The recent election of Donald Trump as U.S. President has significant implications for the EU's economy, trade, defense, sustainability, and the broader global dynamics. The post-Trump period represents a pivotal time in global geopolitics, marked by rising nationalism, strategic realignment among major powers, and a renewed focus on multilateralism. For businesses in the EU, which is now challenged to recalibrate both its geopolitical and geo-economic strategies, this shift demands a proactive approach to maintain global relevance and competitive edge.

This article is written by Mourad Seghir ([email protected]) and Lorena Velo ([email protected]). Mourad and Lorena are part of RSM Netherlands Business Consulting Services with a specific focus on Finance & International Trade.

This article explores the anticipated role of the EU economy within this transformed landscape, where EU businesses must adapt.

Trump's proposed tariffs on imports—ranging from a potential 10% across-the-board tariff up to 60% for goods with Chinese components—present a significant risk to the EU economy. The launch of possible tariff war by the US, the EU’s biggest trading partner, could impact industries such as automobiles, pharmaceuticals and machinery. As a result of these uncertainties, the EU may need to raise military spending, which will further affect national budgets and increase deficits. With the EU adopting a more diplomatic stance in the U.S.-China tariff tensions, it may face pressure to choose sides or risk repercussions from a possible Trump administration. Even if U.S. tariffs are not directly aimed at EU goods, the EU market could still be negatively impacted if the US decides to put sanctions on products using Chinese parts or technology, especially if pressured to reduce ties with China. Europe, with China as its second-largest trading partner, depends on imports like telecom equipment, electrical machinery, and exports such as vehicles and machinery. Disruptions in these sectors could significantly harm Europe's economy, making it vulnerable to U.S. actions aimed at slowing China’s growth.

For example, Volkswagen who is the biggest automaker in Germany recently announced that it would likely lay off workers and close plants in addition to the competition coming from the Chinese EV sales in Europe. European leaders face a dilemma between challenging or appeasing China, as seen when Germany opposed EU tariffs on Chinese electric vehicles leading China to retaliate with new tariffs on European brandy, primarily impacting France.

You can find more information on these proposed tariffs in one of our previous installments.

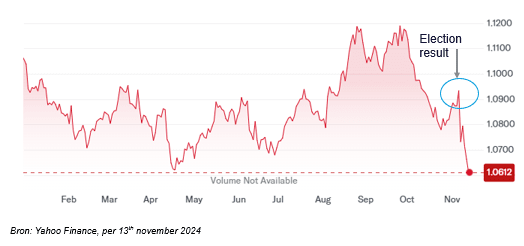

Another key market response was the reaction of the euro. Since Trump’s win the euro has weakened by almost %-3 against the dollar, a trend that may persist if Trump’s fiscal and trade policies pressure the Federal Reserve to limit rate cuts. To understand the implications of rate cuts for international trade click here.

This situation could prompt the European Central Bank (ECB) to consider rate reductions or unconventional monetary measures to stabilize the euro.

Compounding this, Trump’s was congratulated by leaders like Putin and Xi. They also indicated that they wanted to work more closely with Trump which may signal geopolitical alignments that could further isolate the EU, weakening its competitive stance globally and exacerbating pressure on the euro.

This could lead to a shift in the current geopolitical landscape in Europe, as the EU has invested heavily in supporting Ukraine and maintaining sanctions against Russia. Therefore, any U.S. and Russia negotiations that sideline European interests might trigger market instability. A U.S. policy shift could lead to divisions within the EU on whether to maintain or remove sanctions, affecting markets dependent on trade with Russia.

New Power Blocs

Trump’s foreign policy stance, including the possibility of reduced U.S. support for NATO, has intensified discussions within the EU about its defense responsibilities. Currently, the U.S. covers nearly 70% of NATO’s budget, and a significant reduction in its contributions would compel European countries to reallocate resources towards their own defense budgets. Redirecting funds from essential sectors to increase defense spending could create economic strain, raising the stakes for finding a balanced approach that maintains both fiscal sustainability and security.

The world is transitioning from a unipolar, U.S.-led order to a multipolar one due to a combination of U.S. retrenchment and the rise of other influential powers. The U.S. has voted for a shift towards an "America First" approach, focusing on domestic priorities over global commitments. This inward stance, marked by scepticism towards alliances like NATO and tariffs on allies and adversaries alike, has led regions like the EU to reconsider their dependence on U.S. leadership and pursue strategic autonomy. Meanwhile, China’s rapid economic growth, expansive Belt and Road Initiative (also known as the new Silk Road), and strategic alliances reflect its ambition to reshape global systems in its favour, positioning itself as a counterbalance to U.S. influence.

BRI is a global infrastructure development strategy adopted by the Chinese government China in Red, the members of the Asian Infrastructure Investment Bank in orange.

Russia, although less economically dominant, has used strategic actions in Eastern Europe and the Middle East to reassert its power, prompting the EU and NATO to strengthen their defenses and re-evaluate their global strategies. Additionally, the emergence of regional powers like India and blocs such as ASEAN and are increasingly shifting the global order.

Strategic Autonomy in a Multipolar World

The transition to a multipolar world has substantial implications for the EU, challenging its historically open-market, interdependent model. As new global powers assert influence and as U.S. support grows less predictable, the EU is going to adopt a strategy focused on resilience, values, and prosperity. The EU's concept of "strategic autonomy" (as outlined in Draghi’s report) is central to this approach, representing a push to reduce dependencies on non-EU sources, especially in critical sectors such as pharmaceuticals, semiconductors, and energy.

For smaller EU countries, such as the Netherlands, which have traditionally leveraged free trade to drive economic growth, achieving strategic autonomy requires businesses to rethink their policies and practices. This shift includes a greater responsibility for businesses in markets dependent on unstable factors, particularly in sectors essential for long-term economic and strategic stability. Investing in domestic production and cultivating resilience within key industries, such as renewable energy and high-tech manufacturing, will allow EU businesses to reduce its vulnerabilities and safeguard its position on the global stage.

From Interdependence to Self-Sufficiency

To mitigate risks in this new world order, the EU is increasingly focused on self-sufficiency and reducing reliance on external regions for critical resources. Enhancing production within the EU, offers a foundation for economic resilience that can withstand potential global disruptions. Recent EU policies, including the Net Zero Industry Act and the Critical Raw Materials Act, reflect a proactive approach to creating resilient, Europe-based supply chains, thereby securing greater self-sufficiency in vital industries.

An understanding of EU supply chains is essential to assess vulnerabilities and prepare for disruptions. By building reserves of essential materials and fostering knowledge-sharing within industries, EU businesses can strengthen their resilience against external shocks. While previously considered costly, this approach aligns with current economic realities and reflects a critical strategy in an increasingly unpredictable global environment.

Forward Thinking

The developments above reveal that the assumptions for driving business strategy the past decades—such as the reliability of open markets, free trade, and seamless global supply chains — are now being tested. These trends require businesses to take proactive steps towards identifying and mitigating risks in their economic and supply chain dependencies.

Assess Dependencies Across All Economic Chains

Understanding where dependencies lie in your economic chains is fundamental to maintaining stability and securing your business operations. Businesses should prioritize mapping their entire supply chain, identifying critical points of reliance on external suppliers or regions, especially in sectors like energy, technology, pharmaceuticals and raw materials. This means asking questions like:

- Where are the highest concentration risks? Assess if you’re overly reliant on a single country or supplier, especially those subject to geopolitical tensions or regulatory shifts.

- What materials or components are critical to operations? Identifying essential materials and parts can help forecast where supply disruptions could have the most impact.

- How agile are supply chains? Diversification and flexibility in sourcing can reduce vulnerabilities. Contingency planning should become part of routine business strategy.

A Long-Term Perspective: Build for Resilience, Not Just Recovery

While it may seem natural to wait until disruptions hit, proactive investment in resilience enables a better response when they do. Companies that adopt a long-term perspective, accounting for both economic and geopolitical risks, will be better equipped to thrive in a multipolar world, where regional tensions and competition may disrupt traditional supply routes and sourcing patterns. A resilient approach transforms disruptions into manageable challenges, ensuring that businesses remain agile and competitive.

Additionally, achieving balance between efficiency and resilience is challenging yet essential for sustainable business practices. As businesses assess supply chains, a shift from sole efficiency-focused models toward balanced efficiency and security is prudent. Though prioritizing regional suppliers or suppliers within stable trade agreements may come with added costs, it may also offer critical long-term stability, particularly in industries with significant geopolitical exposure, such as technology, pharmaceuticals, and raw materials.

In the face of a potential fragmented global order, EU businesses’ economic strategy must prioritize strategic autonomy, resilience, and adaptability. By focusing on sustainable growth and self-sufficiency, EU businesses can navigate the complexities of a multipolar world while safeguarding their prosperity and stability. Through careful policy decisions and sustained investment in critical sectors, EU businesses can secure their future and reinforce their role as a stabilizing force on the global stage.

RSM is a thought leader in the field of International Trade consulting. We offer frequent insights through training and sharing of thought leadership that is based on a detailed knowledge of regulatory obligations and practical applications in working with our customers. If you want to know more, please reach out to one of our consultants.

[1] Europe Braces for Trump: ‘Worst Economic Nightmare Has Come True’ - The New York Times