Takeover prices

Takeover prices for acquisitions < 20 mio € fall by less than 10%. The market segment > 20 mio € even sees a slight increase in 2020. Across all segments, the multiple remains fairly stable at 6.4 times EBITDA.

Multiples per sector

In the previous edition of the M&A Monitor, average multiples > 9 were still reported, such as in the Pharma and Chemicals sectors. This is no longer the case.

The sectors with the largest drops in multiples are:

- Chemicals(-2,4)

- Pharma (- 1,4)

- Telecommunications(-1,4)

- Entertainment & media (-1,1)

The sectors with traditionally lower multiples as construction, transport and retail, remained stable.

In some sectors where sufficient deals were reported, segment figures were also reported for the first time:

Some more interesting facts

- On average, the own contribution is 30% for the smaller deals. This can go up to 50% for deals > EUR 100 million. A slight upward trend can be seen here.

- Earnouts, where part of the acquisition price is only paid if certain targets are achieved in the future, are concluded in 36% of deals. In the previous edition, this was in 31% of cases.

- A vendor loan, whereby the seller grants a loan to the acquirer, is granted in 43% of the deals, coming from 35%.

- On average, there are 4 bidders per acquisition.

- There is an increase in the number of deals that take more than 1 year to complete the acquisition process.

Future

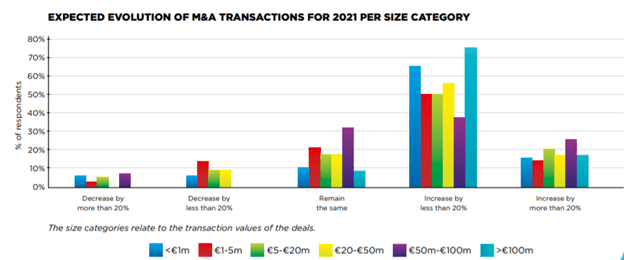

Most actors in the Belgian M&A market are positive about the near future.