Key takeaways

Attention: Following the Social Security Financing Act and the reform of employer contributions in 2025, changes have been adopted that significantly impact businesses. We invite you to consult our explanatory infographic here or in the dropdown menu at the end of the article.

Originally designed to respond to the "Yellow Vest" crisis, and known as the "Exceptional Purchasing Power Bonus" (PEPA), formerly the "Macron Bonus," the "Value Sharing Bonus" (PPV) came into force on July 1, 2022, as part of a permanent system.

This mechanism has been recently relaxed under a more ambitious law passed by the public authorities: Law No. 2023-1107 of November 29, 2023, "transposing the national interprofessional agreement on value sharing within companies."

This law (which came into effect on December 1, 2023) encompasses the PPV and introduces new value-sharing mechanisms while amending existing ones, such as profit-sharing and employee participation.

The objectives of this law are centered around three main goals:

- Better involving employees in the performance of their company to support their purchasing power.

- Encouraging companies with fewer than 50 employees to implement one or more value-sharing mechanisms: participation, profit-sharing, employee savings plans, PPV.

- Facilitating the widespread adoption of employee savings mechanisms.

Several decrees published in late June and early July 2024 now allow companies to fully embrace the mechanisms outlined in this law.

Additionally, three sets of Q&A (Questions & Answers) were recently released by the administration to clarify the new legal obligations and to better understand the scope of certain provisions.

Our experts offer a detailed analysis of this system, its changes, and the new obligations for companies (depending on their workforce size).

Value Sharing: PPV, the Simple Solution

Why implement the PPV?

First and foremost, the Value Sharing Bonus (PPV) can be implemented:

- Through a company or group agreement following the terms of a profit-sharing agreement;

- Or through a unilateral decision (DU) after consulting the Social and Economic Committee (CSE), if one exists.

The employer is free to choose the method that suits them.

PPV: What Are the Advantages and Benefits?

The PPV offers significant advantages:

- The ceiling for exemption from social security contributions for the PPV is set at €3,000 per beneficiary per calendar year under normal conditions.

- The ceiling increases to €6,000 if the company has implemented a profit-sharing mechanism (for companies with at least 50 employees) or a profit-sharing or participation plan (for companies with fewer than 50 employees).

When compared to a so-called "classic" bonus, the PPV is exempt from social security contributions and provides substantial benefits, as the classic bonus is subject to both social security contributions and income tax.

However, the PPV does not create social rights related to unemployment or retirement.

What’s New with the PPV?

Since January 1, 2024, two PPVs can now be granted for the same calendar year. Previously, only one could be granted.

Additionally, Decree No. 2024-644 of June 29, 2024, finalizes the tax exemption for the PPV (in favor of employees), regardless of the salary earned by the employee.

This decree also specifies the timeframes and procedures for informing employees and allocating all or part of the value-sharing bonus to an employee savings plan (PEE, PEI, PERCO) or a company pension plan (PERECO or PERO).

The PPV details are now integrated into the official Social Security Bulletin (boss.gouv.fr).

Specific updates regarding different types of companies are also planned. Our RSM experts invite you to explore these in the dropdown menu at the end of this article.

Expert Advice from RSM:

The PPV undeniably offers simplicity in its implementation, as it results in the formalization of a unilateral employer decision (DUE), which does not require filing with the authorities.

The system is not linked to any performance targets for employees, unlike the legal profit-sharing regime.

The amount of the PPV can be differentiated between employees based on criteria set out in the law (a non-exhaustive list):

- Remuneration,

- Job classification level,

- Seniority within the company,

- Duration of actual presence during the past year,

- Contracted working hours in the case of part-time work.

Furthermore, its financial cost is very low for companies with fewer than 50 employees:

For example, a company with fewer than 50 employees wishing to pay €500 to an employee (earning less than three times the annual SMIC) will pay only €500, excluding the accounting benefits derived from the deductibility of this expense.

As part of a precautionary approach and pending any further Q&A from the administration, it is advisable to update (or set up) your employee savings plan to include the PPV by contacting the institution that you’ve worked with to implement it, thereby providing employees with the benefits of the tax exemption.

It is essential to submit the savings plan (or the amendment) to the labor administration via the dedicated site (TéléAccords) to qualify for the tax exemption.

Note that this system does not replace salary increases or bonuses defined by a wage agreement, employment contract, or company practices. It also does not substitute for compensation elements that would become mandatory under legal, contractual, or customary rules.

Value Sharing: What Adjustments and New Measures Are Contained in the Law?

Focus on the PPVE

The Law of November 29, 2023, introduces a new system: the Enterprise Valuation Sharing Plan (PPVE).

This optional system allows employers (regardless of size) to financially engage employees in the company’s financial valuation, while also fostering employee retention. In this respect, it aligns with the philosophy of “employee share ownership,” without being equivalent.

The PPVE aims to award employees a bonus if the company’s value increases over a three-year period as defined by the plan.

This bonus is accompanied by favorable social security and tax treatment.

The maximum amount that can be awarded to a single employee in a given fiscal year is three-quarters of the annual social security ceiling (PASS), or €34,776 (in 2024).

The PPVE must be established through an agreement with the employees according to the same terms as a profit-sharing or incentive plan:

- Collective agreement,

- Agreement between the employer and the representatives of the employee unions within the company,

- Agreement within the CSE,

- Ratification by two-thirds of the employees of a proposed agreement by the employer.

Decree 2024-644 of June 29, 2024, has now made this system operational.

Profit-sharing and Employee Participation: What Changes?

Possibility to Advance Profit-Sharing Payments

Similar to profit-sharing, an agreement may now allow for the payment of advances on amounts owed under the Special Profit-Sharing Reserve or profit-sharing schemes.

Advances are paid to the recipient with their agreement, on a periodic basis, no less than quarterly.

Article L 3348-1 also specifies:

- The conditions for reimbursement in case of overpayment (salary deductions),

- The tax regime for overpayments allocated to an employee savings plan, which can be unlocked (voluntary payments).

Proportional Distribution by Salary

A new provision has been introduced, which can be used for proportional distribution based on salaries within profit-sharing agreements.

Thus, the profit-sharing agreement can set a minimum salary, maximum salary, or both, to determine the individual distribution when it is proportional to salaries. This provision aims to favor lower salaries and reduce income inequality.

Abolition of the 3-Year Delay for Profit-Sharing

Previously, when a company with an incentive agreement employed at least 50 employees, the participation obligations did not apply until the third fiscal year after the threshold was crossed, provided the agreement continued uninterrupted during that period.

Now, the establishment of the Special Profit-Sharing Reserve (RSP) is to be considered without regard to an existing profit-sharing agreement.

Employee Savings: 3 New Cases of Early Release

Under the Labor Code (Articles L 3324-10, L 3332-25, and R 3324-22), there were previously 9 cases for early release of profit-sharing or amounts invested in an employee savings plan or PEE.

Decree No. 2024-690 of July 5, 2024, introduces three new cases for early release, summarized below:

- Energy renovation work on the primary residence,

- Caregiver activity performed by the individual, their spouse, or civil union partner on behalf of a relative as defined in Articles L. 3142-16 and L. 3142-17 of the Labor Code,

- Purchase of a vehicle using electricity, hydrogen, or a combination of both as its exclusive energy source, or an electric-assist bicycle.

PEE: Increased Contribution Limits

With the law of November 29, 2023, companies are increasingly confronted with the topic of value sharing with their employees, in a context of persistent inflation.

The law introduces innovative mechanisms that every business leader must carefully consider and examine, given the opportunities (or obligations) they create.

It remains to be seen how these systems will evolve in an uncertain legislative context following the dissolution of the National Assembly. RSM France can assist you in this process, which is based on evolving balances.

Our RSM experts analyze the possibilities available to business leaders of companies with fewer than 11 employees.

What Obligations Do Companies with Fewer Than 11 Employees Have?

The law of November 29, 2023, does not impose any specific obligations on companies with fewer than 11 employees regarding value-sharing mechanisms.

How to Implement a Value-Sharing System, Even Though No Obligation Is Imposed?

If you wish to implement a value-sharing system for your employees, our RSM experts explain that there are several avenues available to you, with facilitation and adjustments provided by the law:

- PPV (Prime de Partage de la Valeur - Value Sharing Bonus)

- Profit Sharing (Intéressement)

- Employee Profit Participation

- Employee Savings Plan (PEE)

- Employee Business Valuation Sharing Plan (PPVE)

Our experts emphasize that the choice of a system should be made according to the objectives pursued by the business leader, notably:

- Simplicity: Paying a PPV or contributing to an employee savings plan.

- Performance Goals: Setting objectives for employees through a legal profit-sharing agreement.

- Redistribution of Profits: Allocating a portion of the profits via a participation agreement.

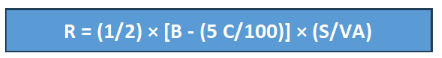

In terms of profit-sharing, the new law allows companies with fewer than 50 employees to implement a voluntary participation system with a calculation formula that is less favorable than the legal formula. The legal formula is as follows:

B = Taxable profit, after deducting the corresponding tax but adding the provision for investment.

C = Equity capital of the company.

S = Gross salaries.

VA = Added value.

The administration has confirmed, in its Q&A on "the experimentation of a participation system deviating from the equivalence rule of employee benefits," that a company choosing a non-legal formula no longer needs to compare its results to the legal formula and is not obliged to pay at least the result of the legal formula.

The alternative formula can result in a lower or higher outcome than the legal formula.

Therefore, companies can choose to use the participation system based on a financial results formula, as opposed to objectives linked to productivity, which are more suited for profit-sharing agreements.

It is important to note that the experiment for the alternative participation system lasts for 5 years and ends on November 29, 2028.

Starting January 1, 2025, these companies will be required to implement a value-sharing scheme if their net taxable profit is at least 1% of their turnover for the previous three consecutive fiscal years (for the first time: 2022-2023-2024).

This will be an experimental measure lasting five years from the enactment of the law. An evaluation report will be produced at the end of the five years to assess whether this scheme will be continued beyond November 29, 2028.

Which Companies Are Affected by This New Requirement?

The companies targeted by this new scheme are those constituted as corporations with at least 11 employees that are not required to implement profit-sharing, as well as certain entities with at least 11 employees in the social and solidarity economy sector.

Foreign companies with permanent establishments in France, provided they submit their tax and social security declarations in France, are also subject to this legal obligation.

The law defines net taxable profit in the same way it is used for calculating the Special Profit-Sharing Reserve (RSP). This refers to the profit generated in mainland France and in Guadeloupe, Guyana, Martinique, Mayotte, Réunion, Saint-Barthélemy, and Saint-Martin, as it is assessed for income tax or corporate tax purposes, after deducting the corresponding tax.

Thus, if a company with 11 to 49 employees generates a net taxable profit in France of at least 1% of its turnover over three consecutive fiscal years, it is subject to this new obligation.

However, the administration clarifies that certain “companies with 11 to 49 employees that consistently generate profits” are excluded from this experimental value-sharing scheme:

- Sole proprietorships;

- Companies that fall under the status of "worker cooperative" public limited companies (SAPO), if they have paid a dividend to their employees for the past fiscal year and have not opted to pay a priority dividend proportional to the capital to shareholders;

- Companies that already have an agreement for profit-sharing or participation.

Decree No. 2024-690 of July 5, 2024 specifies that the threshold of 11 employees must be determined according to the methods set out in Article L 130-1, I of the Social Security Code (using the "social security" headcount).

The net taxable profit considered is the one used to apply the legal formula for calculating the special profit-sharing reserve.

It should be noted that companies that have implemented one of the value-sharing schemes (profit-sharing, participation, contribution to a salary savings plan, or PPV) for the fiscal year following these three years are not subject to this obligation.

The administration specifies in its Q&A that the rule of five consecutive calendar years, as stated in Section II of Article L. 130-1 of the Social Security Code, does not apply to determine when the threshold of 11 employees is exceeded.

What obligations are there on January 1, 2025?

To meet the legal obligation, the companies concerned can choose from several value-sharing instruments, including:

- A profit-sharing scheme by joining a sector agreement approved under a voluntary profit-sharing regime or by applying the less favorable participation regime established by Article 4 of the law;

- A profit-sharing scheme through an agreement or unilateral decision under the conditions of common law or by joining an approved sector agreement;

- Contributing to a salary savings plan (PEE, PEI, Perco, or Pereco, whether company-specific or inter-company) under the standard conditions set for these various plans;

- Paying a value-sharing bonus (PPV).

Our RSM Advice:

Make sure to verify if your company is affected based on the employee-counting methods now specified by the decree and clarified in the Q&A published by the administration.

Indeed, starting January 1, 2025, the fiscal years 2022, 2023, and 2024 will be taken into account to assess the fulfillment of the condition related to the growth of net taxable profit.

The law has created a new obligation to negotiate the definition of an exceptional net taxable profit (BNF exceptional) and the sharing of that profit with employees if such a profit is realized (new article L. 3346-1 of the Labor Code).

What changes for companies with more than 50 employees?

The administration's Q&A dated June 6, 2024 (Q&A n°1) first clarifies which companies are concerned. Three cumulative conditions:

- Being subject to profit-sharing requirements based on their headcount (50 employees or more),

- Having one or more union representatives (DS) in their workforce,

- Opening negotiations on profit-sharing or participation.

Companies that meet these three cumulative conditions are now legally required to negotiate also on:

- the definition of what constitutes an “exceptional increase in their profits,”

- and the methods of value sharing for employees.

This definition takes into account criteria such as:

- the size of the company,

- the sector of activity,

- the occurrence of one or more share buyback operations followed by their cancellation, provided these operations were not preceded by free share allocations to employees as set out in the Commercial Code (C. com. art. L 225-197-1 et seq. and L 22-10-59 et seq.),

- profits made in previous years or exceptional events external to the company that occurred before the profit was realized.

The value sharing triggered by exceptional results can take the form of:

- A supplementary profit-sharing payment or an additional incentive if the company has an incentive agreement in place, under common law conditions.

It could also take the form of opening a new negotiation to establish:

- An incentive scheme if the company does not already have one,

- A supplementary profit-sharing or incentive payment, provided the initial agreement on participation or incentive has resulted in a payment,

- A contribution to a savings plan: PEE, PEI, company or intercompany Perco, Pereco,

- Or a PPV.

Companies already having a profit-sharing or incentive agreement in place as of the date of the law's enactment (November 29, 2023) had to begin this negotiation by June 30, 2024.

Our RSM advice:

Make sure to begin these negotiations as soon as possible if it hasn’t been done already. It is a legal obligation to enter negotiations, but not to conclude them.

However, if you already have a profit-sharing or incentive agreement with a specific clause regarding the consideration of profit increases and the resulting value-sharing methods, you are exempt from the obligation to negotiate on this topic.

The administration's Q&A dedicated to this issue provides helpful details on this new obligation.

- Loi 2023-1107 du 29 novembre 2023 : JO 30

- Décret n° 2024-644 du 29 juin 2024 portant application des articles 9, 10, 12 et 18 de la loi no 2023-1107 du 29 novembre 2023 portant transposition de l’accord national interprofessionnel relatif au partage de la valeur au sein de l’entreprise

- Décret n° 2024-690 du 5 juillet 2024 portant transposition de diverses mesures prévues par l’accord national interprofessionnel du 10 février 2023 relatif au partage de la valeur au sein de l’entreprise.

- Questions réponses (QR) de l’administration du travail sur le dispositif expérimental permettant aux entreprises mettant en place un régime de participation volontaire de déroger à la formule de calcul de la réserve spécial de participation (RSP) dans un sens moins favorable aux salariés. www.emploi-travail.gouv.fr

- Questions-réponses (QR) de l’administration les conséquences d'une augmentation exceptionnelle du bénéfice net fiscal (BNF) dans une entreprise soumise à l'obligation de mettre en place un régime de participation et dotée d'au moins un délégué syndical (article L. 3346-1 du code du travail nouveau).

- Questions-réponses (QR) de l’administration « portant sur l’expérimentation d’une nouvelle obligation de partage de la valeur dans les entreprises de 11 à 49 salariés réalisant des bénéfices réguliers »

- BOSS : mesures exceptionnelles / questions- réponses sur la prime de partage de la valeur