Polish Localization Package (PLP) provides an extension of native functionality in NetSuite Oracle.

It is a set of designed modules intended to fully support your financial NetSuite system in compliance with the Polish requirements stated in the Polish Accounting Act. Once the PLP bundle is installed, users gain access to a wide range of transactions, entity records and reports. All ‘PLP’ areas house custom fields and contain functionalities allowing the user to expose and capture their unique local requirements.

波兰本地化模块列表

功能

波兰国家银行每天发布上一个工作日汇率的新表格。该功能允许系统的用户无需任何努力地每天查看并使用直接从波兰国家银行网站上下载到NetSuite的新表格。

优势

每天在 NetSuite 系统中自动更新汇率(直接从波兰国家银行导入的)

消除手动工作

节省时间

保证准确性

功能

JPK,即标准税审文档 (SAF-T) 以XML或CSV格式提供。该功能允许系统的用户以具有合格电子签名的标准化电子形式将数据从 NetSuite 直接传输到税务机关。

BENEFITS

- 编制标准税审文档

- 将文件直接发送到税务机关

- 提供集成到NetSuite的合格电子签名

- 降低处罚风险

- 安全性

功能

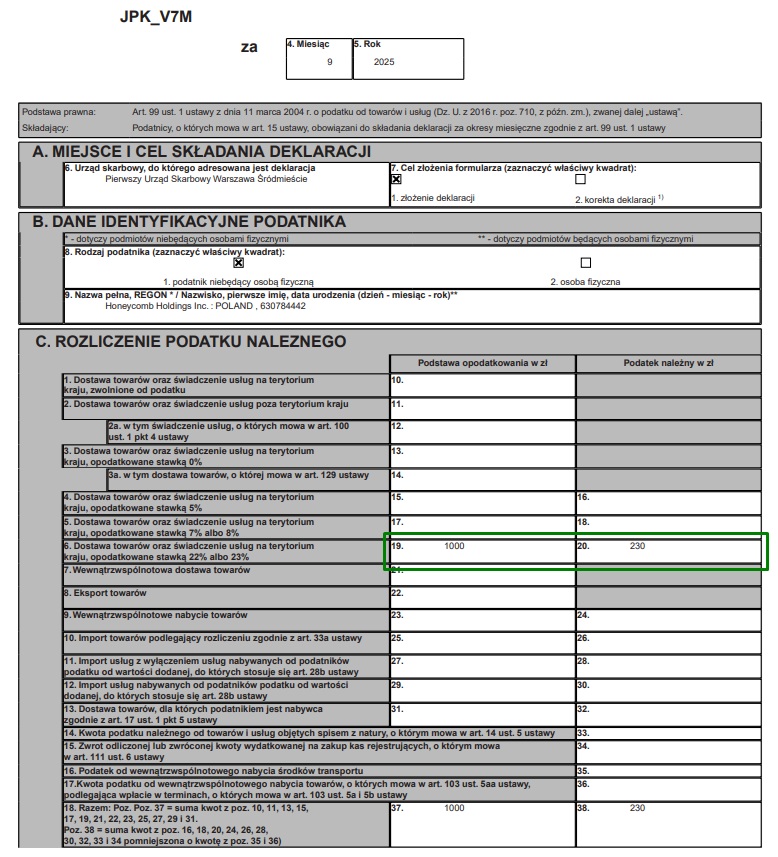

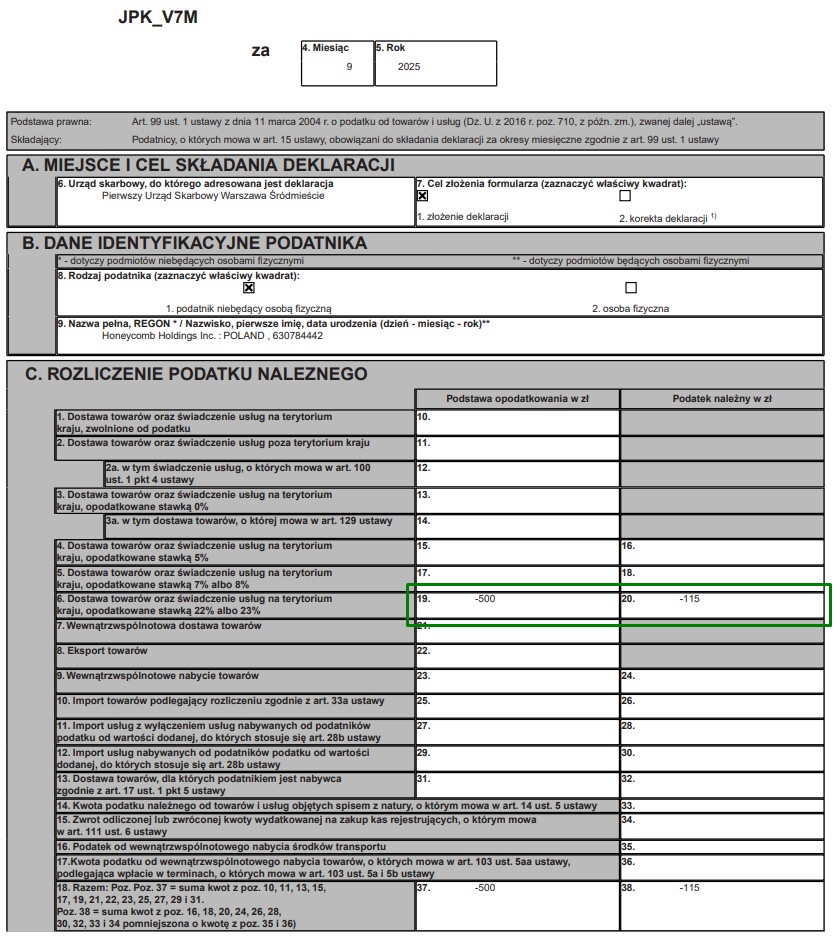

无需使用外部工具来生成增值税申报表以及标准税审文档,并可以将文件直接发送到税务局。以上文档以XML和PDF格式提供。总体而言,Oracle NetSuite波兰本地化模块为与波兰增值税相关的所有交易类型提供认可和支持。

优势

- 便于使用

- 快速准确

- 无需外部工具

- 可用所有交易类型

- 为您生成的退货提供安全存档

功能

支持日常工作的广泛可用选项,可以根据正确的增值税记录及其结算进行报告。最后,数据可以以经过验证的形式传输到财政部。

优势

- 描述每种交易类型的通用税务代码

- 确认交易记录正确性的报告

- 支持正确增值税金额划分的专用工具

- 直接将增值税申报发送到税务机关

功能

特别为在欧盟进行交易的客户准备。VAT-UE申报表是直接从NetSuite波兰本地化模块准备的数据而自动生成的。通过扩展标准功能的,客户可以获取文件的XML格式,并直接将它发送给财政部。

优势

- 遵守增值税法

- 符合财政部的要求

- 根据定期输入到NetSuite的数据准备申报数据

- 预览收集申报表的数据

功能

由于许多数据过滤选项,该列表允许对系统中可用的数据进行详细分析。 该模块允许用户从标准交易中提取数据,并为管理委员会提供广泛的报告。

优势

- 自动使用系统中的数据

- 各种数据过滤选项

- 可以以多种通用格式保存结果

功能

使用先进先出法对外币账户进行重新估价使客户可以将波兰兹罗提的银行账户余额调整为指定日期的当前值(基于上一次历史应收款——先进先出法)

优势

- 不需要外部工具的自动过程

- 根据NetSuite中的交易数据进行的计算

- 支持所有货币

功能

专用的波兰本地化模块银行支付的模块提供分割付款(split payment)的识别。此外,客户还可以在计划向其银行发送批量付款时查看白名单。

优势

- Sending prepared data without having to use other programs

- Receipt of the official confirmation of sending the file by the authority

- Uploaded files blocked for further edition after being sent to the authorities

功能

使用波兰本地化模块提供的功能制备并向财政部服务器发送申报表和标准税审文档(SAF-T)的功能。该功能使能够自动使用可获得的签名和正式收据证书(UPO – Official Receipt Certificate)。

优势

- 无需使用其他程序以发送准备好的数据

- 收到官方机构发送的正式确认书

- 上传的文件在发送给当局后被阻止进行进一步编辑

FUNCTIONALITY

The Polish Localization Package supports balance confirmations and demands for payment for any selected time frame, available both for suppliers and recipients on a printout template that is consistent with other issued documents.

BENEFITS

- Balance confirmation printout available for any given day for both suppliers and recipients

- Demand for payment printout

- Own comments may be added

- The template is consistent with other transmitted documents

- The support is available for multiple language versions

FUNCTIONALITY

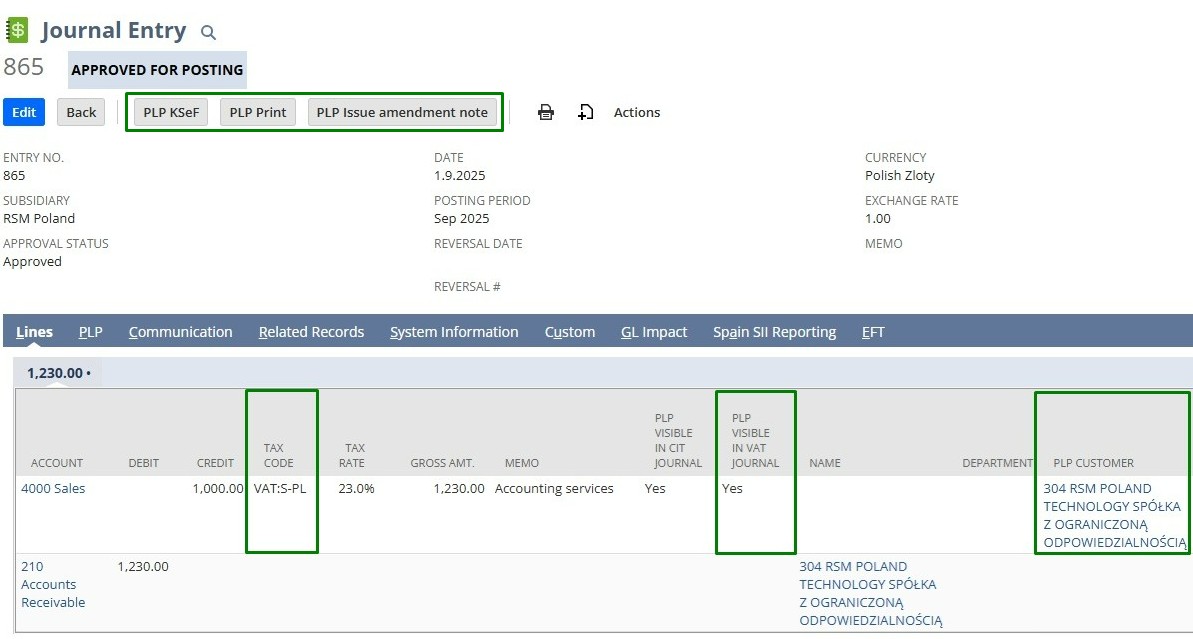

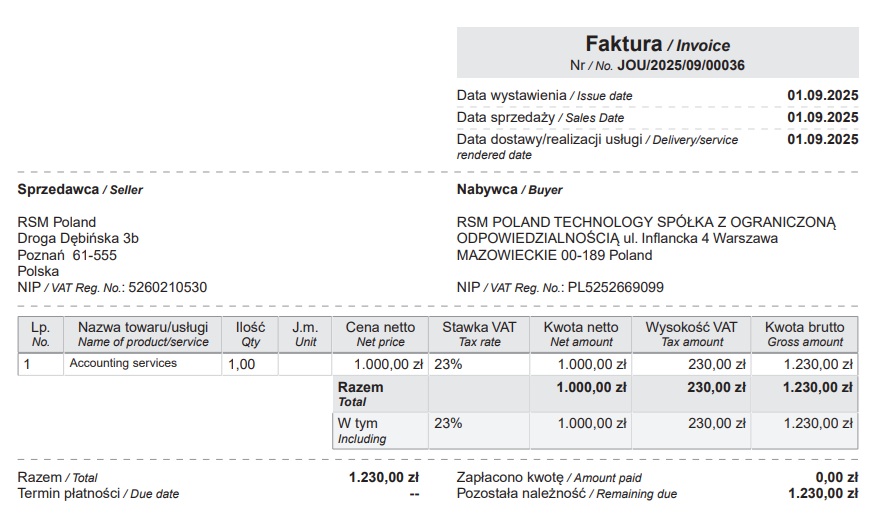

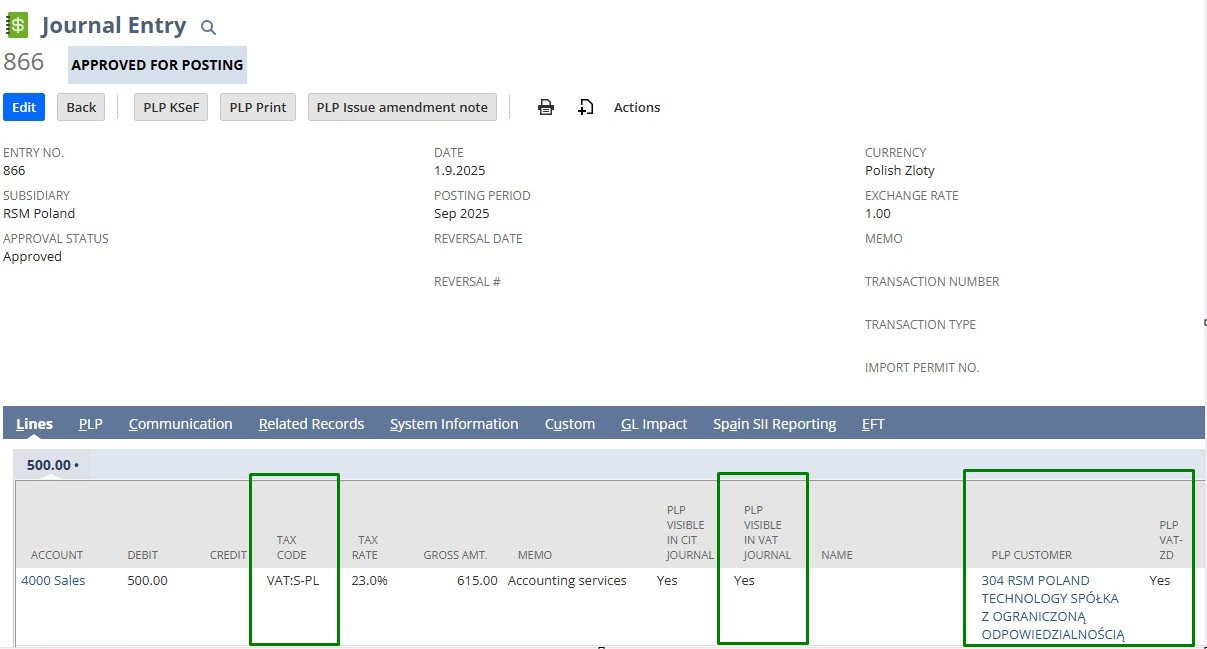

The Oracle NetSuite Polish Localization Package provides support for recording VAT transactions via Journal Entry documents. Properly entered postings enable the document to be reflected in VAT registers, VAT declarations, JPK files, and submitted to the KSeF system. For sales transactions, it is also possible to generate a PLP printout in PDF format, similar to those produced for sales invoices and corrective invoices.

BENEFITS

- Full support for fields and parameters used in sales and purchase transactions

- Handling specific cases shown in registers and VAT declarations, such as internal invoices and bad debt relief

- Support for NetSuite Intercompany Journal Entry transactions

- Ability to generate PLP printouts for sales documents and credit memos

- Option to generate an .xml file in the KSeF structure and submit it accordingly

FUNCTIONALITY

The Oracle NetSuite Polish Localization Package offers support for handling transactions related to adjustments of the VAT taxable base resulting from the so-called bad debt relief. A properly recorded Journal Entry document ensures that the necessary information is presented in the appropriate fields of the JPK declaration. It is possible to enter both downward and upward adjustments to the taxable base for output and input VAT.

BENEFITS

- Support for all types of VAT and taxable base adjustments

- Inclusion of essential supplementary information, such as payment due dates and actual payment dates

FUNCTIONALITY

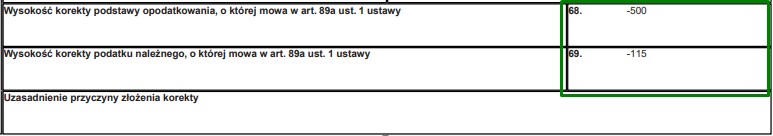

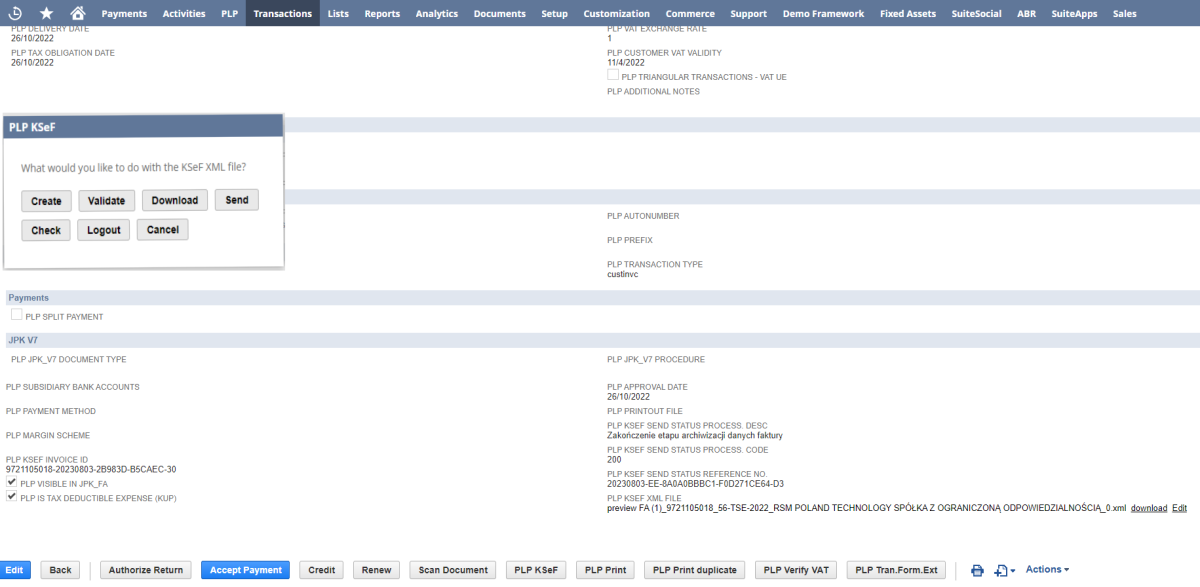

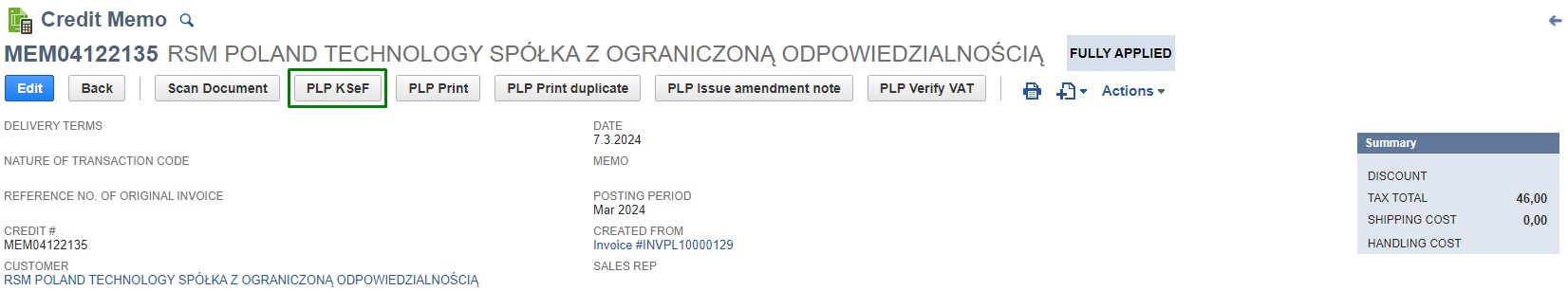

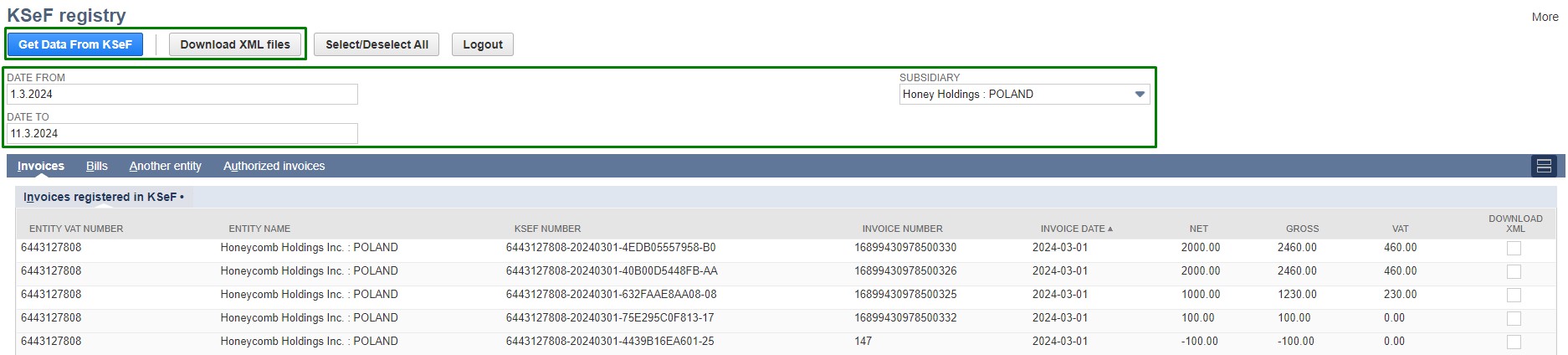

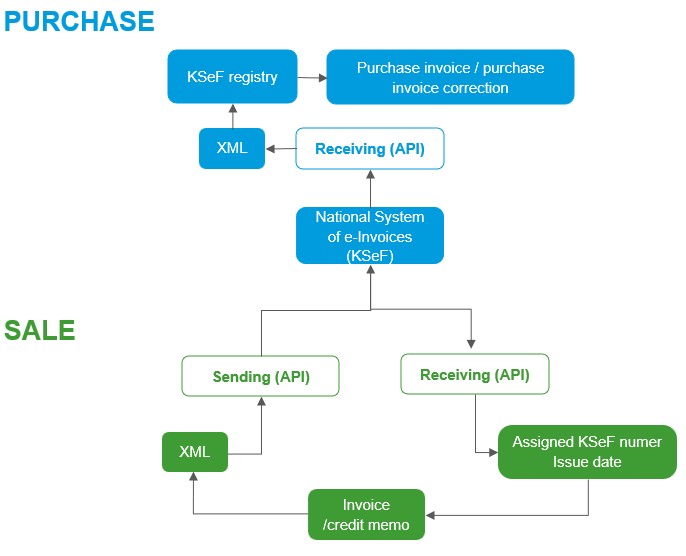

The National e-Invoice System is a platform for issuing and receiving invoices electronically. The KSeF module in the Polish Localization Package of Oracle NetSuite is a comprehensive cloud solution for managing electronic documents. This solution enables efficient and secure connection with the Ministry of Finance platform using tokens generated from the administrator's profile, generating and sending invoices individually or in bulks, as well as receiving confirmations of sending. The KSeF module creates a register of incoming and outgoing documents and enables automatic creation of purchase documents based on xml files received from our supplier.

BENEFITS

- Secure generation, sending and receiving of e-invoices to/from KSeF (authentication with an official token)

- Automation of the invoice sending process through appropriate script configuration (securing the process against sending unapproved documents, documents not covered by the KSeF system, or sending them twice)

- Automation of invoice status verification in the KSeF system (retrieving current information about the processing stage of a given document in KSeF can occur without user intervention)

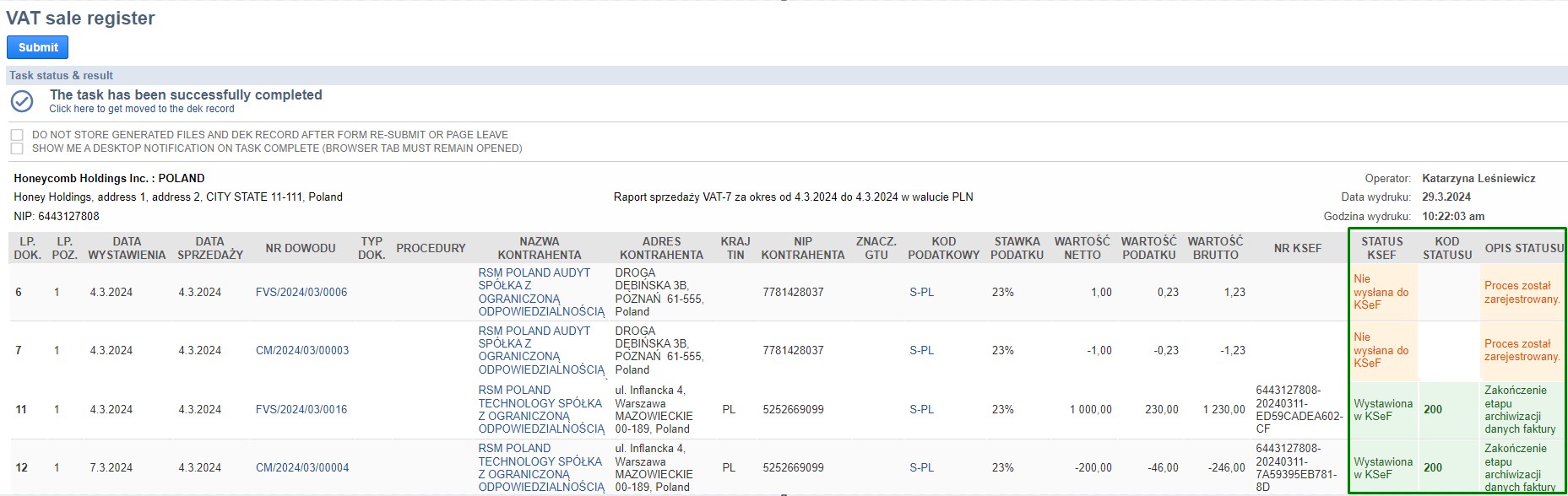

- Visibility of KSeF status in the VAT sales register

- Handling the visibility of KSeF data also from the purchasing process side in the purchase register and managing information required by the new JPK_VAT7 file format

- KSeF Registry functionality for the purchasing process – this module allows you to download information about documents recorded in the e-invoice platform for a given company in a specified time period. This functionality allows comprehensive process handling from within NetSuite without the need to log in to the Ministry's website

- Mechanism for importing purchasing documents in the KSeF Registry module, which enables automatic linking of the invoice with the corresponding purchase order and identification of tax settings of purchase invoices – supporting automation of accounting processes

- Full transparency of the process of linking the invoice in NetSuite with the record, session, and status from the KSeF level

- Ability to adapt the system to customer requirements and needs

- Full customization of optional fields considering the requirements and expectations of invoice recipients

- Line grouping rules – a rule configuration mechanism ensuring correct presentation of sales lines, tailored to specific business requirements

- Full support for all types of documents, including corrections

- Comprehensive customer support regarding system availability in case of more advanced architecture using external systems (file transfer, file visibility management at the level of a sales system other than NetSuite)

- Full support for offline mode also using external systems

- Additional mechanisms for invoice materialization in PDF format and full compliance with workflow processes, allowing flexible modeling of the sending process via email and the KSeF gateway.

KSeF Module in the Advanced Polish Localization Package:

Sending the KSeF invoice:

Visibility of KSeF status in the VAT sales register - using additional columns, we can perform collective verification of the document processing status in the KSeF system at the stage of reconciliation of VAT sales registers.

KSeF Registry:

FUNCTIONALITY

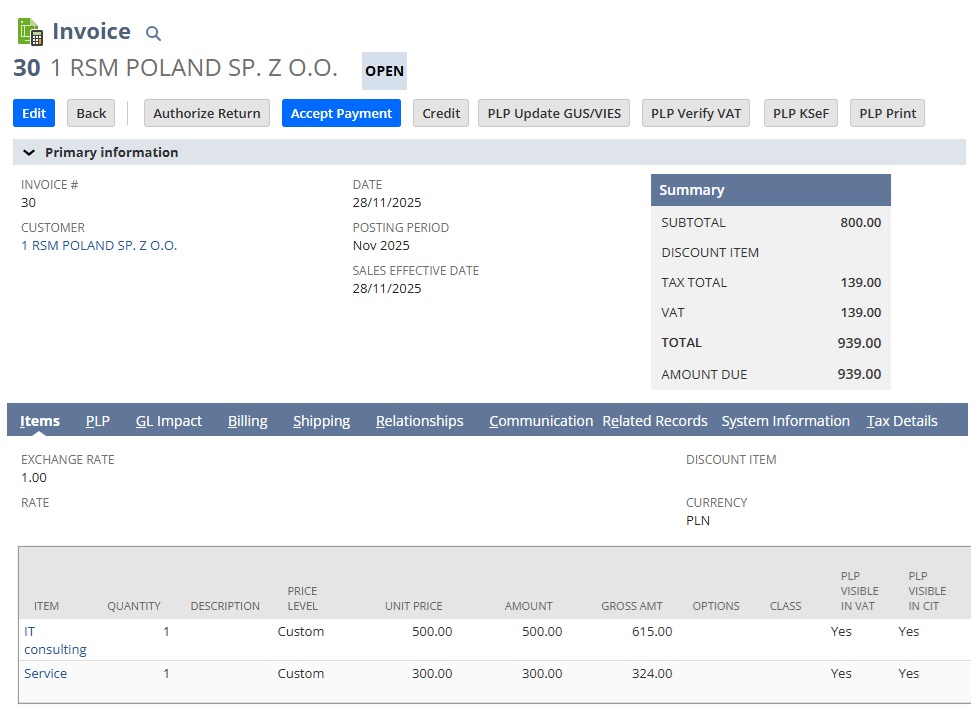

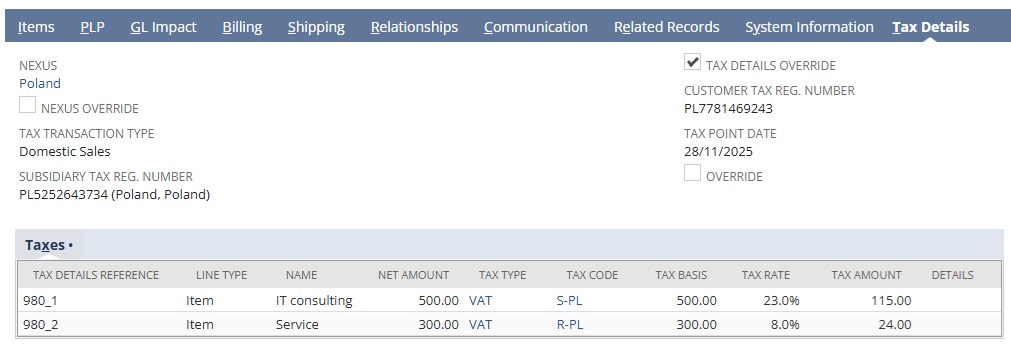

SuiteTax is one of the tax engines available in the Oracle NetSuite system. Compared to the alternative Legacy Tax engine, SuiteTax introduces differences in the way taxpayer identification numbers for counterparties are defined and how tax data is recorded on transactions.

The Polish Localization Package leverages new fields and SuiteTax mechanisms, ensuring support and accuracy of applied and presented data in the following processes:

- Retrieving counterparty data and verifying it in GUS and VIES systems

- Printing sales documents

- Recording tax data on sales, purchase and accounting documents

- Generating VAT registers, VAT returns and JPK files

- Generating payment files in the Bank Payments Module of the Polish Localization Package

- Sending sales data to the KSeF system

波兰本地化模块支持的交易类型

- 形式发票

- 销售发票

- 贷项通知单

- 借项通知单

- 供应商账单

- 修正案

- 费用报告

- 供应商预付款

- 会计分录

- 摊销日记账

- 公司间往来日记帐分录

- 高级公司间日记账

Tax areas supported by the Polish Localization Package

The Polish Localization Package available under Oracle NetSuite provides comprehensive tools for settling income tax and goods and services tax, enabling safe and compliant bookkeeping as well as settlement of transactions with the tax office. The functionalities of the package are regularly expanded and adapted to changing legal requirements. Implementation of the Polish Oracle NetSuite Localization Package guarantees full compliance with Polish tax regulations, while providing ongoing support and updates in response to the dynamically changing requirements.

The Oracle NetSuite Polish Localisation Package enables.:

- support for transactions related to the Intra-Community Supply/Acquisition of Goods;

- import/export of services and goods;

- trilateral transaction support;

- support for transactions generating tax obligation in another country;

- support for the VAT OSS procedure;

- support for all codes, printouts and procedures for VAT purposes;

- calculation of VAT and reconciliation of the discrepancy between the FX rate for income tax and VAT;

- verification of eligibility for VAT deductions based on data obtained from VAT records and VIES;

- full bad debt relief support;

- support for automatic internal documents for VAT purposes;

- support for advance payments and their settlement;

- calculation of car costs settlement and other partial deductions, including for income tax and VAT purposes;

- settlement of employee benefits for VAT and income tax;

- support for VAT proportion;

- support for VAT margin transactions;

- support for all types of annual amendments for VAT return purposes;

- support for cash accounting settlements;

- access to an advanced functionality enabling the determination of the sales date at the level of each transaction line, both in PLN and foreign currencies, based on sales documents;

- access to an advanced logic supporting the setting of the tax point for purchase invoices;

- support for amendments of all types of data and charges requiring amendment documents, both amendment invoices and credit /debit notes;

- automation in the scope of FX rates for VAT purposes in amendment documents;

- automation supporting the consistency of dates on final documents matched with warehouse documents (correct determination of the tax point);

- access to an advanced logic supporting the user in the scope of determining the tax point;

- support for multi-booking involving various currencies for the aforementioned transactions;

- support for income tax calculation (tax classifiers and CIT report printout);

- full integration of all of the above tax transactions with the KSeF system;

- user support in the scope of reconciliation of VAT amounts and the need to make amendments;

- access to a tax logic enabling the correct determination of tax parameters for purchase invoices based on invoices received in KSeF;

- automatic presentation of all aforementioned JPK (SAF-T) calculations.

Why is selecting the right Oracle NetSuite localization crucial for your business?

Enables compliance with Polish tax and legal regulations

Minimizes the risk of errors and non-compliance penalties

Supports the growth of your business by smoothly managing multi-currency transactions, cross-border operations, and expanding to new markets

Streamlines processes by integrating local requirements directly into your NetSuite environment

Improves cost efficiency by avoiding the costs associated with manual workarounds, corrections of compliance issues, or potential fines due to regulatory breaches

Why is RSM Poland the right choice for your company?

RSM Poland is the biggest Oracle NetSuite Partner in Poland, fueled with qualified experts, such as NetSuite-certified developers and ERP consultants, as well as tax advisors, accountants and auditors, who understand the needs of companies struggling with complex Polish regulations. We offer comprehensive support throughout the implementation of the Advanced PLP, as well as ongoing assistance post-implementation. This includes regular software updates to ensure compliance with evolving legal and tax regulations. Our experienced consultants have successfully helped numerous clients optimize their business processes and reach their objectives. We proudly support companies across a wide range of industries and varying sizes, tailoring our services to meet their unique needs.

Oracle NetSuite in Poland – Frequently Asked Questions

Absolutely not. NetSuite is an excellent solution also for smaller, growing companies and start‑ups. NetSuite was designed as a one hundred percent cloud‑native system, eliminating the need to worry about server infrastructure or purchasing costly licences.

The solution operates on a subscription model – the monthly access fee depends on the number of users and selected modules. As a result, the entry barrier is relatively low. You can start with the implementation of essential modules (typically the financial one) and then, as your business grows, gradually expand the functionality of the ERP system to new areas such as warehouse or production management.

NetSuite is a highly configurable solution. This means we can tailor its functionalities to the specific needs of nearly any company, regardless of its size or industry. At RSM Poland, we support clients from a variety of sectors, and based on our experience, the system performs exceptionally well in industries such as Software, Fintech, HiTech, Professional Services and Healthcare. However, this list is not exhaustive – NetSuite successfully supports companies from many different fields.

Absolutely! The RSM Poland team has developed a comprehensive functionality extension for Oracle NetSuite – the Polish Localization Package. The solution has been adapted to fully meet the requirements of the Polish Accounting Act.

The package is intended both for Polish clients and global organisations with Polish subsidiaries that must work in NetSuite and comply with Polish statutory requirements in their accounting system.

A detailed description of the modules included in the Polish Localization Package is available on our website. The RSM Poland IT Consulting team continuously updates the Oracle NetSuite Polish Localization Package to reflect changing tax regulations, legal updates and accounting practices in Poland. Information about new features and improvements is shared in Release Notes in the blog section and in our IT Insights newsletter.

Of course – our team has developed a comprehensive cloud solution for managing electronic documents.

The KSeF Module within the Oracle NetSuite Polish Localization Package is a ready‑to‑use, fully functional and comprehensive cloud‑based solution for electronic document management. It enables efficient and secure integration with the Ministry of Finance platform.

If you would like to learn more about the features and configuration options of the KSeF Module within the Polish Localization Package, we encourage you to consult the dedicated brochure.

Yes, absolutely! Our cooperation does not end with the implementation and configuration of the system. We provide ongoing support from our Helpdesk team, whose task is to assist NetSuite users in their daily work.

Our support may include, among others, eliminating system errors, resolving issues related to closing accounting periods, assistance with personalising functionality, support in administrative tasks such as role management, dashboard configuration, maintaining account security and managing user permissions.

We offer three levels of application support, tailored to different budgets and expectations.

Yes. We fully understand that transitioning to a new system is a major challenge for any organisation. We can prepare tailor‑made NetSuite training sessions, adapted to the specific needs of each client.

Training may take two forms:

- sessions delivered by our certified NetSuite consultants, covering a wide range of features within the Polish Localization Package and other Oracle NetSuite modules

- since RSM is also a team of experienced accountants working daily in NetSuite, we also offer dedicated training for accounting teams.

These sessions cover the practical aspects of system operation in the context of Polish tax and accounting regulations, as well as the use of functionalities available through the Polish Localization Package. Participants leave with knowledge that enables them to independently manage accounting processes in NetSuite – from daily bookkeeping and invoice processing to preparing reports and declarations.

The scope and schedule of the training are always tailored to participants' experience and the specifics of the company’s operations.

The implementation timeline depends on the complexity of the project. Simple implementations that do not require many customisations for the client’s specific needs typically take around 3–4 months. More advanced projects may take up to 6 months.

The BPO programme is ideal for companies that want to start using an enterprise‑class platform quickly while maintaining flexibility and the ability to transition smoothly to their own NetSuite instance in the future as their business grows. It is especially suitable for start‑ups and rapidly growing small and medium‑sized businesses seeking a scalable cloud solution and preferring to maintain a small internal team. A major advantage is that clients can easily move from the BPO environment to an internal NetSuite instance without complex data migration between systems.

RSM Poland is a partner of the NetSuite BPO programme, which enables us to offer clients full system functionality without the costs and complexity of a full ERP implementation at the start. In this model, clients gain access to the system within a few days of signing the agreement.

Yes – we provide both comprehensive accounting support using the system and a supervisory accounting service. Full accounting outsourcing is ideal for clients who want to focus on their core business objectives while leaving other tasks to a specialised external team. The supervisory accounting service is intended for companies that manage their accounting internally within NetSuite but require professional expert support in maintaining accounting books. As part of supervision, we perform tasks typically assigned to senior accountants and chief accountants. In urgent situations, we also offer temporary substitution for absent finance team members working in Oracle NetSuite. The scope of accounting support is always tailored to the specific expectations of each client.

RSM Poland is your guarantee of success in implementing and operating NetSuite in Poland. We are the largest official Oracle NetSuite partner in Poland. Our team consists of qualified experts, including certified NetSuite developers and consultants, tax advisors, accountants and auditors who understand the complexity of Polish regulations.

We support our clients not only during the implementation and configuration of Oracle NetSuite and the Polish Localization Package, but also by offering a wide range of services that facilitate day‑to‑day work with this system.

从 RSM 波兰的 NetSuite 专家那里获得 100% 免费的定制演示