From this article you will learn:

- the new functionalities of Oracle NetSuite Advanced Polish Localization Package 2025.0.

- the new improvements of Oracle NetSuite Advanced Polish Localization Package 2025.0.

Advanced Polish Localization Package (Advanced PLP) provides an extension of a native functionality in Oracle NetSuite. It is a set of designed modules intended to fully support your financial NetSuite system in compliance with the Polish requirements stated in the Polish Accounting Act. We regularly update the PLP module and so we would like to announce a new version of the Oracle NetSuite Advanced Polish Localization Package 2025.0 software. Our release notes provide information on the features and improvements in each release.

FUNCTIONALITIES:

In response to the upcoming tax changes and our plans to support the new Standard Audit File JPK KR PD (“Jednolity Plik Kontrolny Księgi Rachunkowe Podatek Dochodowy”) in the Polish Localisation Package under Oracle NetSuite, we have introduced additional designations in the package:

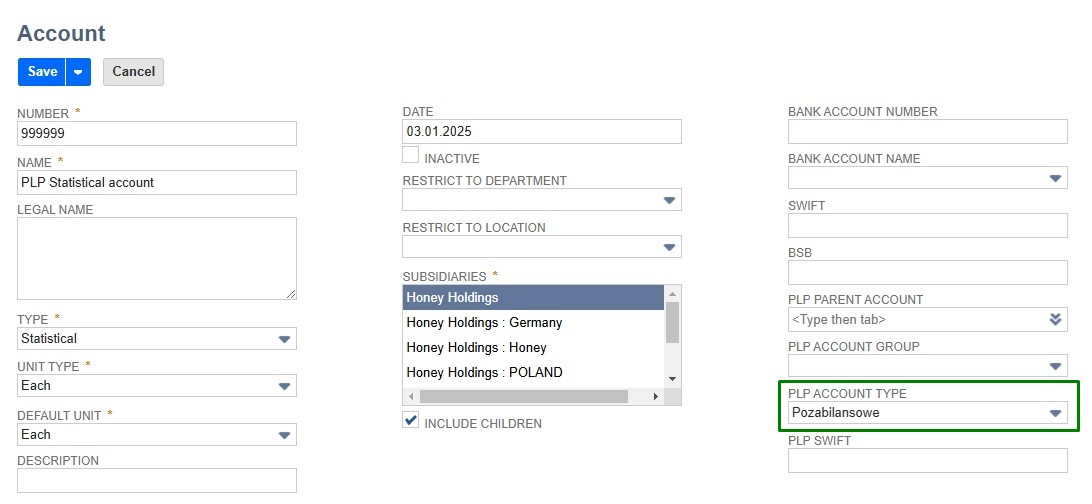

- New type of account in the JPK KR PD report – statistical (off-balance-sheet). When selecting the Pozabilansowe (“off-balance-sheet”) account, there is an option to indicate a value at the account level, in the PLP Account Type field.

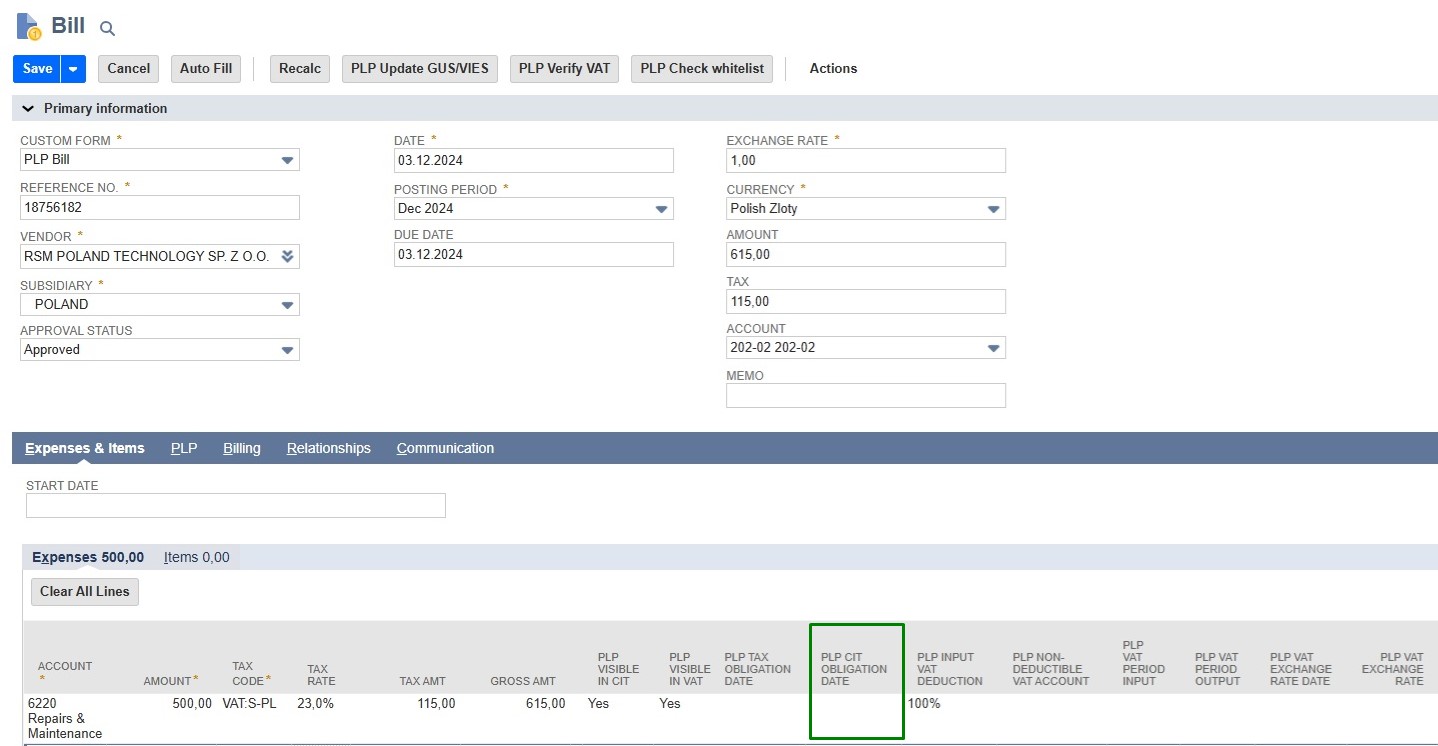

- New field available for the transaction line – PLP CIT Obligation Date. This field allows users to indicate the period of recognition of the document item for CIT settlement purposes. Failure to fill in the PLP CIT Obligation Date on the document is equivalent to showing the document as suggested by the date indicated in the document header.

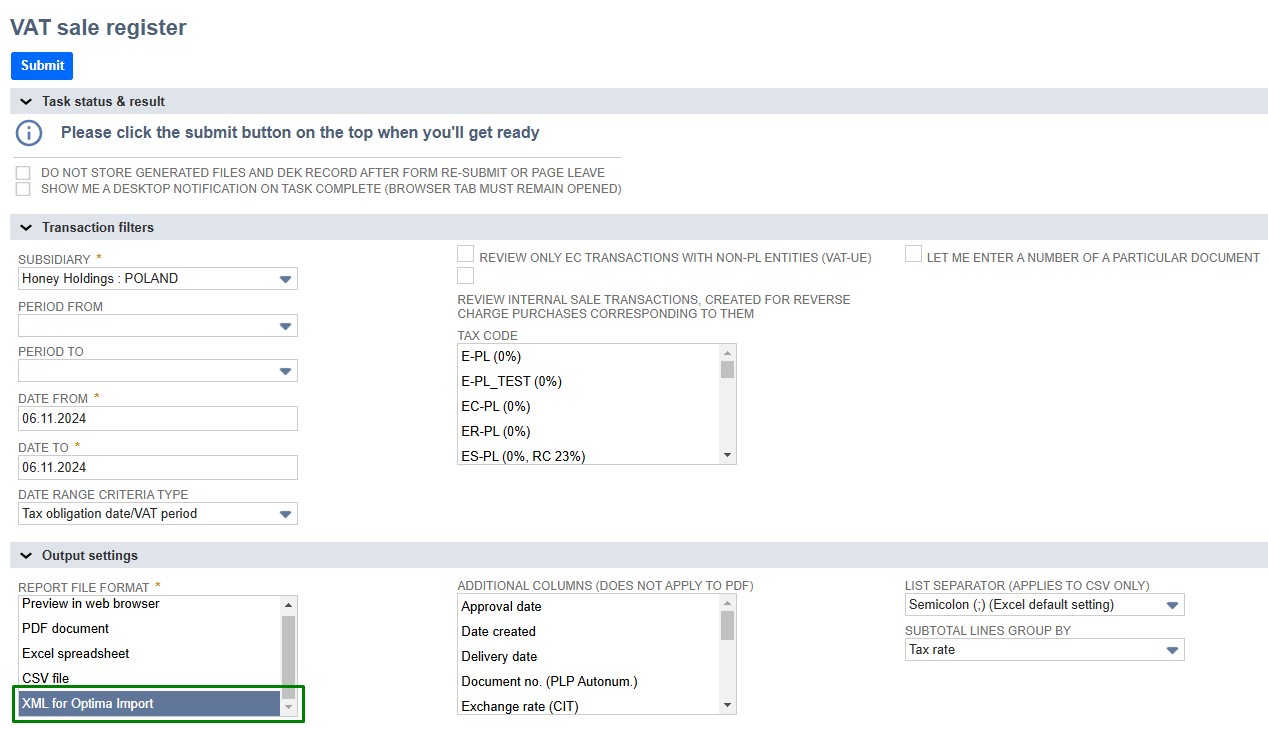

We have incorporated an additional functionality enabling the export of VAT sales registers in XML, supported by Comarch ERP Optima.

To generate an XML file, the user should enter the PLP VAT sales register module and select XML for Optima Import in the Report File Format field. It is possible from the configuration level of the Polish Localisation Package to indicate the name of the Optima database, which is necessary for correct file import in the target system. This functionality is available as part of the extended service package and is additionally charged. For detailed information on the exact cost and implementation, please contact our team.

The XML file includes the following information:

- details of counterparties appearing in transactions;

- sales documents and credit memos;

- payments linked to documents;

- support for non-standard forms of payment using the dedicated PLP Optima Payment method field.

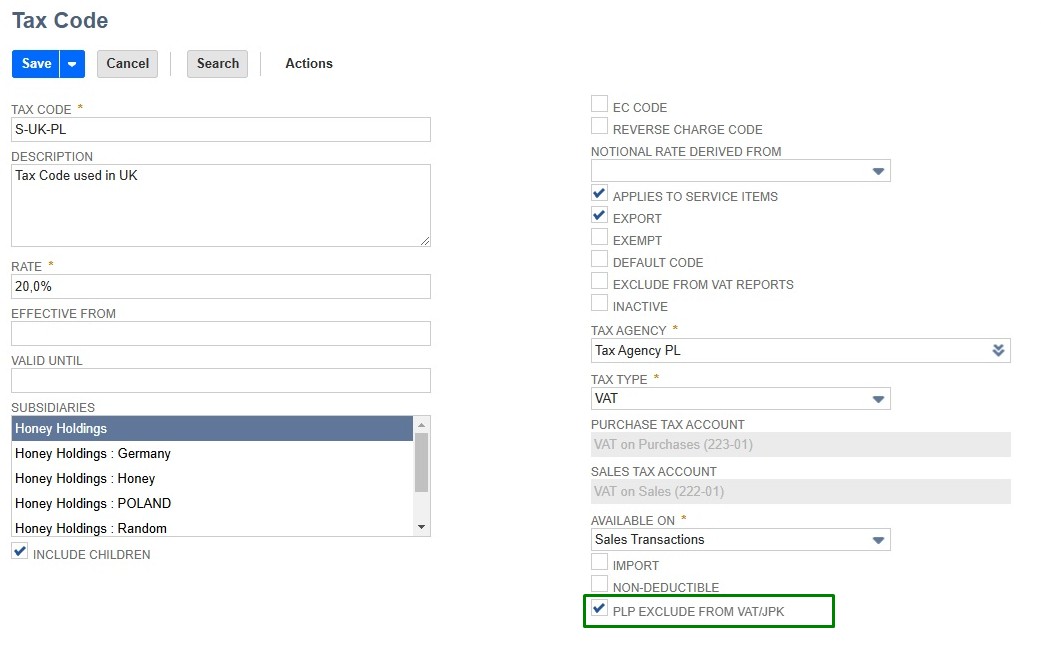

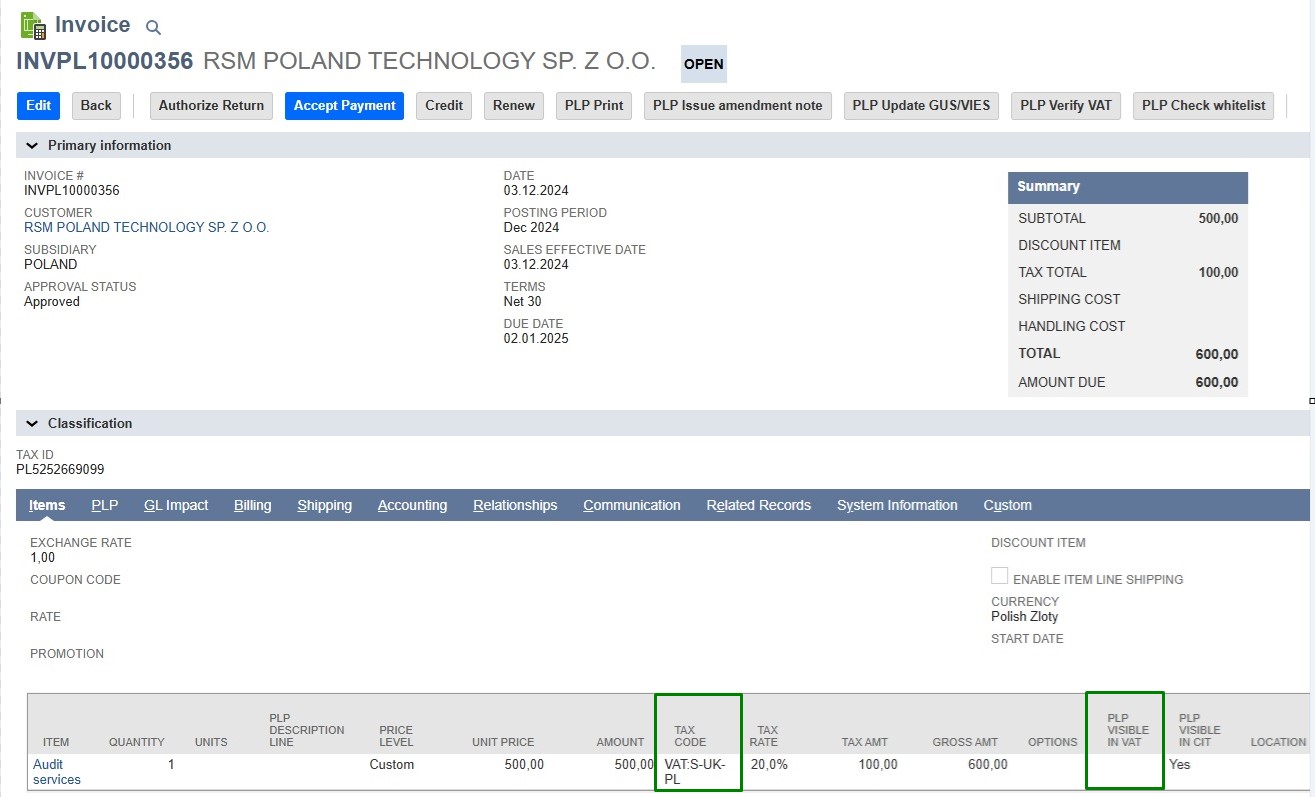

We have incorporated a new designation at the tax code level – PLP Exclude from VAT/JPK, enabling automation in excluding transactions from VAT registers and returns.

Ticking the PLP Exclude from VAT/JPK box results in unticking the PLP Visible in VAT box for new document items where a tax code has been applied. This allows for automatic exclusion of e.g. OSS transactions or transactions settled for tax in another country.

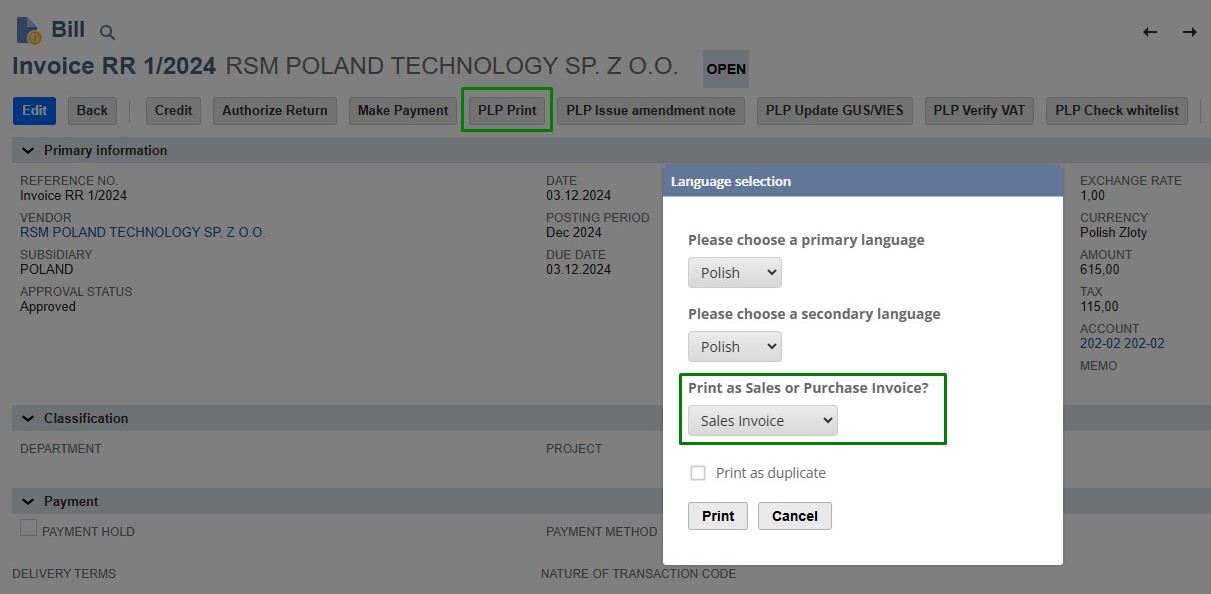

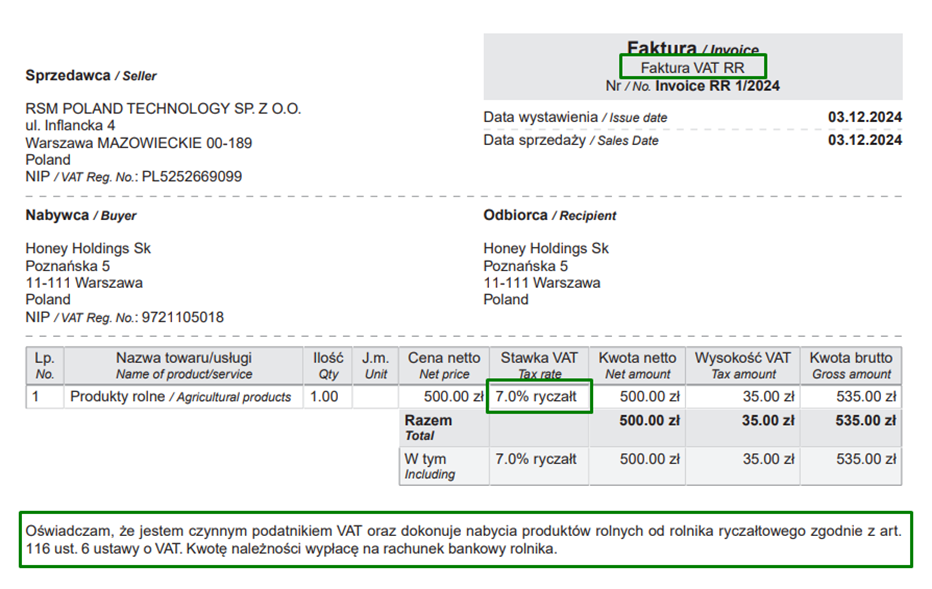

We have enabled the option to generate sales invoice printouts based on entered purchase invoices from flat-rate farmers. The PLP Print option for purchase invoices allows users to select a required type of printout:

- as a purchase invoice – an internal printout of the purchase document;

- as a sales invoice – a printout of the document as a sales invoice on behalf of the flat-rate farmer.

The dedicated sales invoice printout features additional elements:

- the entry Faktura VAT RR (“VAT Invoice form flat-rate farmers”) in the document header;

- the dedicated rate: 7% ryczałt (“7% flat rate”);

- the legal basis.

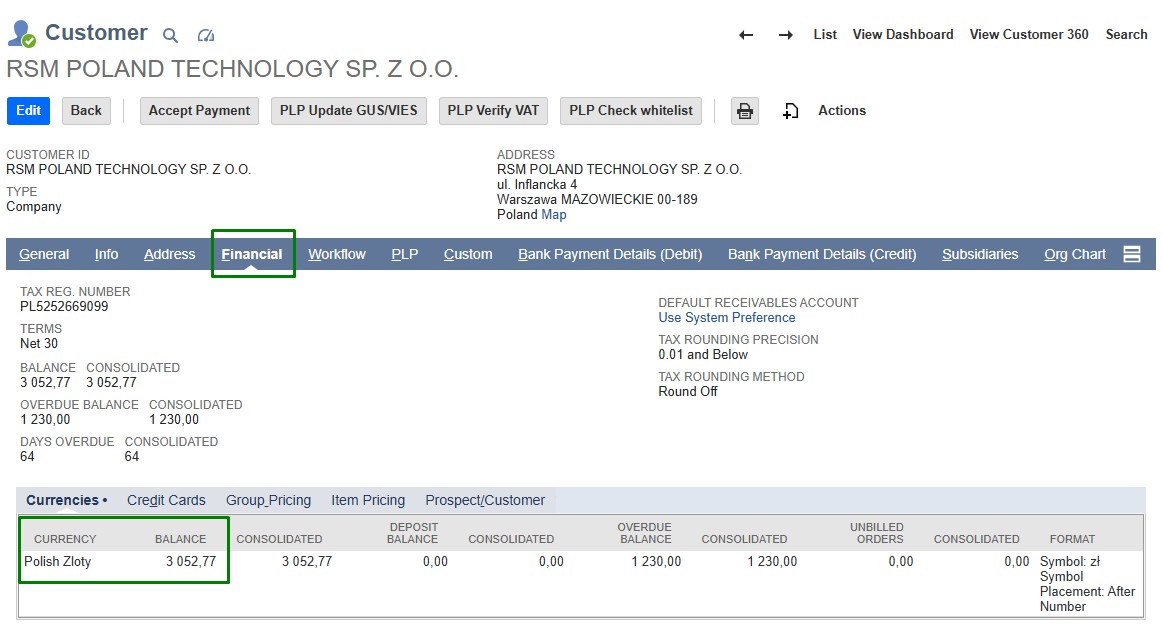

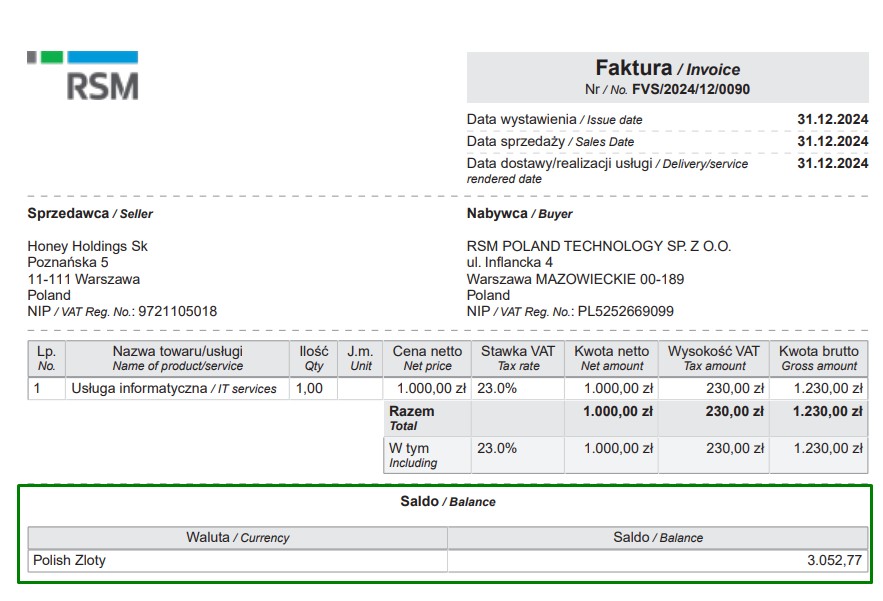

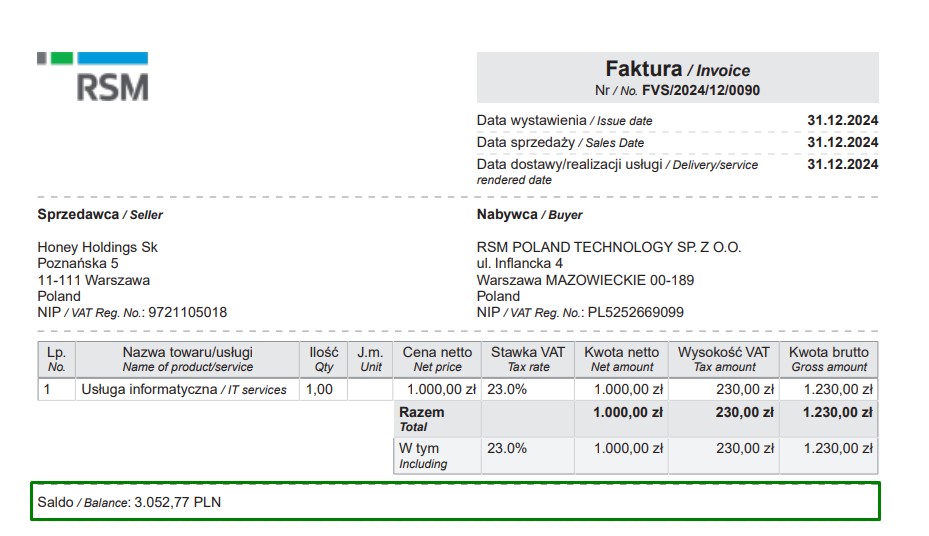

We have ensured the possibility to include information on the counterparty’s balance, visible in the customer card, on PLP printouts.

We have enabled three options for displaying the balance on printouts that can be customised from the Polish Localisation Package configuration level.

- Presentation of balances in the form of a table:

- Presentation of balances in the form of a list:

- No balance presentation on the printout.

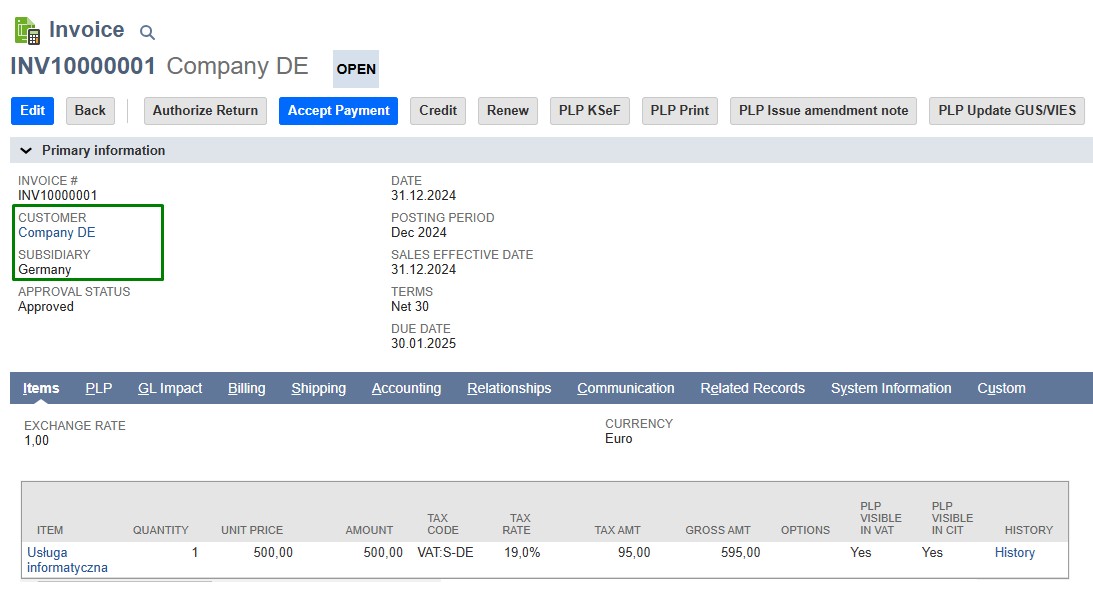

We have introduced an additional functionality that allows the use of printouts of sales documents from the Polish Localisation Package under Oracle NetSuite by other companies defined in the NetSuite system. This functionality is available as part of the extended service package and is additionally charged. For detailed information on the exact cost and implementation, please contact our team.

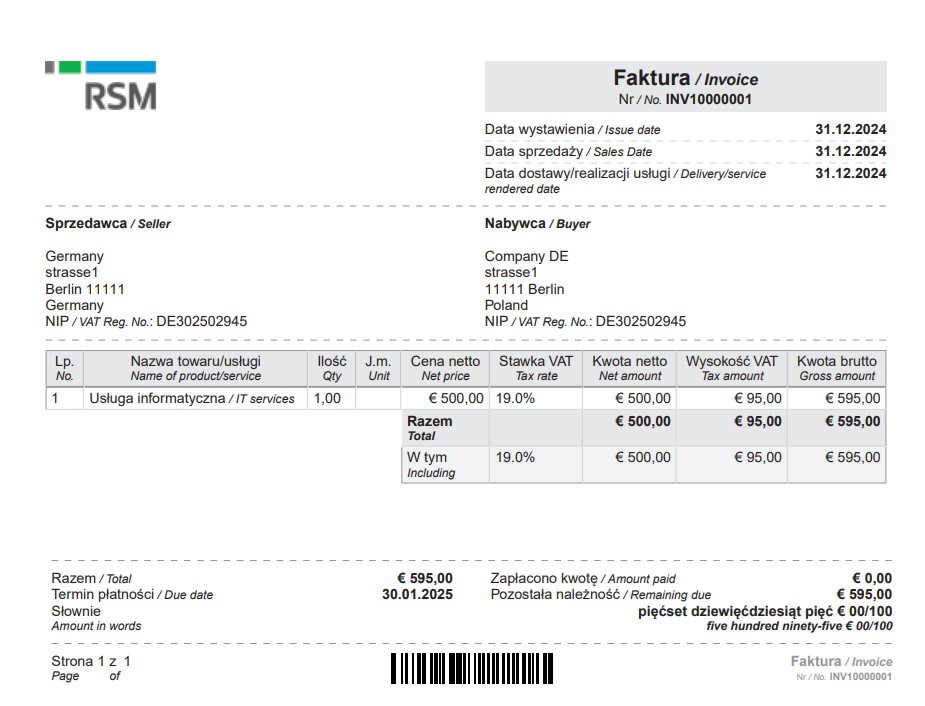

This functionality allows the use of dedicated printouts of Sales Order, Invoice and Credit Memo documents, issued by companies from countries other than Poland.

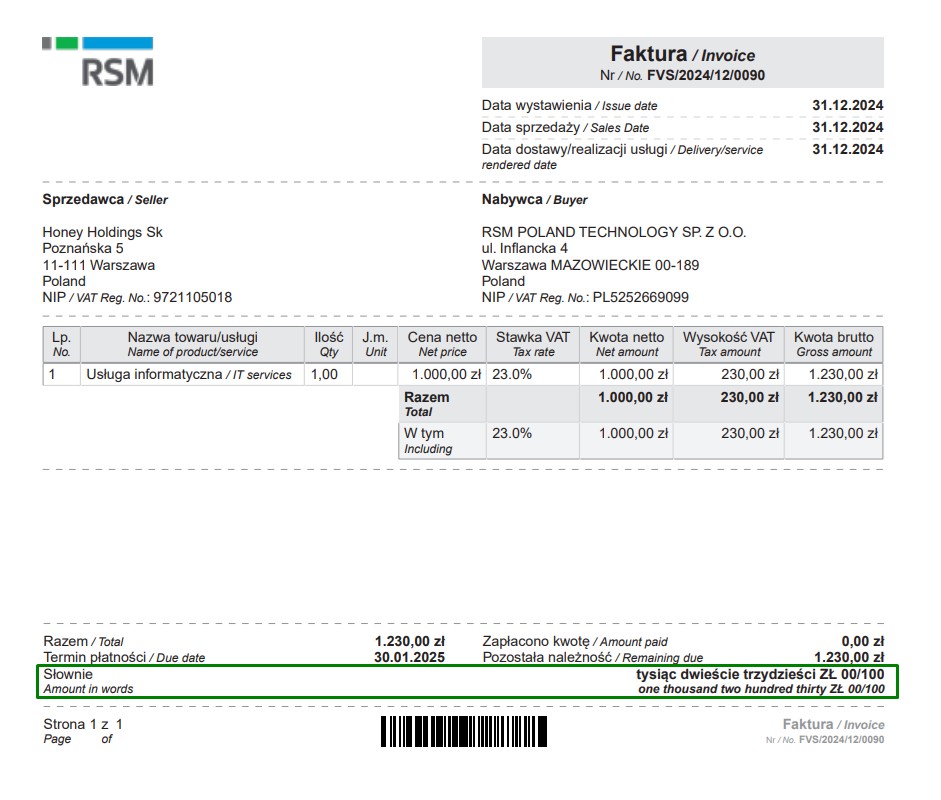

We have included an option for PLP printouts of sales invoices and credit memos to state amounts in words with regard to amounts payable. The translation is available for the supported language versions: Polish, English and German.

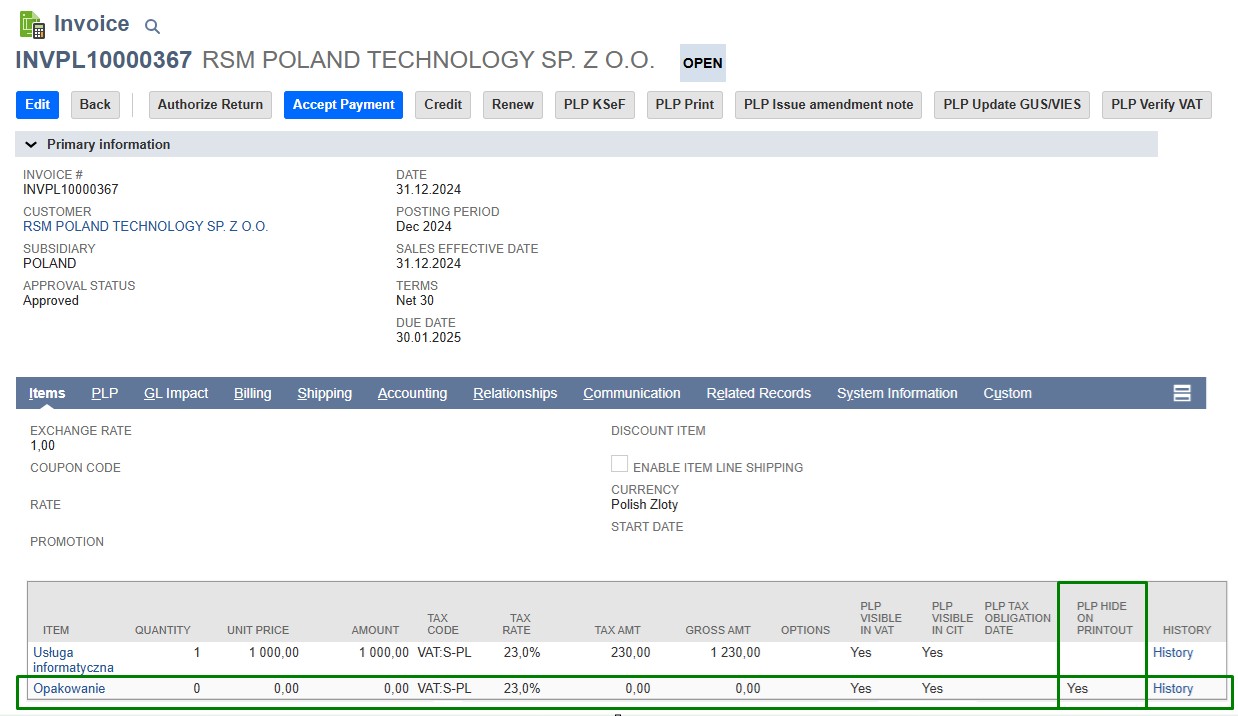

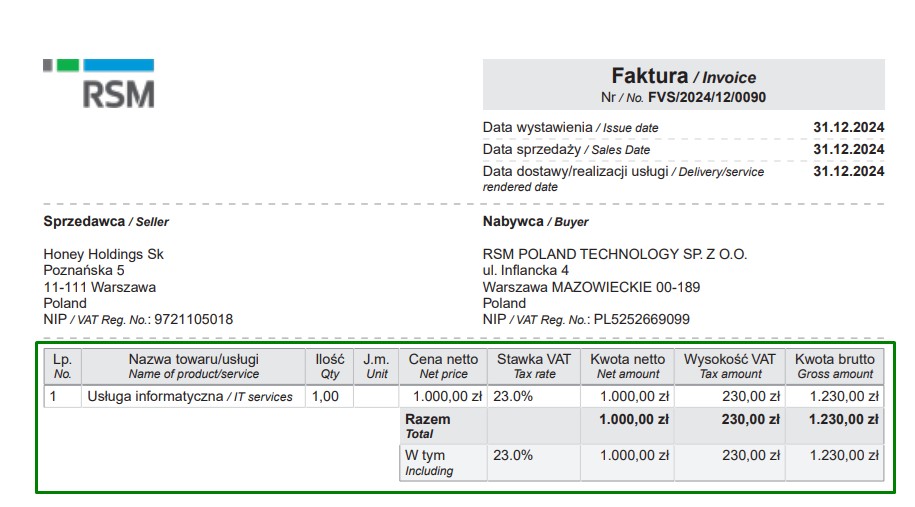

We have ensured the option to hide selected lines in PLP printouts related, for example, to the settlement of package issuing.

At the level of the transaction line we have ensured a dedicated PLP Hide on printout field, which, when selected, hides a given item:

- On the printout of a PLP document:

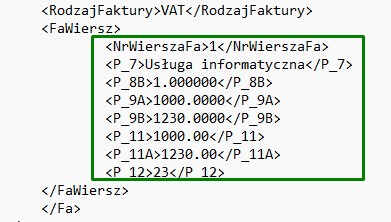

- In the contents of an XML file that is to be sent to the KSeF system:

Learn more about our IT Consulting services

IMPROVEMENTS:

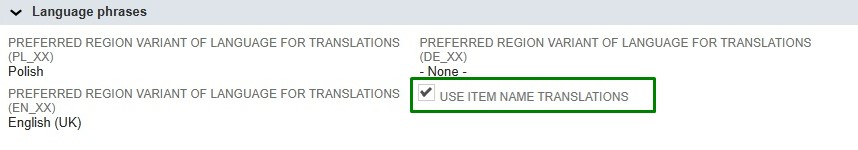

We have introduced a possibility to choose whether the translations of the names of goods and services should be included on PLP printouts of sales documents.

The configurations enables users to indicate the preferred regional variation for the supported language versions: Polish, English and German.

We have ensured support for special characters in the names of goods and services on the printouts of sales documents under the Polish Localisation Package. This enhancement includes translations in various language versions.

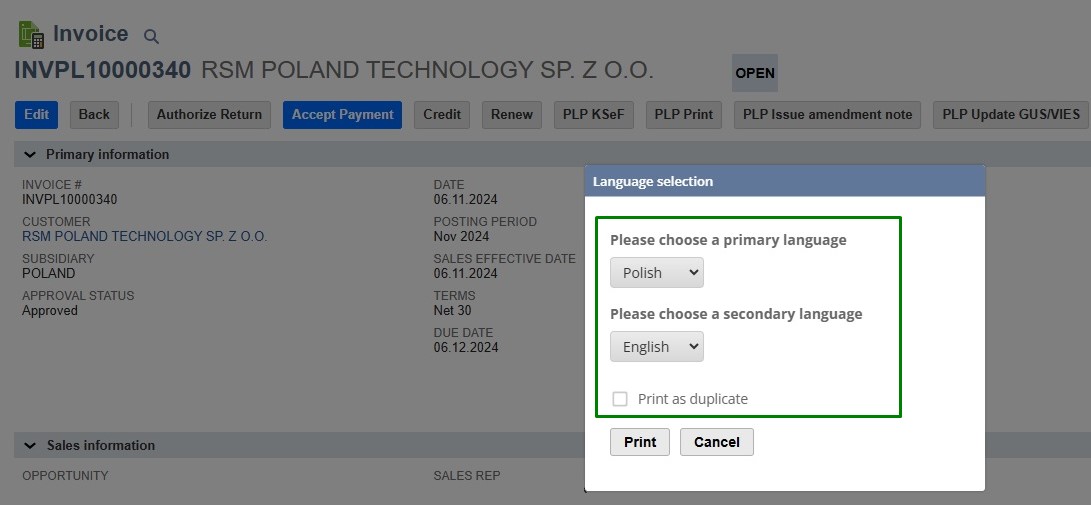

We have changed the general appearance of the print window by adding the option to generate a duplicate and removing the separate PLP Print duplicate button.

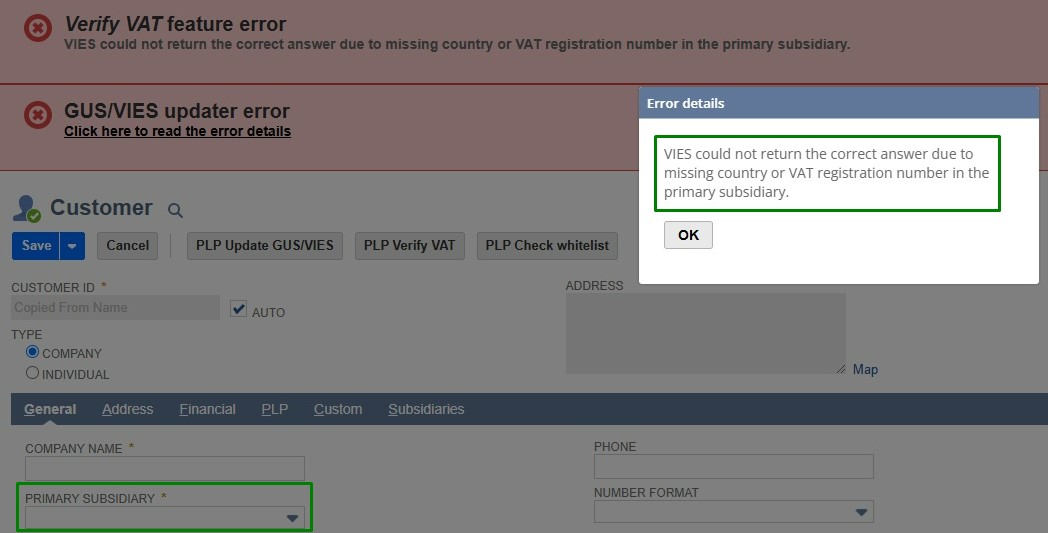

We have enhanced the message popping up when the user attempts to run the PLP Update GUS/VIES and PLP Verify VAT functionalities where in the counterparty’s directory the Subsidiary was not indicated.