The clock is ticking for businesses as the Corporate Sustainability Reporting Directive (CSRD) reporting deadline approaches. How well are companies prepared to meet this new obligation?

Businesses are facing growing demands from stakeholders, society, investors, banks, and regulators to focus more on their non-financial performance. This push aligns with global initiatives like the Paris Agreement and the European Green Deal, which promote sustainable economic practices. As part of the Green Deal, the EU mandates that large businesses comply with the CSRD by FY 2025, requiring transparent ESG reporting under the European Sustainability Reporting Standards (ESRS). Based on our experience, adapting to CSRD requirements represents one of the most significant transformations for businesses.

Where do businesses currently stand in their journey toward CSRD compliance? This article explores the maturity of ESG reporting among large businesses by analyzing publicly available voluntary ESG reports and combining that information with our experience assisting clients. Our analysis provides insights into the maturity of similarly sized businesses, a clearer understanding of CSRD obligations, and how existing non-financial reporting can be leveraged for upcoming CSRD requirements.

This article is written by Bart Ladru ([email protected]) and Mourad Seghir ([email protected]). Bart and Mourad are both part of RSM Netherlands Business Consulting Services with a focus on Sustainability and Finance.

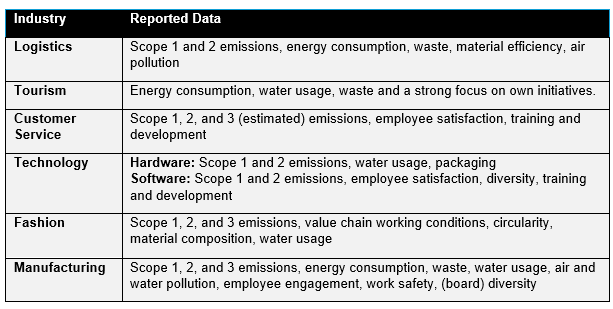

To provide a clear overview of the results, here are the key findings from our analysis:

In the following, we will cover the type of businesses included in our study, outline the methodology, analysis, identify common gaps for CSRD compliance, and discuss potential aspects in the analysed ESG reports that can be leveraged for the upcoming CSRD report.

What types of businesses were analyzed?

Under the CSRD, different groups of businesses must start reporting at different times. The article focuses on large EU businesses not currently covered by the Non-Financial Reporting Directive (NFRD), which must start reporting under the CSRD in fiscal year 2025. A company is classified as large if it meets at least two of the following criteria:

- Total assets exceed EUR 25 million

- Annual revenue exceeds EUR 50 million

- More than 250 employees

Additional groups, such as listed SMEs and non-EU businesses with significant EU revenue, will need to report by FY 2026 and FY 2028, respectively.

The analysis covered businesses in logistics, manufacturing, technology, tourism, customer service, and fashion. These industries face varying levels of scrutiny from consumers, governments, and other groups. Notably, fashion businesses are more likely to voluntarily publish CSR reports, driven by significant environmental and human rights concerns and strong stakeholder activism around sustainability.

What frameworks are the reports based on?

To comply with the CSRD, businesses must report according to the ESRS framework, which covers general and ESG disclosures. When the analyzed reports were published, the ESRS was not finalized or required, so many businesses used other frameworks for non-financial performance reporting.

The EU's CSRD aims to make the ESRS interoperable with global frameworks, so existing data may still be useful for reporting. However, the ESRS requires more detailed disclosures and considers both impact materiality (how a company affects stakeholders) and financial materiality (how sustainability issues impact the company's finances). Other frameworks typically address only one of these perspectives, so additional effort will be needed even if businesses follow other standards.

The GRI non-financial reporting framework was the most widely used in our analysis, covering a broad range of environmental, social, and governance (ESG) topics with a focus on impact materiality rather than financial materiality. It looks at an organization’s broader effects on the economy, environment, and society, along with how these impacts influence stakeholders.

Other frameworks used included the Sustainability Accounting Standards Board (SASB) industry-specific standards and the Task Force on Climate-Related Financial Disclosures (TCFD), which focuses solely on financial materiality. Some businesses made use of both GRI and TCFD, and as such approached ESG from both materiality perspectives, but not for all topics.

Over 90% of reports reviewed referenced the Sustainable Development Goals (SDGs) to identify relevant sustainability topics and align their objectives with global standards. Basic reports often use the SDGs as a foundational tool to determine their focus and develop their sustainability strategy, while more advanced reports reference them without relying on them as the starting point. As frameworks like the ESRS gain importance, the SDGs may become more symbolic, serving as a straightforward communication tool rather than a substitute for a thorough double materiality assessment required by the CSRD.

ISO 14001 certifications were often noted by logistics and manufacturing firms, while industry-specific certifications like the Better Cotton Initiative and Green Key address sector-specific impacts.

What ESG topics and data are the reports focused on?

CSR reports vary in ESG focus across industries. Environmental issues are prioritized in logistics, manufacturing, fashion, and tourism due to their significant impact on resources, emissions, and waste. These sectors emphasize circularity, energy efficiency, and emissions reduction. In contrast, technology (software), customer service, and some fashion businesses focus on social topics like DEI and employee wellbeing because they rely heavily on human capital and aim to foster a positive workplace culture. Governance topics in our sample received less attention overall but are integrated into the reporting of technology and manufacturing sectors, often focusing on ethics, transparency, and adherence to industry-specific standards. This shows that industries with physical impacts focus on environmental stewardship, while people-centric sectors prioritize social responsibility.

Commonly reported data includes energy usage, Scope 1, 2, and frequently Scope 3 emissions (often estimated), as well as employee engagement. Water usage, waste management, (board) diversity, and training are also frequently reported.

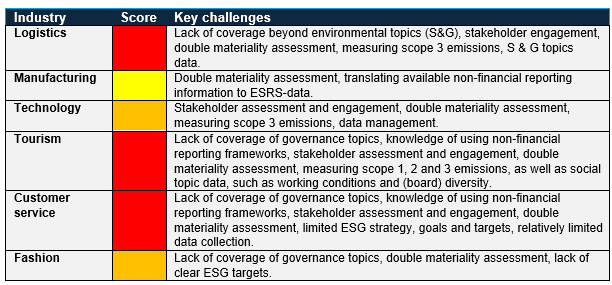

In terms of reporting data focus per industry in our sample, the following observations can be made:

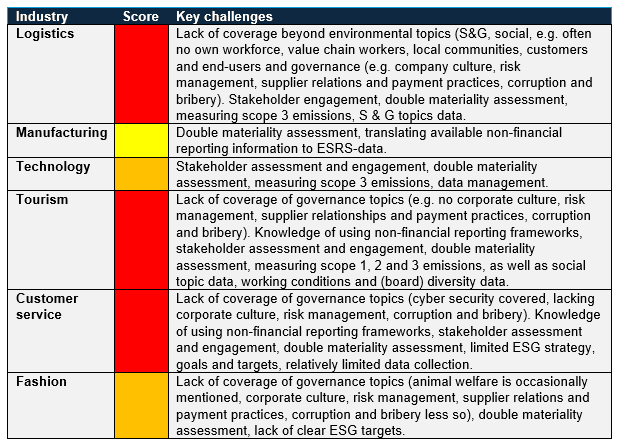

What is missing for CSRD compliance?

Many reports lack clarity on the publishing entity and the entities considered in the report. This oversight may lead to incorrect starting points for subsequent steps.

Stakeholder engagement varies widely in the analyzed CSR reports. About half of the businesses have identified their stakeholders and mapped out their priorities, but only a quarter disclosed how they plan to consult stakeholders or integrate their feedback into sustainability strategies. To comply with the CSRD, businesses must demonstrate comprehensive stakeholder engagement processes. This includes not only identifying key stakeholders but also clearly outlining methods for ongoing consultation and incorporating stakeholder input in decision-making processes. Additionally, the CSRD suggests integrating stakeholder engagement into the double materiality process to ensure diverse stakeholder concerns are taken into consideration.

None of the reviewed reports included comprehensive double materiality assessments. It's essential to address both materiality aspects. While some businesses have started to take important steps—such as understanding the organizational context, mapping out the business model and value chain, conducting a stakeholder assessment, identifying actual and potential impacts, and assessing the significance of these impacts—these efforts are insufficient for CSRD compliance.

Many CSR reports focus on past achievements and current initiatives but lack clear, future-oriented goals. The quality of strategic reporting varies significantly, with about 30% of reports emphasizing positive outcomes without establishing clear strategic priorities. Additionally, when ESG priorities are outlined, they often lack a strong connection to the corporate strategy. For CSRD compliance, businesses must adopt more transparent and forward-looking reporting, including setting specific, measurable, time-bound, and action-oriented targets. This shift will enhance accountability and align businesses with broader sustainability objectives, emphasizing not only past achievements but also providing a roadmap for future improvements.

Besides setting targets, businesses are also required to disclose policies, actions, and metrics for each material topic. Often, there's a gap between stated targets and actions, with inadequate resource allocation. To meet CSRD requirements, businesses must show how actions and resources align with strategic objectives and support sustainability goals transparently.

What can be leveraged?

None of the reports currently align with CSRD standards and as such, will need significant revisions. However, the experience gained from preparing CSR reports will be valuable for CSRD compliance. Teams can leverage their experience in data gathering, disclosing information in line with frameworks such as GRI, and the information gathered on potentially material ESG topics.

The GRI framework, used in over half the reports, overlaps significantly with ESRS topics and there is interoperability guidance available. However, GRI's required disclosures are less comprehensive, meaning that additional information and data will be necessary to meet CSRD standards. Similarly, businesses using the TCFD framework have also gained useful experience, particularly through the scenario-analysis process for climate-related risks and opportunities, which parallels the approach needed to determine financial materiality under the CSRD. Nonetheless, substantial work is needed to fully meet CSRD requirements.

Forward thinking

Considering the evolving regulatory landscape shaped by the CSRD, businesses are increasingly focusing on establishing ESG reporting mechanisms. This shift is driven by the need to meet new compliance requirements while also leveraging ESG as a strategic advantage.

Businesses that have already adopted voluntary ESG reporting provide valuable insights into effective practices and common challenges for other businesses at the beginning of their CSRD journey. Moreover, while the approach used in the voluntary reports is bound to differ from the exact disclosure requirements of the CSRD, businesses that have spent the time to develop said reports can build on the gained experience and data collection processes established for reporting under other frameworks.

Businesses should begin by defining their reporting scope, assembling a project team, gaining knowledge about CSRD requirements, mapping their business model and value chain, involving stakeholders, and conducting a double materiality analysis.

Following these steps will allow businesses to position themselves for success under the CSRD and harness ESG reporting as a catalyst for positive change. Not only will it set you up on the path to successful compliance but will also build stakeholder trust and foster sustainable growth. Businesses that effectively integrate ESG principles will gain a competitive edge and contribute to a more responsible, resilient business landscape.

RSM is a thought leader in the field of Sustainability consulting. We offer frequent insights through training and sharing of thought leadership based on a detailed knowledge of industry developments and practical applications in working with our customers. If you want to know more, please contact one of our consultants.

Annex:

Industry CSRD maturity table (elaborate):

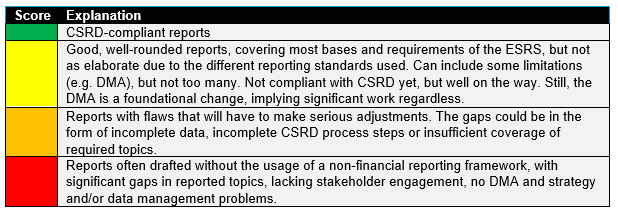

Grading table