What is the Oracle NetSuite Advanced Polish Localization Package?

Advanced Polish Localization Package (Advanced PLP) offers a comprehensive extension of the standard functionality available in Oracle NetSuite, specifically tailored to meet the requirements placed on businesses operating in Poland.

Designed with full compliance in mind, Advanced PLP equips your financial NetSuite system with the necessary tools to adhere to the provisions outlined in the Polish Accounting Act and Polish VAT regulations, enabling that your organization remains fully compliant with local laws and regulations.

The Advanced Polish Localization Package provides an integrated suite of modules that work seamlessly within your existing NetSuite environment. Upon installation, users are granted access to an extensive range of transaction types, entity records, and customizable financial reports. These modules are built to support every aspect of financial management in line with Polish tax and accounting regulations, allowing for precise reporting and compliance with legal obligations.

RSM Poland’s ITC Team regularly updates our Advanced PLP to ensure it adapts seamlessly to evolving Polish tax laws, regulations, and accounting practices keeping your business compliant and up to date. We share release notes with new functionalities and improvements with our clients to make sure they are fully informed about the latest updates, enabling them to take full advantage of the enhanced features.

Advanced PLP Modules

FUNCTIONALITY

New tables with exchange rates from previous working day are published by NBP (the central bank of the Republic of Poland) each day. We enable your company to have them downloaded on a daily basis directly to NetSuite with no effort on your side. This functionality is integrated with the VAT calculation mechanism, supporting both the process of generating VAT returns and the presentation of data that must be displayed on invoices.

BENEFITS

- Up-to-date rates automatically in NetSuite each day (straight from the National Bank of Poland)

- Elimination of manual work

- Information imported for the purpose of printing VAT invoices or calculating JPK (SAF-T) and KSeF

- Timesaving

- Accuracy

FUNCTIONALITY

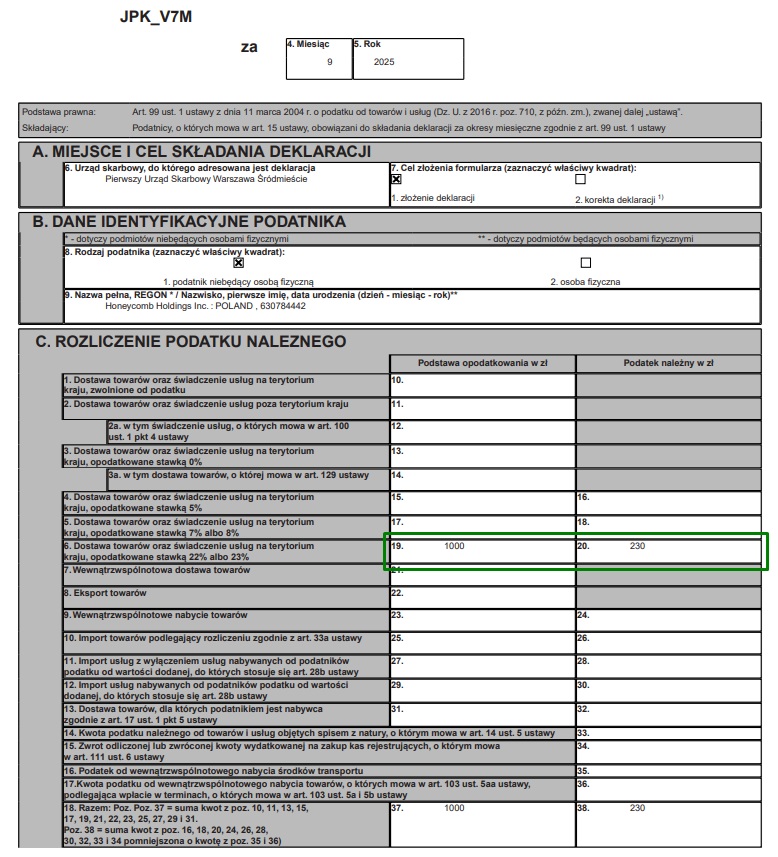

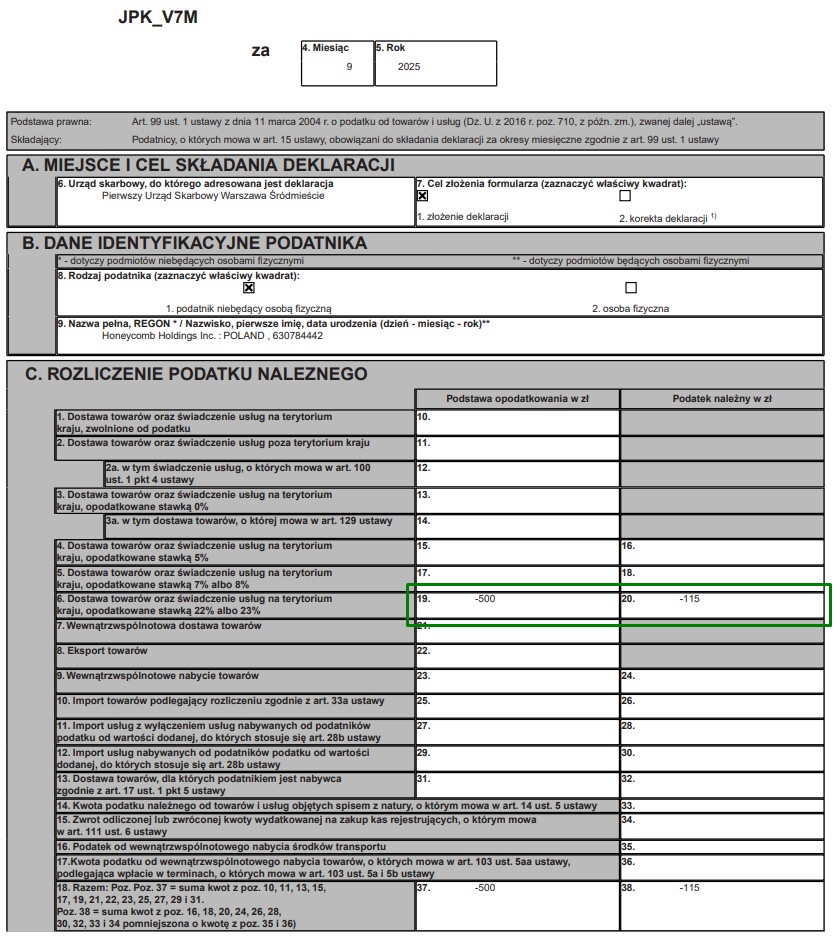

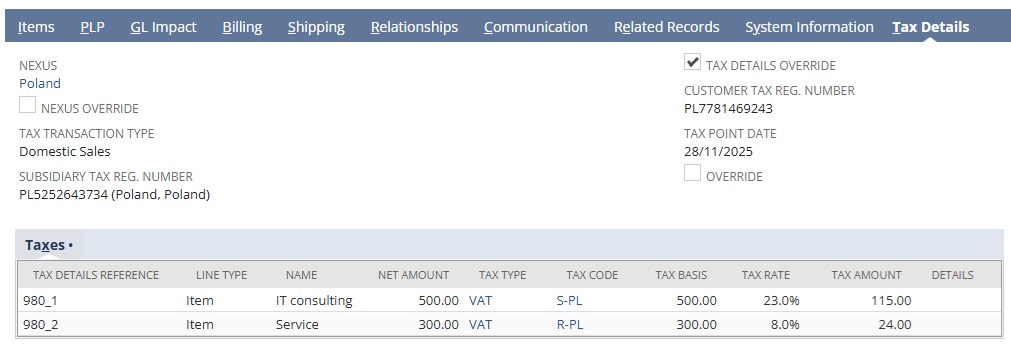

This module enables comprehensive preparation of VAT returns and SAF-T. The app provides access to the pdf files view and allows for signing and transmitting returns directly to the tax office. All events and documents accompanying the entire process are recorded, secured and linked to the returns record. The process of collecting data, processing information and generating settlements, together with confirming the return status, is automatic and centralised.

BENEFITS

- Preparing Standard Audit File for Tax purposes

- The declaration part can be viewed in pdf

- Access to the full path verifying the status of the transmitted document

- Sending the file directly to Tax Office

- Qualified Electronic Signature integrated with NetSuite

- All events are safely stored throughout the declaration generation process

- The risk of penalties is minimised and full operation logs for audit purposes are provided

- Encrypted transmission, secured signatures, data storing and logs

FUNCTIONALITY

The Polish Localization Package enables the creation of a purchase and sales register, as well as the generation of summary information. This functionality not only allows for the preparation of registers, but also provides the ability to analyse data, identify the need to prepare an amendment and generate partial registers for analytical purposes. Various file formats are available. The register stores information related to KSeF, verification of taxpayers in registers and other data necessary to validate the accuracy of documents. All registers can be archived for analysis or audit purposes.

BENEFITS

- Reports confirming the accuracy of transaction recording, which is useful in the analysis process

- Reports confirming the consistency of data in returns and accounts

- Dedicated tool for collecting and grouping data for tax verification purposes

- Compliance with all legal requirements

- Tool for monitoring necessary amendments

- The status of invoices in KSeF is monitored

- Possibility to verify VAT taxpayers and the applied rate for sales

- Security and access to detailed documentation for audit purposes

FUNCTIONALITY

The Polish Localization Package module is developed for clients transacting in the European Union. The VAT-EU declaration is generated automatically using data directly prepared within our Advanced PLP in NetSuite. Thanks to the expansion of standard functionalities, it is now possible to generate an XML file that is ready to be transmitted to the Ministry of Finance. This module has been enriched with a method of introducing amendments that is dedicated to a given data scope.

BENEFITS

- Compliance with the requirements of the Ministry of Finance, including the Goods and Services Tax Act

- The declaration part can be viewed in pdf

- The availability of the full path verifying the status of the transmitted document

- Files are transmitted directly to the tax office

- Digital signature is integrated with NetSuite

- All events are stored throughout the return generation process

- The risk of penalties is minimised and full logs of operations for audit purposes are provided

- Encrypted transmission, secured signature, data storage and logs

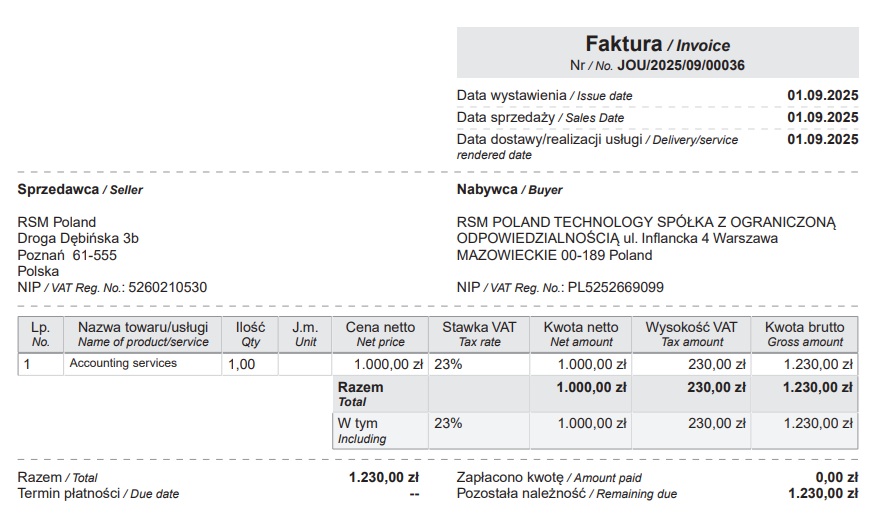

FUNCTIONALITY

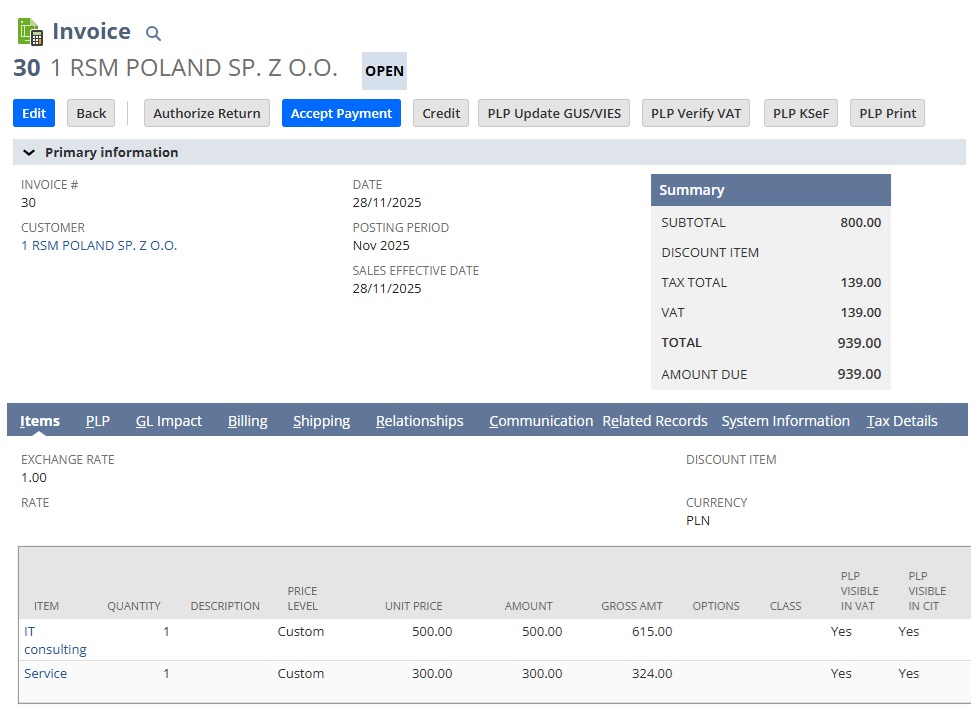

The Polish Localization Package under Oracle NetSuite provides an extensive, fully configurable functionality that allows clients to prepare and send documents to recipients and suppliers, ensuring compliance with applicable legal regulations and meeting the information needs of both the issuer and the recipient of the document. When utilising the Polish Localization Package, the user does not have to worry about access to the required types and formats of documents, amendments, additions or calculations. Printouts have extensive settings with a variety of options, additional fields in each section, and the layout can be customised to individual requirements. The functionality also includes dedicated printouts of advance payment invoices, proforma invoices and credit notes.

BENEFITS

- Ensuring compliance with Polish accounting standards

- Automatic generation of information based on the selected transaction type

- All documents and printouts can be generated using NetSuite

- Multiple configuration options

- Support for all types of sales transactions

- Full support for credit notes

FUNCTIONALITY

Multi-variant document numbering system. Possibility to maintain the continuity of numbering, which is required under the Goods and Services Tax Act and the Accounting Act. Configuration variants can be tailored to the expectations of the most demanding clients.

BENEFITS

- Numbering continuity for given document types

- Possibility of implementing various sequences for the same types of transactions

- Individualised prefixes and postfixes

- Numbering available for monthly and annual periods

- Transparency in your books register

- Numbering compliant with the requirements of the Standard Audit Files

FUNCTIONALITY

Dedicated printable template for the trial balance (including turnovers). Tailored to mirror the Polish chart of accounts and meet all the client’s requirements.

BENEFITS

- Reflects the Polish Chart of Accounts

- The printout presents accounts entries in accordance with Polish standards for both analitical and synthetic accounts

- Various export formats available, including a printout

FUNCTIONALITY

The list, thanks to a rich set of filters, allows for a detailed analysis of data available in the system. This module allows you to extract the data from standard transactions and transfer it to extensive reports for the management board.

BENEFITS

- Automated use of data available in the system

- Various data filtering options

- The ability to save the results in several universal formats

FUNCTIONALITY

The Polish Localization Package available under Oracle NetSuite offers now an advanced functionality that allows for comprehensive verification of contractor data in the GUS, VIES registers and in the active VAT payers database. Thanks to this, the user, when entering a new contractor into the system or updating their data, can automatically download and update information from these registers. The verification can be effected for every process for which it is necessary. For example, when a payment is made, the system checks whether the supplier's account is on the white list, and when a register is generated, the system verifies the taxpayer in terms of their status as an active VAT payer under Polish law and in light of EU transactions.

BENEFITS

- Verification of contractor data

- Automatic update of data based on the GUS / VIES registers

- Verification of transactions at each and every stage, from creating and generating registers to remitting payments

- Security and compliance with regulations

- Information about verification is available for audit purposes

- Functionality and verification is performed in the background of processes

- A single tool that is integrated with all accounting and tax registers

FUNCTIONALITY

Valuation of foreign currency accounts using the FIFO method allows for the conversion of bank account disbursements in a given currency to the corresponding amount in PLN as at a given day according to the FIFO principle (based on chronological inflows or outflows from the bank account). Thus calculated valuation is automatically posted into the software.

BENEFITS

- An automatic process that does not require external tools

- Calculations made on the basis of data from transactions in NS

- Supports all currencies

- Automatic generation of accounting vouchers

- Archiving of calculations

FUNCTIONALITY

The dedicated module of the Polish Localization Package for bank payments includes a split payment mechanism. This functionality allows for the preparation of batch payments, grouping and sending the batch to the bank in various formats, depending on the requirements of a specific banking system. Advanced module functions allow for automatic marking of transactions as paid and verification of bank account numbers for compliance with the white list. The module is flexible and can be adapted to virtually any electronic banking platform.

BENEFITS

- Up to date information on the correctness of your supplier’s bank account registry

- Integrated with the mechanism for creating payment and settlement documents in NetSuite

- The comfort of preparing and verifyng your payments

- Information on payments already effected

Automatic bank account validation - Dedicated package supporting the security of bank data

FUNCTIONALITY

The Ministry of Finance Integration module provides the possibility of sending VAT returns and JPK files directly into the government servers using a qualified electronic signature. This module enables the user to receive a confirmation code of the Official Confirmation of Receipt called UPO. Thanks to this functionality, each authorized accountant will be able to communicate with the tax office in a secure and automated manner using the NetSuite platform.

BENEFITS

- Submission of the prepared data without having to use other programs or platforms

- Automatic transmission of the Official Confirmation of Receipt (UPO)

- Full visibility of the status of all documents sent to the tax office

- Protection of all data thanks to one secure NetSuite data storage

FUNCTIONALITY

Maintaining records of commercial goods and materials stored in warehouses in NetSuite generates the need to meet the reporting obligations, i.e., to prepare JPK_MAG, print warehouse documents or seek support for process automation. The functionalities available under the JPK_MAG module are consistent with those that have been described in the section concerning JPK and declarations. The module enables the preparation, archiving, signing and sending reports to the relevant office. All data is saved and available for a potential audit. Additionally, the module allows for printing documents and the introduced automations ensure the consistency of data resulting from these transactions with financial documents, such as invoices or amendment invoices.

BENEFITS

- Generating JPK_MAG reports

- Verification and validation can be carried out based on a statutory template

- Automatic document repository

- The prepared file is signed and transmitted to the tax office gateway, similarly to other returns, e.g. JPK_VAT7

- Creating and printing warehouse documents

- Automatic flow of information – from purchase or sale orders, through warehouse documents, to purchase or sale invoices

- Support for financial processes where parameterisation is important at the level of index definition or the warehouse transaction itself

FUNCTIONALITY

The Polish Localization Package supports balance confirmations and demands for payment for any selected time frame, available both for suppliers and recipients on a printout template that is consistent with other issued documents.

BENEFITS

- Balance confirmation printout available for any given day for both suppliers and recipients

- Demand for payment printout

- Own comments may be added

- The template is consistent with other transmitted documents

- The support is available for multiple language versions

FUNCTIONALITY

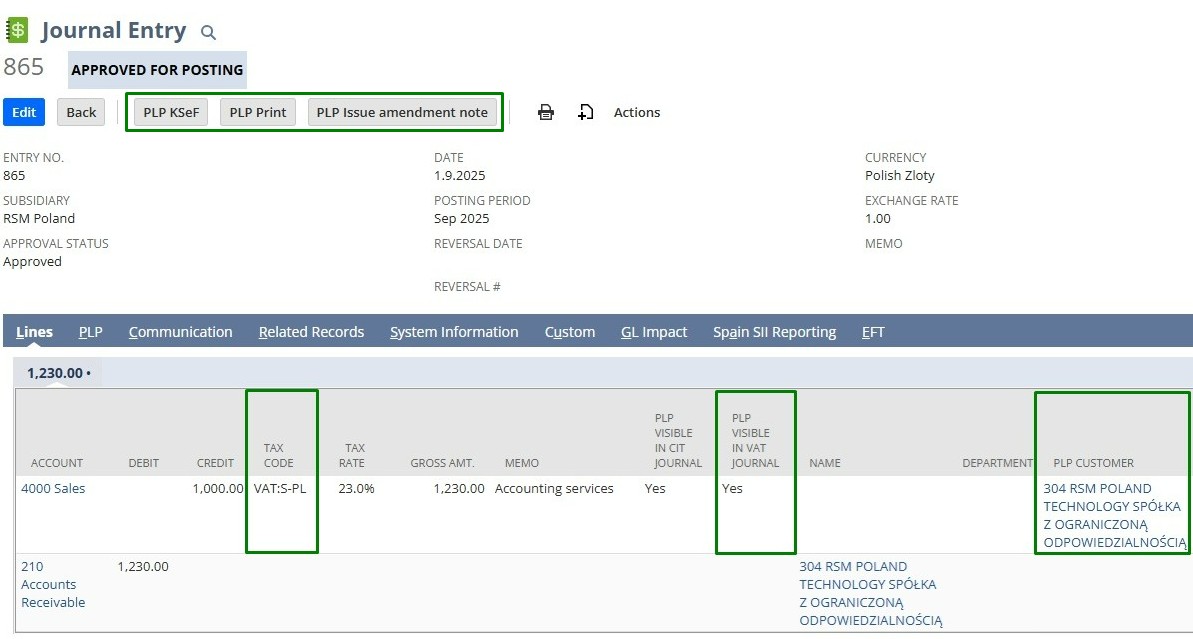

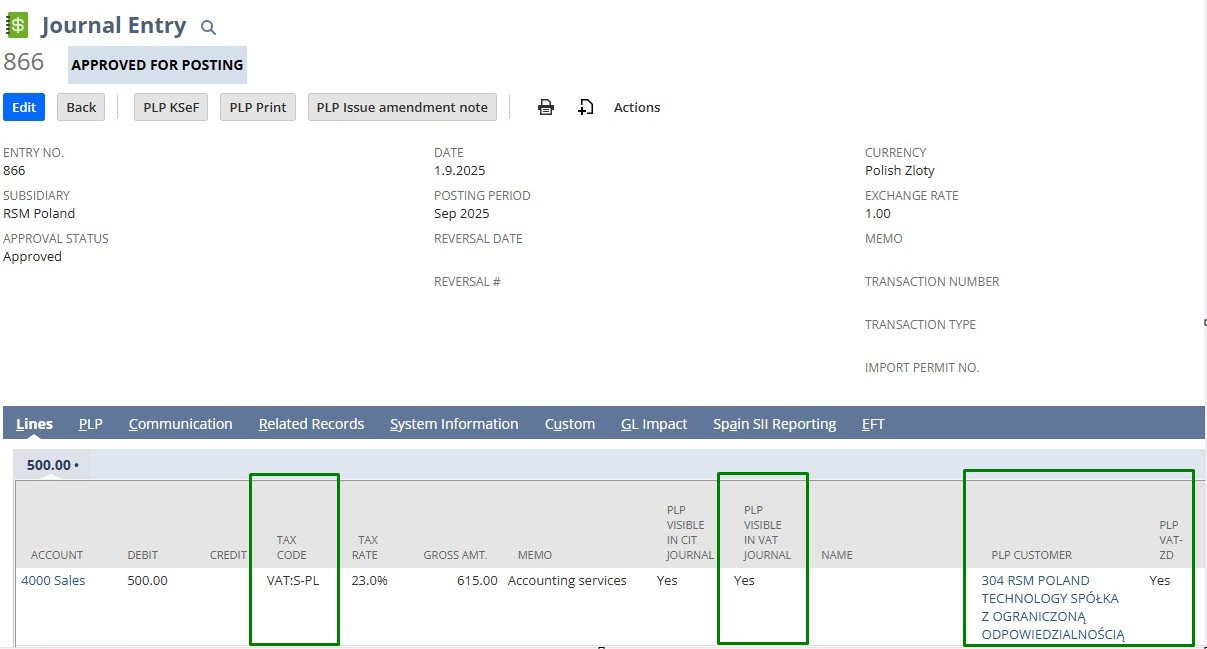

The Oracle NetSuite Polish Localization Package provides support for recording VAT transactions via Journal Entry documents. Properly entered postings enable the document to be reflected in VAT registers, VAT declarations, JPK files, and submitted to the KSeF system. For sales transactions, it is also possible to generate a PLP printout in PDF format, similar to those produced for sales invoices and corrective invoices.

BENEFITS

- Full support for fields and parameters used in sales and purchase transactions

- Handling specific cases shown in registers and VAT declarations, such as internal invoices and bad debt relief

- Support for NetSuite Intercompany Journal Entry transactions

- Ability to generate PLP printouts for sales documents and credit memos

- Option to generate an .xml file in the KSeF structure and submit it accordingly

FUNCTIONALITY

The Oracle NetSuite Polish Localization Package offers support for handling transactions related to adjustments of the VAT taxable base resulting from the so-called bad debt relief. A properly recorded Journal Entry document ensures that the necessary information is presented in the appropriate fields of the JPK declaration. It is possible to enter both downward and upward adjustments to the taxable base for output and input VAT.

BENEFITS

- Support for all types of VAT and taxable base adjustments

- Inclusion of essential supplementary information, such as payment due dates and actual payment dates

FUNCTIONALITY

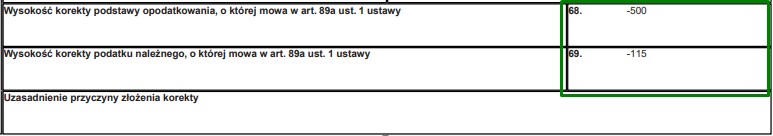

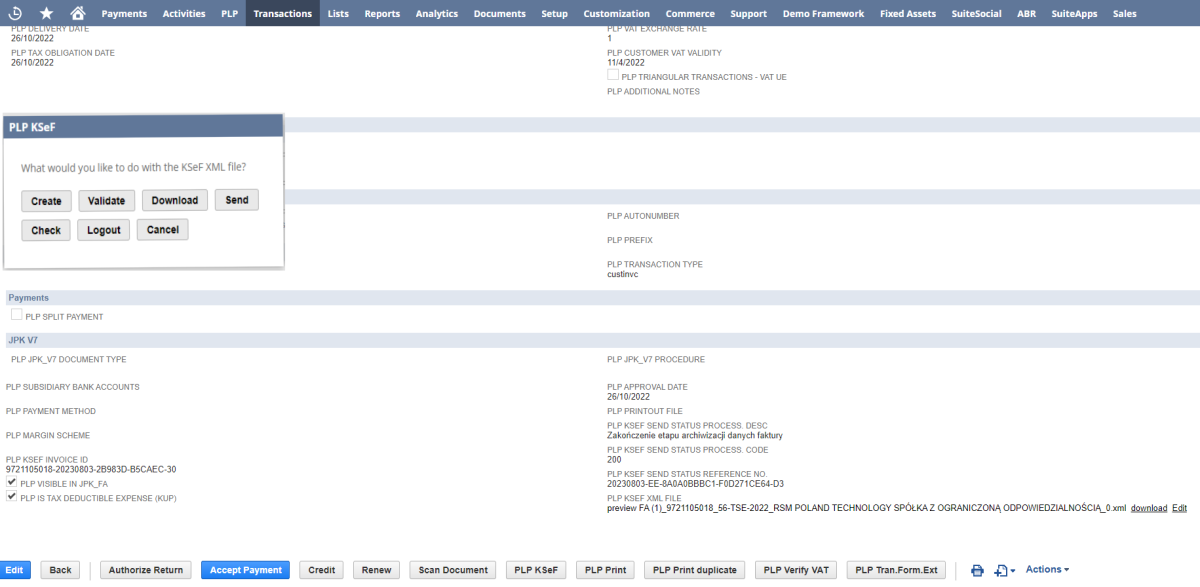

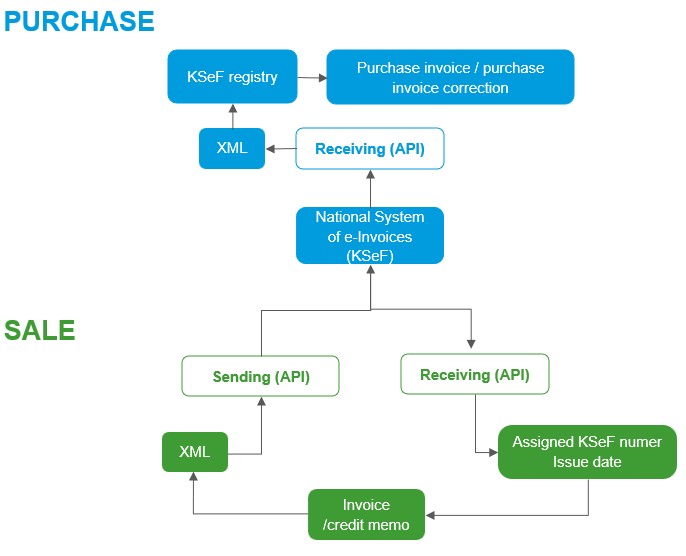

The National e-Invoice System is a platform for issuing and receiving invoices electronically. The KSeF module in the Polish Localization Package of Oracle NetSuite is a comprehensive cloud solution for managing electronic documents. This solution enables efficient and secure connection with the Ministry of Finance platform using tokens generated from the administrator's profile, generating and sending invoices individually or in bulks, as well as receiving confirmations of sending. The KSeF module creates a register of incoming and outgoing documents and enables automatic creation of purchase documents based on xml files received from our supplier.

BENEFITS

- Secure generation, sending and receiving of e-invoices to/from KSeF (authentication with an official token)

- Automation of the invoice sending process through appropriate script configuration (securing the process against sending unapproved documents, documents not covered by the KSeF system, or sending them twice)

- Automation of invoice status verification in the KSeF system (retrieving current information about the processing stage of a given document in KSeF can occur without user intervention)

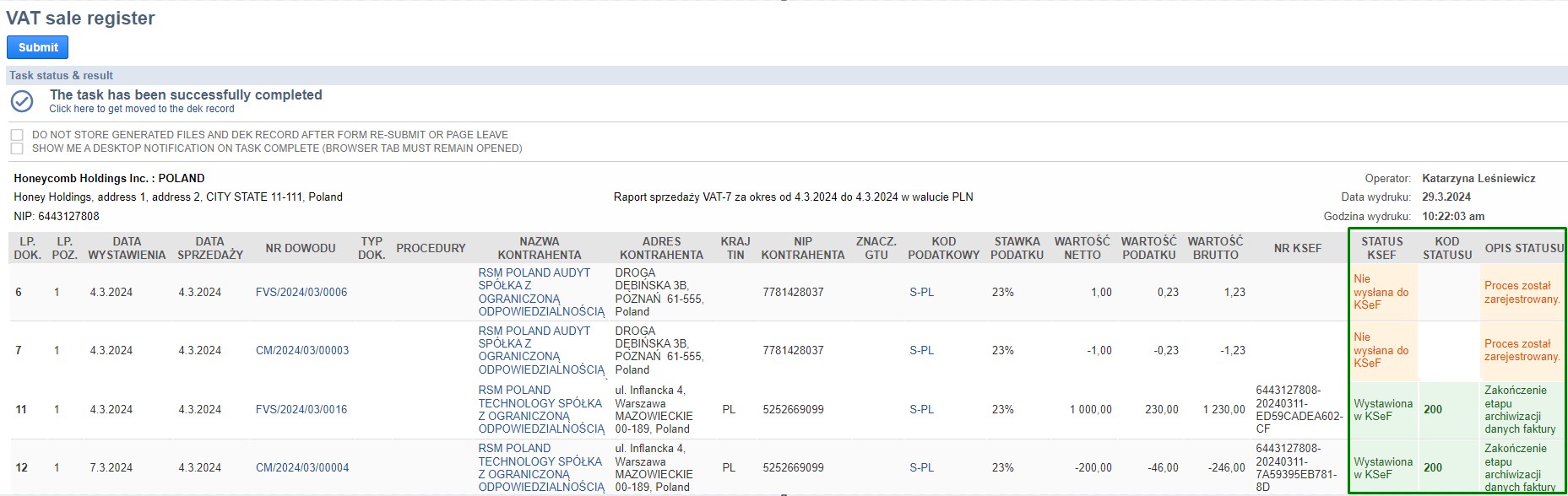

- Visibility of KSeF status in the VAT sales register

- Handling the visibility of KSeF data also from the purchasing process side in the purchase register and managing information required by the new JPK_VAT7 file format

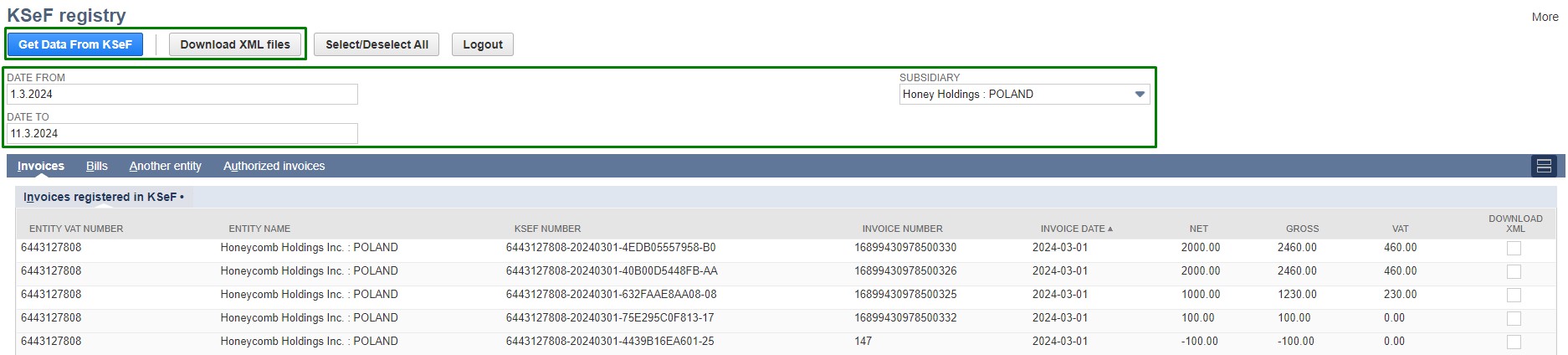

- KSeF Registry functionality for the purchasing process – this module allows you to download information about documents recorded in the e-invoice platform for a given company in a specified time period. This functionality allows comprehensive process handling from within NetSuite without the need to log in to the Ministry's website

- Mechanism for importing purchasing documents in the KSeF Registry module, which enables automatic linking of the invoice with the corresponding purchase order and identification of tax settings of purchase invoices – supporting automation of accounting processes

- Full transparency of the process of linking the invoice in NetSuite with the record, session, and status from the KSeF level

- Ability to adapt the system to customer requirements and needs

- Full customization of optional fields considering the requirements and expectations of invoice recipients

- Line grouping rules – a rule configuration mechanism ensuring correct presentation of sales lines, tailored to specific business requirements

- Full support for all types of documents, including corrections

- Comprehensive customer support regarding system availability in case of more advanced architecture using external systems (file transfer, file visibility management at the level of a sales system other than NetSuite)

- Full support for offline mode also using external systems

- Additional mechanisms for invoice materialization in PDF format and full compliance with workflow processes, allowing flexible modeling of the sending process via email and the KSeF gateway.

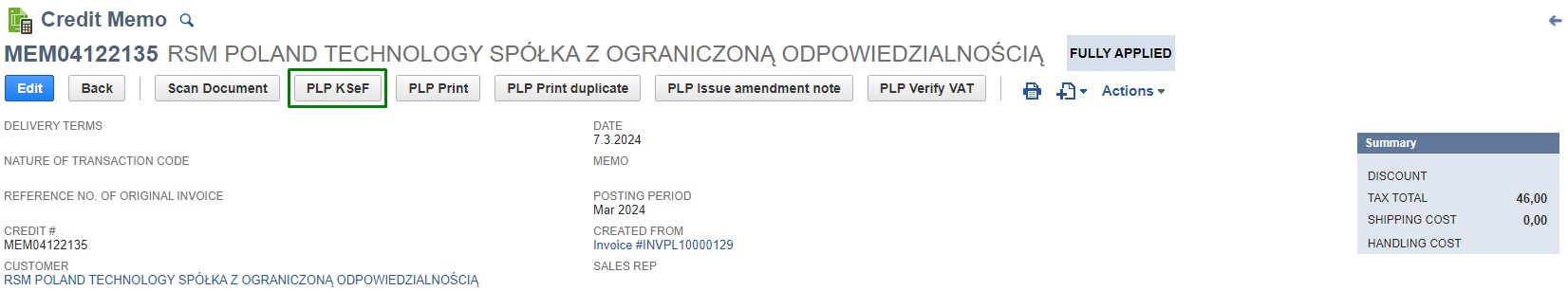

KSeF Module in the Advanced Polish Localization Package:

Sending the KSeF invoice:

Visibility of KSeF status in the VAT sales register - using additional columns, we can perform collective verification of the document processing status in the KSeF system at the stage of reconciliation of VAT sales registers.

KSeF Registry:

FUNCTIONALITY

SuiteTax is one of the tax engines available in the Oracle NetSuite system. Compared to the alternative Legacy Tax engine, SuiteTax introduces differences in the way taxpayer identification numbers for counterparties are defined and how tax data is recorded on transactions.

The Polish Localization Package leverages new fields and SuiteTax mechanisms, ensuring support and accuracy of applied and presented data in the following processes:

- Retrieving counterparty data and verifying it in GUS and VIES systems

- Printing sales documents

- Recording tax data on sales, purchase and accounting documents

- Generating VAT registers, VAT returns and JPK files

- Generating payment files in the Bank Payments Module of the Polish Localization Package

- Sending sales data to the KSeF system

Transactions supported by Advanced PLP

- Proforma invoices

- Purchase and sales orders

- Warehouse documents

- Sales invoices and sales invoice amendments (in plus and in minus)

- Debit and credit notes

- Purchase invoices and purchase invoice amendments

- Purchase and sales credit notes

- Advance and settlement invoices, and amendments to these documents

- Posting orders and automatic reversals

- Specific transactions – transfers between accounts, settlements, automatic transactions

- Consolidation transactions - multi-company transfers

Tax areas supported by the Polish Localization Package

The Polish Localization Package available under Oracle NetSuite provides comprehensive tools for settling income tax and goods and services tax, enabling safe and compliant bookkeeping as well as settlement of transactions with the tax office. The functionalities of the package are regularly expanded and adapted to changing legal requirements. Implementation of the Polish Oracle NetSuite Localization Package guarantees full compliance with Polish tax regulations, while providing ongoing support and updates in response to the dynamically changing requirements.

The Oracle NetSuite Polish Localisation Package enables.:

- support for transactions related to the Intra-Community Supply/Acquisition of Goods;

- import/export of services and goods;

- trilateral transaction support;

- support for transactions generating tax obligation in another country;

- support for the VAT OSS procedure;

- support for all codes, printouts and procedures for VAT purposes;

- calculation of VAT and reconciliation of the discrepancy between the FX rate for income tax and VAT;

- verification of eligibility for VAT deductions based on data obtained from VAT records and VIES;

- full bad debt relief support;

- support for automatic internal documents for VAT purposes;

- support for advance payments and their settlement;

- calculation of car costs settlement and other partial deductions, including for income tax and VAT purposes;

- settlement of employee benefits for VAT and income tax;

- support for VAT proportion;

- support for VAT margin transactions;

- support for all types of annual amendments for VAT return purposes;

- support for cash accounting settlements;

- access to an advanced functionality enabling the determination of the sales date at the level of each transaction line, both in PLN and foreign currencies, based on sales documents;

- access to an advanced logic supporting the setting of the tax point for purchase invoices;

- support for amendments of all types of data and charges requiring amendment documents, both amendment invoices and credit /debit notes;

- automation in the scope of FX rates for VAT purposes in amendment documents;

- automation supporting the consistency of dates on final documents matched with warehouse documents (correct determination of the tax point);

- access to an advanced logic supporting the user in the scope of determining the tax point;

- support for multi-booking involving various currencies for the aforementioned transactions;

- support for income tax calculation (tax classifiers and CIT report printout);

- full integration of all of the above tax transactions with the KSeF system;

- user support in the scope of reconciliation of VAT amounts and the need to make amendments;

- access to a tax logic enabling the correct determination of tax parameters for purchase invoices based on invoices received in KSeF;

- automatic presentation of all aforementioned JPK (SAF-T) calculations.

Why is selecting the right Oracle NetSuite localization crucial for your business?

Enables compliance with Polish tax and legal regulations

Minimizes the risk of errors and non-compliance penalties

Supports the growth of your business by smoothly managing multi-currency transactions, cross-border operations, and expanding to new markets

Streamlines processes by integrating local requirements directly into your NetSuite environment

Improves cost efficiency by avoiding the costs associated with manual workarounds, corrections of compliance issues, or potential fines due to regulatory breaches

Why is RSM Poland the right choice for your company?

RSM Poland is the biggest Oracle NetSuite Partner in Poland, fueled with qualified experts, such as NetSuite-certified developers and ERP consultants, as well as tax advisors, accountants and auditors, who understand the needs of companies struggling with complex Polish regulations. We offer comprehensive support throughout the implementation of the Advanced PLP, as well as ongoing assistance post-implementation. This includes regular software updates to ensure compliance with evolving legal and tax regulations. Our experienced consultants have successfully helped numerous clients optimize their business processes and reach their objectives. We proudly support companies across a wide range of industries and varying sizes, tailoring our services to meet their unique needs.

Oracle NetSuite in Poland – Frequently Asked Questions

Absolutely not. NetSuite is an excellent solution also for smaller, growing companies and start‑ups. NetSuite was designed as a one hundred percent cloud‑native system, eliminating the need to worry about server infrastructure or purchasing costly licences.

The solution operates on a subscription model – the monthly access fee depends on the number of users and selected modules. As a result, the entry barrier is relatively low. You can start with the implementation of essential modules (typically the financial one) and then, as your business grows, gradually expand the functionality of the ERP system to new areas such as warehouse or production management.

NetSuite is a highly configurable solution. This means we can tailor its functionalities to the specific needs of nearly any company, regardless of its size or industry. At RSM Poland, we support clients from a variety of sectors, and based on our experience, the system performs exceptionally well in industries such as Software, Fintech, HiTech, Professional Services and Healthcare. However, this list is not exhaustive – NetSuite successfully supports companies from many different fields.

Absolutely! The RSM Poland team has developed a comprehensive functionality extension for Oracle NetSuite – the Polish Localization Package. The solution has been adapted to fully meet the requirements of the Polish Accounting Act.

The package is intended both for Polish clients and global organisations with Polish subsidiaries that must work in NetSuite and comply with Polish statutory requirements in their accounting system.

A detailed description of the modules included in the Polish Localization Package is available on our website. The RSM Poland IT Consulting team continuously updates the Oracle NetSuite Polish Localization Package to reflect changing tax regulations, legal updates and accounting practices in Poland. Information about new features and improvements is shared in Release Notes in the blog section and in our IT Insights newsletter.

Of course – our team has developed a comprehensive cloud solution for managing electronic documents.

The KSeF Module within the Oracle NetSuite Polish Localization Package is a ready‑to‑use, fully functional and comprehensive cloud‑based solution for electronic document management. It enables efficient and secure integration with the Ministry of Finance platform.

If you would like to learn more about the features and configuration options of the KSeF Module within the Polish Localization Package, we encourage you to consult the dedicated brochure.

Yes, absolutely! Our cooperation does not end with the implementation and configuration of the system. We provide ongoing support from our Helpdesk team, whose task is to assist NetSuite users in their daily work.

Our support may include, among others, eliminating system errors, resolving issues related to closing accounting periods, assistance with personalising functionality, support in administrative tasks such as role management, dashboard configuration, maintaining account security and managing user permissions.

We offer three levels of application support, tailored to different budgets and expectations.

Yes. We fully understand that transitioning to a new system is a major challenge for any organisation. We can prepare tailor‑made NetSuite training sessions, adapted to the specific needs of each client.

Training may take two forms:

- sessions delivered by our certified NetSuite consultants, covering a wide range of features within the Polish Localization Package and other Oracle NetSuite modules

- since RSM is also a team of experienced accountants working daily in NetSuite, we also offer dedicated training for accounting teams.

These sessions cover the practical aspects of system operation in the context of Polish tax and accounting regulations, as well as the use of functionalities available through the Polish Localization Package. Participants leave with knowledge that enables them to independently manage accounting processes in NetSuite – from daily bookkeeping and invoice processing to preparing reports and declarations.

The scope and schedule of the training are always tailored to participants' experience and the specifics of the company’s operations.

The implementation timeline depends on the complexity of the project. Simple implementations that do not require many customisations for the client’s specific needs typically take around 3–4 months. More advanced projects may take up to 6 months.

The BPO programme is ideal for companies that want to start using an enterprise‑class platform quickly while maintaining flexibility and the ability to transition smoothly to their own NetSuite instance in the future as their business grows. It is especially suitable for start‑ups and rapidly growing small and medium‑sized businesses seeking a scalable cloud solution and preferring to maintain a small internal team. A major advantage is that clients can easily move from the BPO environment to an internal NetSuite instance without complex data migration between systems.

RSM Poland is a partner of the NetSuite BPO programme, which enables us to offer clients full system functionality without the costs and complexity of a full ERP implementation at the start. In this model, clients gain access to the system within a few days of signing the agreement.

Yes – we provide both comprehensive accounting support using the system and a supervisory accounting service. Full accounting outsourcing is ideal for clients who want to focus on their core business objectives while leaving other tasks to a specialised external team. The supervisory accounting service is intended for companies that manage their accounting internally within NetSuite but require professional expert support in maintaining accounting books. As part of supervision, we perform tasks typically assigned to senior accountants and chief accountants. In urgent situations, we also offer temporary substitution for absent finance team members working in Oracle NetSuite. The scope of accounting support is always tailored to the specific expectations of each client.

RSM Poland is your guarantee of success in implementing and operating NetSuite in Poland. We are the largest official Oracle NetSuite partner in Poland. Our team consists of qualified experts, including certified NetSuite developers and consultants, tax advisors, accountants and auditors who understand the complexity of Polish regulations.

We support our clients not only during the implementation and configuration of Oracle NetSuite and the Polish Localization Package, but also by offering a wide range of services that facilitate day‑to‑day work with this system.

Get a 100% free customized demo from a NetSuite expert at RSM Poland

Complete this form and an RSM representative will be in touch.