the UAE, considering the fact that the country has never had any taxes imposed on individuals in its history. The FTA has played an important role in making this possible by closely working with businesses to empower them in adopting the reform with ease. The FTA organized close to 90 seminars along with training workshops to ensure tax awareness. These workshops and trainings attracted close to 28,000 experts from the various business areas. The maiden year of VAT saw 306,500 phone calls being answered by the authorities and 147,000 emails being answered. The government on one hand with businesses and their consultants on other have worked in tandem to rise to the challenges of the new tax.

Feel free to consult RSM UAE @ [email protected] to discuss your VAT concerns. RSM is one of the world's leading audit, tax and advisory service network, recognized for innovative solutions across the globe.